ST. LOUIS – When Carrollton Bank opened its new branch in Clayton, Mo., this fall, the bank sent out a mailing to 20,000 households. Tucked inside the note from its chief executive was an unusual promise: a free apple pie from a local bakery.

Over the last few weeks, Carrollton has given out dozens of pies, kept at the Clayton branch in a warmer, to those who opened new accounts.

The small-town, Andy-Griffith vibe was intentional. The employee-owned community bank with nine branches was trying to set itself apart from large national banks that have drawn flak in recent years for shaky mortgage underwriting practices and, more recently, bank fees.

Many community banks are now emphasizing their small size to attract customers. These banks have always tried to sell themselves on their hometown roots, but the simmering anti-Wall Street sentiment is driving many to ratchet up their sales pitch.

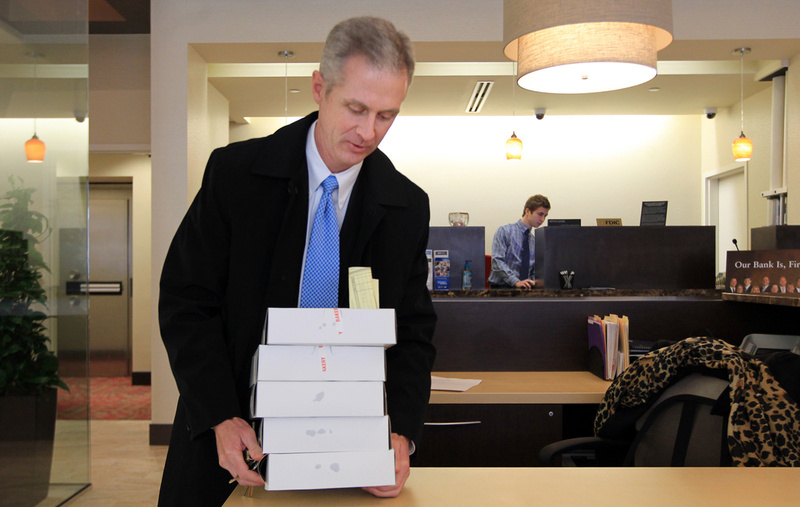

“It’s hard to impose fees and hidden service charges and try to slip them by customers when you’re a small enough bank that you see them in the bank every day,” said Carrollton Bank’s Chief Executive Thomas Hough.

The Southern Illinois bank was founded by Hough’s great-great-grandfather, a point the bank stresses. It is based in Carrollton, about 55 miles north of downtown St. Louis.

Community banks in the U.S. make up the vast majority of banks but hold far fewer deposits than the big banks. The 6,217 community banks as defined by the Dodd Frank Act — those with under $10 billion in assets — had a combined $2.2 trillion in assets at the end of September, according to the Federal Reserve. In comparison, the 80 banks not classified as community banks had $10.2 trillion in assets.

And most community banks, 91 percent, have assets under $1 billion, according to the Independent Community Bankers of America, a trade group based in Washington.

“To a community bank, you’re a name, not a number,” said Jerry Sage, executive director of the Missouri Independent Bankers Association, which represents 176 small banks.

But Bank of America, the second-largest bank nationally, disputed that characterization.

“It’s important to keep in mind that we are a national franchise operating locally,” said Bank of America spokeswoman Diane Wagner. “We have deep roots in St. Louis and are a major employer and provide philanthropic and volunteer support to several area nonprofits.”

A spokeswoman for Minneapolis-based US Bank, the largest bank in the St. Louis area, countered that it is growing both its deposits and lending and has maintained the loyalty of its customers.

“Besides offering value with our relationship accounts, I think we are seeing an increase because customers today value convenience,” said US Bank spokeswoman Lisa Clark.

Both banks also stressed their extensive branch and ATM network, and online and mobile banking services.

Still, community banks sense an opportunity. A new campaign launched last month called Go Local, is seeking to capitalize on consumer backlash against big banks.

Developed by the Independent Community Bankers of America, who has nearly 5,000 member banks nationwide, it urges people to switch to a locally headquartered bank.

The campaign overlaps with Bank Transfer Day, a Facebook-promoted effort created by a California woman who urged people frustrated with bank fees to open new accounts at credit unions on Nov. 5. The effort helped spur customers to open more than 700,0000 new credit union accounts nationwide from mid-October through mid-November, according to the Credit Union National Association.

On the last business day before the end of Bank Transfer Day, the Independent Community Bankers of America’s online bank search program for community banks, at BankLocally.org, had 10,000 hits, said Chris Lorence, the group’s executive vice president. The site typically gets about 100 hits a day.

“We think consumers are done with the big-box, one-size-fits-all retail approach,” he said.

The group also is bringing its message to Wall Street. Last week, it debuted a Go Local ad on the CBS JumboTron billboard in New York’s Times Square that runs until Jan. 1.

Signs on local community bank lawns this fall have drawn attention to their free checking accounts after some larger banks, including Bank of America and Regions Bank, rolled out new monthly debit card fees.

Those fees were ultimately dropped due to backlash, but community bankers see the negative attention as a selling point.

Several community banks have taken their message to social media sites, including Citizens National Bank of Greater St. Louis, which posted this message on its Facebook page in October: “We just don’t get the debit card fee thing and charging you 9 bucks to go make a deposit. Big banks equal big fees.”

The bank doesn’t have much of an advertising budget, so free social media sites have helped boost Citizens’ ability to reach new customers, said President and Chief Executive David Bentele.

“We’ve seen some increase in people opening accounts because they’ve had enough of a big bank,” Bentele said. Maplewood-based Citizens National Bank has six branches.

Bentele said many community banks had caught up with big banks on a service that’s in great demand from customers: online bill paying.

Larger banks have invested more earlier and offered the service first, but most community banks now have similar services, Bentele said.

Some community banks, including Carrollton, have also joined networks with other banks so customers aren’t hit with an ATM fee if they need to get cash.

At Concord Bank in south St. Louis County, the single-branch bank began in August to offer something’s that’s rare: Sunday hours. (US Bank offers Sunday hours at branches in many Schnucks grocery stores.)

Concord also extended the time it’s open on weekdays by four hours, so it’s now open from 8 a.m. to 7 p.m.

Concord’s chief executive, Tony Feraro, hopes to attract customers who are unhappy with big banks’ frequent name and personnel changes.

He’s forecasting growing deposits by between 8 and 11 percent with the extra hours. But an added benefit, Feraro said, is opening up more opportunities for customers to speak with bank employees.

“It’s banking the old-fashioned way, where customers would stop in just to sit and chat,” Feraro said.

But despite the free pies, extra hours and advertising, bankers acknowledge that it’s difficult to persuade customers to switch banks. Switching services such as online bill pay can be arduous and time-consuming to set up.

“When Bank of America announced their $5 debit card fee, we had a lot of (its) customers come to our branches to open new accounts,” said Rick Bagy, president of First National Bank of St. Louis. “It’s slowed dramatically. … In the banking business, you really have to be mad at your bank before you leave.”

Carrollton Bank’s Hough said community banks weren’t for everyone, pointing out that large corporations needing international reach probably wouldn’t have their needs met by a community bank.

“But I think some people like to walk in and talk to the owner of the bank,” he said. “I do think people are gravitating to local businesses where they know a decision maker.”to open new accounts at credit unions on Nov. 5. The effort helped spur customers to open more than 700,0000 new credit union accounts nationwide from mid-October through mid-November, according to the Credit Union National Association.

On the last business day before the end of Bank Transfer Day, the Independent Community Bankers of America’s online bank search program for community banks, at BankLocally.org, had 10,000 hits, said Chris Lorence, the group’s executive vice president. The site typically gets about 100 hits a day.

“We think consumers are done with the big-box, one-size-fits-all retail approach,” he said.

The group also is bringing its message to Wall Street. Last week, it debuted a Go Local ad on the CBS JumboTron billboard in New York’s Times Square that runs until Jan. 1.

But despite the free pies, extra hours and advertising, bankers acknowledge that it’s difficult to persuade customers to switch banks.

Switching services such as online bill pay can be arduous and time-consuming to set up.

“When Bank of America announced their $5 debit card fee, we had a lot of (its) customers come to our branches to open new accounts,” said Rick Bagy, president of First National Bank of St. Louis. “It’s slowed dramatically. … In the banking business, you really have to be mad at your bank before you leave.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.