SOUTH PORTLAND — Stephen Nolet knows that Gov. Paul LePage is hostile to wind energy. But Nolet, senior director for innovation and technology at TPI Composites in Warwick, R.I., was in Maine on Tuesday at a sold-out, regional conference that focused on how businesses can supply the growing wind power industry in the Northeast.

Case in point: Nolet’s company, which builds turbine blades, is testing one for a client at the University of Maine’s wind-blade testing lab, a contract worth $500,000.

“Maine is a mixed message, at this point,” Nolet said of the state’s climate for wind power.

Nolet was among 300 or so attendees at the American Wind Power Association’s Northeast Regional Summit at the Marriott at Sable Oaks. It’s the second time in three years the trade group has come here, underscoring the value that participants say they get from the two-day sessions.

Some attendees are aware of LePage’s involvement in legislative action last year that led Norwegian energy giant Statoil to abandon its plans for a demonstration offshore wind farm. Some are following a bill introduced on LePage’s behalf to require developers to prove a project’s economic impact before it could be approved.

Others know of a recent Maine Supreme Judicial Court decision that upended the legal standing of an investment partnership between First Wind, the state’s largest wind developer and Emera Inc., the Canadian energy company that owns two Maine utilities.

Although U.S. Sen. Angus King of Maine gave opening remarks by video, no state officials turned out to welcome participants in an industry that has spent nearly $1 billion in the past 10 years on more than a dozen projects in Maine. More investment is likely, with new activity planned or underway.

“It says something that, despite the fact that there’s some opposition, Maine has some great wind resources,” said Lindsay North, of the Washington, D.C.-based trade group. “Lately, there’s been a lot of business happening. That’s why we’ve come back.”

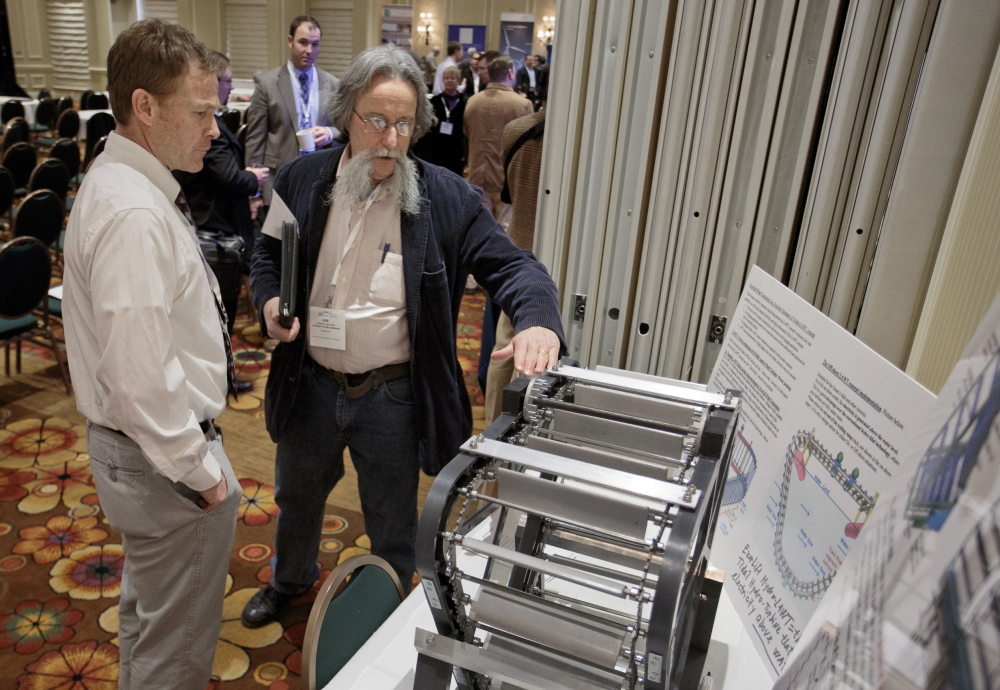

A focus of Tuesday’s event was a wind supply-chain workshop, where businesses could explore commercial opportunities for providing materials and services in the region.

For Cathy Stewart, regional sales manager for American Superconductor Corp. in Devens, Mass., it was a one-stop networking opportunity with key people planning projects. Her company makes wind-turbine electronic controls. Their first installation was at Maine’s largest operating wind farm, Kibby Mountain.

Kepware Technologies of Portland makes industrial control software for automation, and has clients in the power and oil industries. But recent business with Vestas, the large Danish turbine maker, has the 85-person company looking to see where else it can grow.

“Vestas has opened our eyes to this industry,” said Erik Dellinger, Kepware’s product manager. “I’m trying to make those connections.”

Supply chains typically revolve around companies that make products, but Paul Williamson, director of the Maine Ocean & Wind Industry Initiative trade group, said the definition is broader in Maine. Engineering firms, environmental consultants and other services help support wind power development, he said, and are represented at the summit.

One example is the Portland-based Bernstein Shur law firm, which boasts 20 lawyers and other professionals on its “wind energy team,” which works on issues ranging from environmental permitting to power-purchase agreements.

“Maine is the hub of the industry in New England,” said Jack Kenworthy, chief executive officer at Eolian Renewable Energy in Portsmouth, N.H. “That’s what brings folks here.”

Eolian is trying to develop five small-scale farms in the Northeast, including projects in Orland and Frankfort. Kenworthy said the industry has to “roll with the punches” in places such as Maine, where the added cost of wind power to ratepayers draws opposition from some officials, including LePage. But improving technology and rising natural gas prices are making wind competitive with other energy sources, he said, and will be able to complement gas generation on windy, winter days.

That outlook isn’t shared by critics, who say future imports of hydroelectricity from Canada and pipeline upgrades that will boost natural gas capacity and lower prices, making wind uncompetitive.

“They are a motivated and organized trade association,” said Chris O’Neil, a spokesman for the Friends of Maine’s Mountains citizen group. “We continue to see Big Wind scrambling to build whatever projects they can before the honeymoon is over and their product totally falls out of favor.”

O”Neil said that as federal subsidies for wind power dry up, the industry will find itself outperformed and priced out of the market by other generators.

“Our focus is holding them at bay wherever we can, while allowing those external forces to eventually finish off mountain wind power,” he said.

But Williamson, of the ocean and wind trade group, noted that more than half of New England’s electricity now is generated by natural gas, and utilities that want to balance that dependence with other sources are putting more wind into the mix. Power-purchase agreements for Maine projects that will send electricity to Massachusetts and Connecticut confirm the trend, he said, even if Maine’s current governor doesn’t embrace it.

“Governors come and governors go, but the market demands are still here,” Williamson said.

Tux Turkel can be contacted at 791-6462 or at:

tturkel@pressherald.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.