WASHINGTON — Hard economic times have helped push millions of Americans deeply into debt, plunging many into a dark world filled with relentless collection agents, aggressive lawyers, and companies that profit mightily if they can get people to pay up.

Aided by outdated laws and lax oversight, debt collection has become a $12 billion-a-year business as people increasingly have fallen behind on their bills for credit cards, student loans, hospital stays and other expenses.

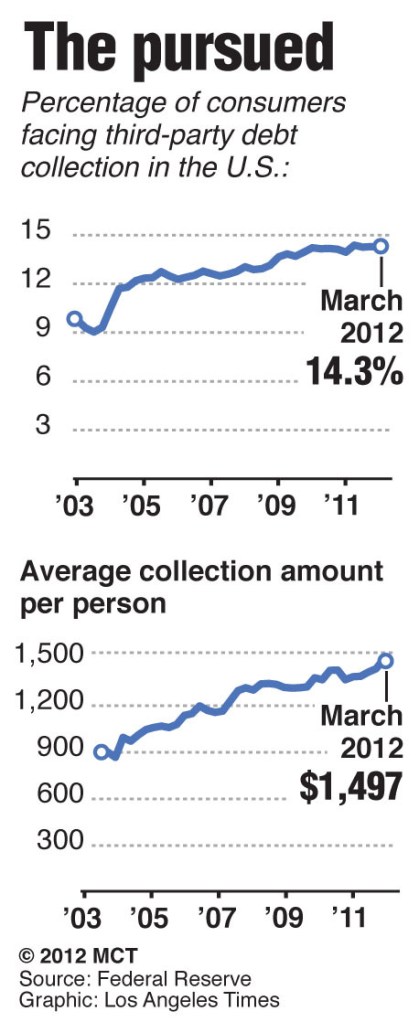

The Great Recession and its aftermath have led to a sharp increase in the number of people facing debt collectors — an estimated 30 million Americans this year, up nearly 50 percent since 2003.

At the same time, job losses and underwater mortgages have made it more difficult for many of those people, who already are struggling to make ends meet, to pay off their debts.

Federal regulators, along with lawmakers in several states, are starting to take action against debt collection firms over aggressive tactics that authorities said are becoming rampant.

Those tactics include intimidating phone calls, unfounded threats of arrest, harassment of relatives and neighbors, and a flood of lawsuits aimed at squeezing money for unpaid bills from paychecks or home equity. In 2010, $55 billion in debts was recovered.

Southern California is home to two of the debt-collection industry’s major players — ones that consumer advocates alleged have been at the forefront of improper behavior.

Encore Capital Group Inc. of San Diego, which buys unpaid bills from businesses, has faced numerous lawsuits filed by state attorneys general and private lawyers, alleging it used false and faulty affidavits, much the way banks allegedly used robo-signing in filing foreclosure documents.

Although some cases are still pending, Encore said it has corrected the problems.

And Brachfeld Law Group in El Segundo, Calif., one of the nation’s largest debt collection law firms, has been contending with allegations that it failed to investigate the facts adequately when it pursued some debts. A spokesman said the firm checks to ensure accuracy.

In one case, though, Brachfeld allegedly helped pursue the wrong person for a debt he never owed.

Several years ago, debt collectors began pursuing California state Sen. Lou Correa, D-Santa Ana, for an unpaid Sears bill they said he owed. He told them they had the wrong man, but the debt collectors never wavered.

“These folks are very aggressive,” Correa said. “They’ll call back repeatedly and say, ‘Tell us some personal information so we can tell it’s not you.’ When all of a sudden is the burden of proof on me?”

Michael Gottlieb, director of business development for Brachfeld, said the suit was served on the person who owed the debt, but the senator later was incorrectly targeted for wage garnishment.

Once informed of the problem, Gottlieb said, Brachfeld stopped the process before any of Correa’s wages were taken.

For many who do owe money, the debt collection process can be intimidating and nightmarish.

Katie Brown got a call in March about her unpaid $3,000 credit card bill from Hhgregg Inc. The person said he was from a free legal aid service she had contacted to try to stop harassing phone calls from debt collectors.

“After I told him everything, he laughed and said, ‘Now let me tell you who I am. I hold your debt from Hhgregg,’ ” said Brown, 26, of Piqua, Ohio. She didn’t know how the debt collector knew she had contacted legal aid.

“I was scared they would get to my husband’s work and start calling them,” she said, “because at this point they would stop at nothing if they were going to misrepresent themselves.”

Brown did what an increasing number of consumers are doing: She filed a lawsuit. Her complaint against International Asset Group Inc. in Amherst, N.Y., alleged the company violated a federal law that prohibits misrepresentation and harassment by debt collectors. The suit is pending.

Brent Nowicki, the company’s general counsel, said he couldn’t comment about the case. International Asset Group is an upstanding company, he said, but sometimes technical violations of the law occur.

“It could be the rogue employee who gets a little overzealous about something,” Nowicki said. “It happens. It’s unfortunate.”

In addition to lawsuits, consumers have been complaining to government officials. Last year, the Federal Trade Commission received more complaints about debt collectors — 180,928 — than about any other industry. The figure is up 73 percent from 2008.

“We’ve seen a high level of complaints, and I think some of it is collectors realizing in hard times they may have to press that much harder to get someone to pay,” said Tom Pahl, the FTC’s chief debt-collection lawyer. “And a lot of them are pressing.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.