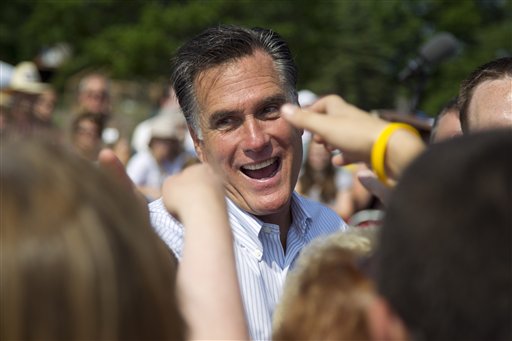

WASHINGTON — When it comes to their federal taxes in the last two years, Republican presidential candidate Mitt Romney has paid a lower federal tax rate than his running mate, congressman Paul Ryan.

Ryan paid an effective federal tax rate of 15.9 percent in 2010 and 20 percent in 2011, according to tax returns released by the Romney campaign Friday evening.

In 2010, Ryan and his wife reported an adjusted gross income of just over $215,000. Most of that came from Ryan’s congressional salary. They paid just under $35,000 in federal taxes on that income. They also paid $3,168 in employment taxes for a household worker.

In 2011, they reported an adjusted gross income of more than $323,000 and they paid nearly $65,000 in federal taxes. In addition to Ryan’s salary, the couple made more than $50,000 in investment income from capital gains and qualified dividends. They also made more than $116,000 in rental income, royalties and trust income. The couple owns rental property in Oklahoma, according to the return.

Romney paid about $3 million in federal income taxes in 2010, an effective federal tax rate of 14 percent. For 2011, Romney’s campaign estimates that he will pay about $3.2 million with an effective federal tax rate of about 15.4 percent.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.