AUGUSTA — State lawmakers and officials in coastal towns are calling for tighter limits on a property tax exemption for tree-growing that they say is being abused as a tax shelter by wealthy oceanfront landowners.

On Thursday, some legislators pointed to one particular landowner: state Treasurer Bruce Poliquin.

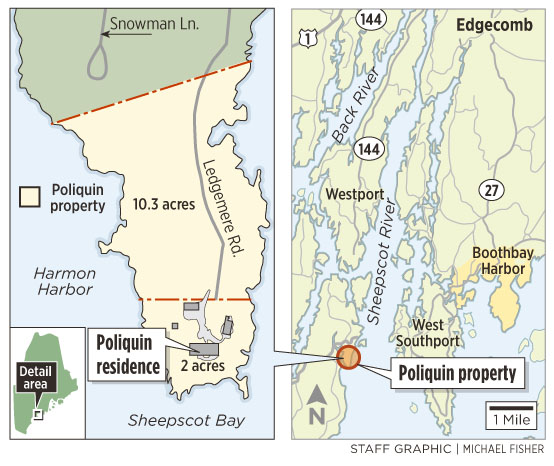

Poliquin’s 12.3-acre peninsula in Georgetown was cited in a state report in 2009 as the type of high-value property that fuels concern that the program is being used to shift the tax burden from wealthy landowners to other taxpayers.

The report said Poliquin wasn’t necessarily breaking any rules but may not have been using the tax exemption to promote commercial tree harvesting, as the law intended. Poliquin did not respond to requests for comment Thursday.

The licensed forester who helped Poliquin get the exemption in 2004 said Thursday that the application was legitimate — there is marketable timber on the land and Poliquin planned to harvest it. But some lawmakers criticized the deal.

Maine’s Tree Growth Tax program “is for commercial harvesting,” said Sen. Troy Jackson, D-Allagash, who is a commercial logger. “I don’t think it’s to help millionaires have $500,000 tax breaks out on the coast.”

When woodland owners get exemptions, the rest of a town’s taxpayers pay more. That’s fine if the woodland owners are harvesting timber and creating jobs, Jackson said, but if owners like Poliquin can legally get the exemption, “we need to change the law.”

In fact, lawmakers moved Thursday to tighten up the law.

The Legislature’s Taxation Committee voted 9-0 to support a bill to tighten some standards for maintaining the exemption, such as requiring a statement that cutting trees and selling timber is the primary use of the land.

The committee is expected to support a second bill, sponsored by Senate President Kevin Raye, R-Perry, to have state foresters make random checks to ensure that landowners are harvesting trees as promised.

Poliquin’s land was cited in the state report before his unsuccessful run for governor or his appointment as treasurer in 2010.

As treasurer, the Republican businessman has been an outspoken critic of Democratic leadership, including the head of the Maine State Housing Authority.

The focus on his tax exemption — while coinciding with the legislative debate — is part of a backlash from Democrats, who also have raised questions about Poliquin’s private business activity and his financial disclosure filings.

Maine’s Tree Growth Tax Law has plenty of defenders. It is intended to encourage owners of woodlands to maintain their land for commercial wood harvesting, which creates jobs, limits development pressure and preserves open space for recreation and other uses.

About 23,000 parcels are enrolled in the program, accounting for more than 11 million acres across the state, according to the Maine Forest Service.

“It’s the reason many landowners are able to afford to (pay their taxes and) keep woodlands in the southern two-thirds of the state,” said Tom Doak, executive director of the Maine Small Woodland Owners Association.

Landowners in the program must present commercial timber management plans and, every 10 years, certify that they are harvesting wood according to their plans. If they don’t comply, the penalties may exceed the taxes they avoided.

In return for the promise to maintain woodlands, owners get potentially big tax breaks. The taxable value of land in the program is based on how much the trees are worth, rather than the land’s highest potential development value

For oceanfront properties, the difference is huge.

Poliquin, for example, enrolled 10 acres of his 12-acre oceanfront parcel in the program in 2004. His 4,800-square-foot home is on the other two acres, at the tip of the peninsula jutting into Sheepscot Bay.

The state report said the 10 acres, part of “one of the most valuable residential lots in the state of Maine,” was taxed in 2009 on a value of $3,560. The information was added to the state report by the Maine Municipal Association, which surveyed tax assessors for examples of potential abuse.

A political advocacy group that is raising questions about Poliquin’s tax exemption released tax records this week that show the assessed value of his 12 acres dropping from $1.8 million to $725,500 after the tree growth exemption was approved in 2004.

In the current tax year, Poliquin’s tax liability for the 10-acre woodlot is just over $30. Combined with his taxes on the remainder of the property, including his house and the two acres on which it sits, his total property tax bill is $19,866.51.

Despite the hefty tax break, Poliquin can’t produce much commercial timber, the state report says.

“For several reasons, including difficult road access and the restrictions on timber harvesting according to the state’s shoreland zoning regulations, the ability to harvest any timber on this property — even if that was the interest of the landowner — is extremely limited,” the report says.

It is up to local officials to enforce the state tax law, and there is no rush to act in Poliquin’s case, said William Plummer, a Georgetown selectman who helped review and approve Poliquin’s exemption application in 2004.

The board will examine the issue in 2014, when Poliquin must show that he is keeping up with the timber management plan.

“That’s when the push comes, when these come up for (recertification),” Plummer said. “The selectmen always make sure there’s plenty of paperwork (about harvesting) so there’s no questions.”

David Schaible, the licensed forester who prepared Poliquin’s management plan eight years ago, said Thursday that the land had potential for commercial harvesting, despite its small size and zoning restrictions that restrict tree cutting near the shoreline.

“There was marketable pulpwood and saw logs that could be sold following the plan’s harvest recommendations,” he said. “I have not heard from Bruce nor have I been back to the property since March 2004. I do not know whether he followed the plan recommendations.”

Staff Writer John Richardson can be contacted at 620-7016 or at:

jrichardson@mainetoday.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.