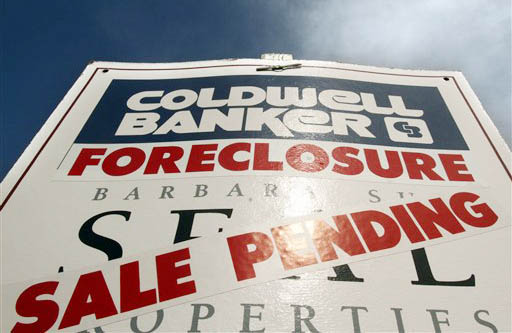

WASHINGTON — U.S. states have reached a $25 billion deal with the nation’s biggest mortgage lenders over foreclosure abuses that occurred after the housing bubble burst.

Federal and state officials announced the deal today. It is the biggest settlement involving a single industry since a 1998 multistate tobacco deal.

Under the agreement, five major banks — Bank of America, JPMorgan Chase, Wells Fargo, Citigroup and Ally Financial — will reduce loans for nearly 1 million households. They will also send checks of $2,000 to about 750,000 Americans who were improperly foreclosed upon. The banks will have three years to fulfill the terms of the deal.

All but one of the 50 states agreed to the deal. Oklahoma, the lone holdout, will receive no money.

The conditions will be overseen by Joseph A. Smith Jr., North Carolina’s banking commissioner. Lenders that violate the deal could face $1 million penalties per violation and up to $5 million for repeat violators.

The settlement ends a painful chapter that emerged from the financial crisis, when home values sank and millions edged toward foreclosure. Many companies processed foreclosures without verifying documents. Some employees signed papers they hadn’t read or used fake signatures to speed foreclosures — an action known as robo-signing.

Under the deal, the 49 states have said they won’t pursue civil charges related to these types of abuses. Homeowners can still sue lenders in civil court on their own, and federal and state authorities can pursue criminal charges.

“There were many small wrongs that were done here,” said U.S. Housing and Urban Development Secretary Shaun Donovan. “This does not resolve everything. We will be aggressive about going after claims elsewhere.”

Bank of America will pay the most to borrowers as part of the deal — nearly $8.6 billion. Wells Fargo will pay about $4.3 billion, JPMorgan Chase will pay roughly $4.2 billion, Citigroup will pay about $1.8 billion and Ally Financial will pay $200 million. This does not include $5.5 billion in federal and state payments.

The deal also ends a separate investigation into Bank of America and Countrywide for inflating appraisals of loans from 2003 through most of 2009. Bank of America acquired Countrywide in 2008.

The banks and U.S. state attorneys general agreed to the deal late Wednesday after 16 months of contentious negotiations.

New York and California came on board late Wednesday. California has more than 2 million “underwater” borrowers, whose homes are worth less than their mortgages. New York has some 118,000 homeowners who are underwater.

In addition to the payments and mortgage write-downs, the deal promises to reshape long-standing mortgage lending guidelines. It will make it easier for those at risk of foreclosure to make their payments and keep their homes.

Those who lost their homes to foreclosure are unlikely to get their homes back or benefit much financially from the settlement.

The settlement would apply only to privately held mortgages issued from 2008 through 2011. Banks own about half of all U.S. mortgages — roughly 30 million loans.

Some critics say the proposed deal doesn’t go far enough. They have argued for a thorough investigation of potentially illegal foreclosure practices before a settlement is hammered out.

Under the deal:

— Roughly $1.5 billion for direct payouts, in the form of $2,000 checks, for about 750,000 Americans who were unfairly or improperly foreclosed upon, another $3.5 billion will go directly to states.

— At least $10 billion for reducing mortgage amounts.

— Up to $7 billion for other state homeowner programs.

— At least $3 billion for refinancing loans for homeowners who are current on their mortgage payments but who are underwater.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.