CANNES, France – Greece will hold a controversial referendum on a European bailout plan in early December that European leaders said Wednesday will determine whether or not it stays in the eurozone.

Greece won’t get any new international loans until then, European leaders said after heaping pressure on Greece’s prime minister at emergency talks Wednesday.

“The referendum … in essence is about nothing else but the question, does Greece want to stay in the eurozone, yes or no?” said German Chancellor Angela Merkel at a press conference.

The statement, echoed by French President Nicolas Sarkozy at her side, was the clearest acknowledgement to date that pulling out of the eurozone is a possible outcome.

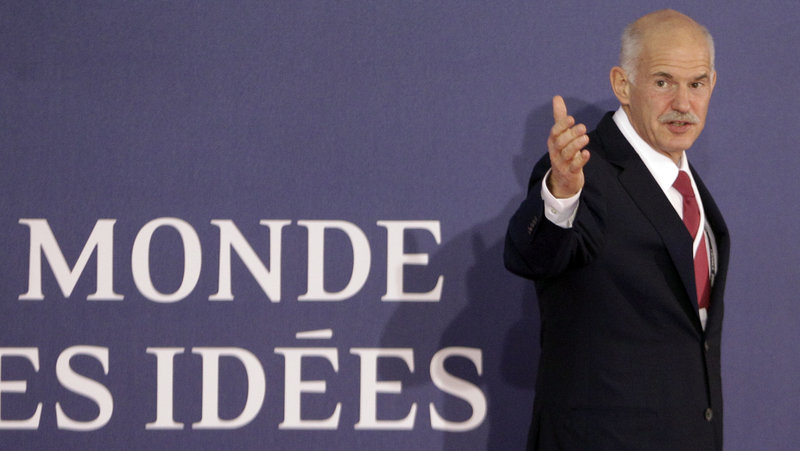

Luxembourg Prime Minister Jean-Claude Juncker announced that the referendum would be held Dec. 4, after a meeting with Greek Prime Minister George Papandreou and other European leaders in Cannes.

Sarkozy said the next installment of Greek rescue loans, which had already been approved and were due to be paid in November, cannot be paid until after the referendum.

“We want to continue with the Greeks but there are rules and it’s unacceptable that these rules are not followed,” Sarkozy said.

The chief of the International Monetary Fund, Christine Lagarde, said “I hope that this whole thing can be closed and completed by mid-December – I think it’s important from a cash point of view.”

Papandreou’s stunning announcement Monday that he would stage a referendum roiled world financial markets and threw into question an ambitious and costly European deal worked out in torturous negotiations a week ago.

Merkel confirmed that Greece did not inform the rest of the eurozone about the referendum. “This did not happen in a coordinated fashion,” she said.

She and Sarkozy summoned Papandreou to Cannes for talks Wednesday at which European leaders expressed their anger and pressed him to hold the referendum as soon as possible.

A “no” vote in the referendum would have enormous consequences not just for Greece but for the rest of Europe. It could lead to a disorderly Greek default, force Greece out of the 17-nation eurozone, topple many fragile European banks and send the global economy spinning back into recession.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.