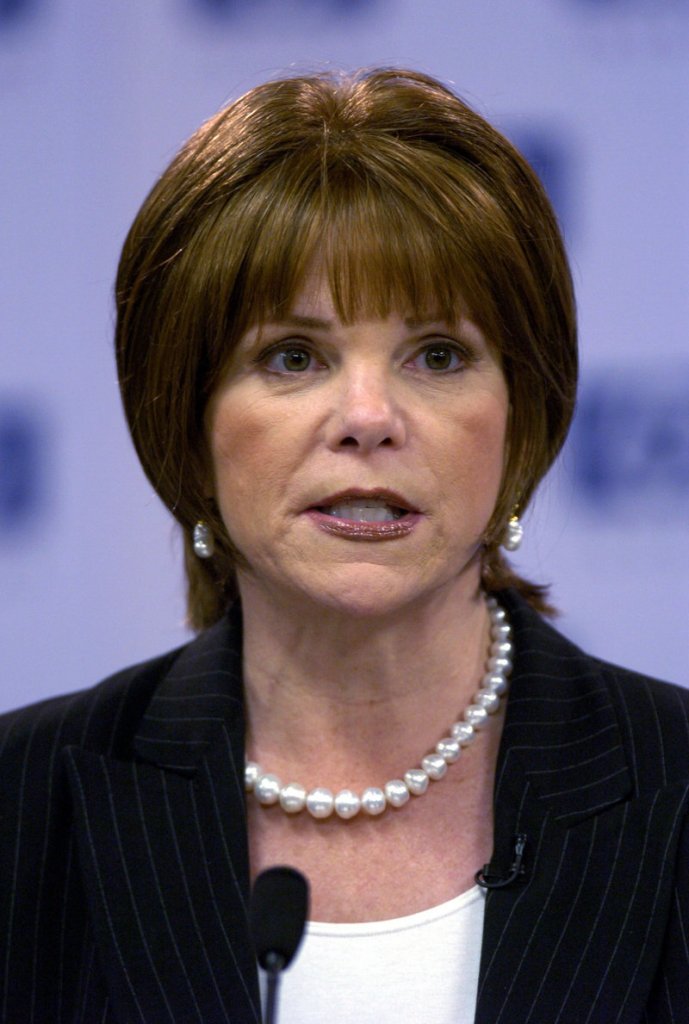

SAN FRANCISCO — Patricia Dunn, the former Hewlett-Packard Co. chairwoman who authorized a boardroom surveillance probe that ultimately sullied her remarkable rise from investment bank typist to the corporate upper class, has died. She was 58.

Dunn, who had battled ovarian cancer, died Sunday at her home in Orinda surrounded by her family, according to her sister, Debbie Lammers.

Once one of the most powerful women in corporate America, Dunn saw her career tarnished in 2006 when she was ousted from HP and brought up on criminal charges — which were ultimately dropped — for approving the company’s plan to snoop into the private phone records of board members, journalists and HP employees to catch people leaking to the media.

The scandal unfolded as Dunn continued to battle a disease that had haunted her through a sparkling investment banking career and a stormy nine-year stretch on the board of HP, one of the world’s largest technology companies.

Her time at HP coincided with some of the most contentious and challenging periods since the Palo Alto-based company was founded in 1939.

Dunn joined HP’s board in 1998 and was instrumental in the hiring and firing of CEO Carly Fiorina, whose flamboyant personality and ferocity in securing the $19 billion purchase of Compaq Computer Corp. ultimately helped hasten her ouster amid a sagging stock price and disappointing results from the combined company.

Dunn was the one who announced Fiorina’s ouster in February 2005 and named her low-key successor, Mark Hurd, previously CEO of NCR Corp. Hurd himself was ousted last year after an investigation into a sexual harassment claim found inconsistencies in expense reports filed.

Dunn also assumed Fiorina’s role as chairwoman at the time. Dunn was forced out of that role in September 2006 in an embarrassing scandal involving spying on the telephone records of board members and journalists to ferret out the source of leaks to the media.

Just a month later, California’s attorney general charged Dunn and four others with four felony counts each — conspiracy, fraud, identity theft and illegally using computer data — for their roles in the probe. That came just two days before she started chemotherapy treatments for advanced ovarian cancer.

The criminal charges against Dunn were eventually dropped, as prosecutors said she had little involvement in the actual “pretexting” — the ruse used by investigators to view private telephone records by pretending to be someone else — and because of her ailing health. Charges against the other defendants were also dropped, with a Santa Clara County Superior Court judge calling their conduct “a betrayal of trust and honor” at worst that was not criminal behavior at the time it occurred.

Once an aspiring investigative reporter, Dunn found more lucrative work in the financial world and made her mark in investment banking.

After working briefly as a part-time reporter for a community newspaper in San Francisco, Dunn began her corporate climb by capitalizing on a temporary typist gig that she landed at an investment firm in the 1970s.

She was able to turn the two-week typing assignment into full-time work and managed to quickly rise through the ranks by earning a reputation as a hard-edged businesswoman. That reputation eventually helped her earn the promotion to CEO of fund management behemoth Barclays Global Investors in 1995.

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.