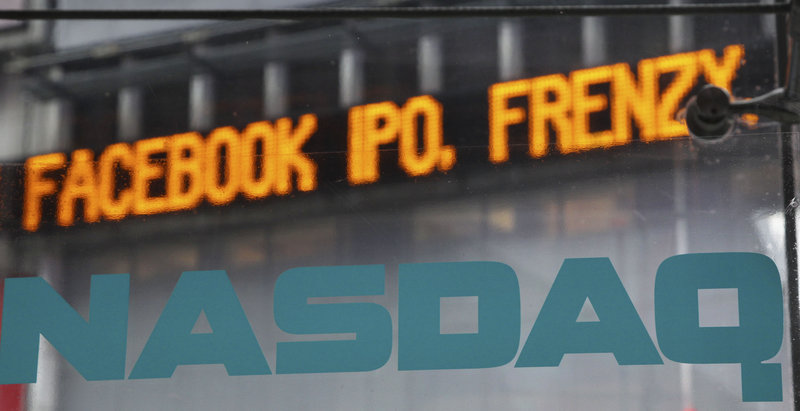

SAN JOSE, Calif. – So you want a piece of Facebook? Get in line. If other hot stock offerings of the past are any indication, investment funds and institutional investors probably grabbed most of the shares in the company’s oversubscribed initial public offering, despite the company’s efforts to spread some of them around.

That means you’ll be competing with mom-and-pop investors like Tessie Cuy, an East Bay real estate agent who plans to dive in when shares of the hottest new tech company in years start trading on the open market Friday morning.

“I’ll buy the stock just to see what happens,” Cuy said. “To a lot of people around the world, Facebook is the Internet, so I’d love to grab a few shares the first day it goes public. Plus, I can show them off to my friends and impress people.”

Facebook’s IPO has been one of the most widely anticipated tech stock debuts of the decade, and many analysts are bullish about the company’s long-term prospects. But some financial experts are advising individual investors to keep their cool.

For one thing, most individuals weren’t able to buy at the initial offering price. They’ll have to wait until public trading starts Friday, when demand is expected to drive the price much higher.

“The investment banks tilt their IPO allocations to their biggest and best clients, and that’s rarely the mom-and-pop investors,” said Joe Magyer, a senior analyst at the Motley Fool, an investment advisory website.

Facebook made some effort to give small investors a crack at the IPO shares. It added online broker E-Trade, often used by smaller investors, to the list of underwriters that had the right to sell stock at the IPO price. Most of the 33 underwriters are big investment banks like Morgan Stanley and JPMorgan Chase, which primarily serve wealthy investors, big pension and mutual funds and the like. High threshold Other retail brokers such as Charles Schwab, TD Ameritrade and Fidelity have said they expected to get some IPO shares even though they are not underwriters. A Fidelity spokesman said his firm will have some IPO shares through an arrangement with Deutsche Bank, for example.

Those brokers have not said how many shares they expected to have. But they set minimum eligibility requirements for prospective buyers, anticipating that demand would outstrip limited supply. And most say that meeting those requirements wouldn’t guarantee customers will get their hands on any shares at the sought-after IPO price.

E-Trade did not respond to requests for comment, but a statement on its website said shares would be allocated to customers “after a subjective review” of their asset level, trading history and other factors. At TD Ameritrade, spokeswoman Beth Evegan said clients who want to participate in the IPO must have an account valued at $250,000 or more, or have completed 30 trades in the past three months. There are additional requirements, she said, which she declined to discuss.

“Everything else being equal, they’d want to favor the people that do the most trading and who are the most profitable for them,” said Charles Rotblut, a vice president at the nonprofit American Association of Individual Investors. “Those are customers the brokerage firms want to keep happy.”

Shares will become a lot easier to buy once the stock starts trading publicly Friday, as some IPO investors look to flip their shares for a quick profit. But that’s also when the price is expected to rise quickly. Among other recent social networking IPOs, Yelp shares rose 64 percent in their first day of trading, while Groupon rose 33 percent and LinkedIn popped up 109 percent. All three have subsequently fallen.

“The danger is you’re buying at a euphoric price” on the first day, Magyer said. “Research shows that most IPOs underperform over the first few years. We generally advise investors to be patient when it comes to IPOs and see how things play out before diving into the pool.”

Rotblut agreed. “It’s important for people to realize that, as popular as Facebook is, a lot of that popularity is already priced into the stock’s offering price,” he said. “I think people would be better off waiting a couple of days, at least, to get a sense of the valuation levels the shares are trading at.”

The risks and unknowns confronting Facebook as it goes public make the company too hot to handle right now, say some investors and advisers who are staying on the sidelines. William Huey, of San Jose, who runs a private elementary school, said he appreciates the allure of owning such a hot stock. “People think Facebook could be another Microsoft, and if they buy in at the bottom, they’ll hit a pot of gold,” he said.

But Huey’s not jumping in quite yet. He’s not confident enough about the company’s true value to risk getting roughed up in an ugly scrum of rabid amateur investors.

“I won’t put in a buy order just yet,” Huey said. “I’ll follow the stock and wait and see what happens.”

San Ramon, Calif., certified financial planner Steve Schliesser worries that the hype surrounding the IPO could spell trouble for investors who jump in without understanding the risks. He said he’s “gotten calls from people hoping to buy it even though they don’t even know what Facebook is. “I’ve heard from grandmothers in their 70s whose grandkids tell them, ‘You should buy this Facebook thing.’ “

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.