GARDINER — Frank Hillman has been trying to sell his building in downtown Gardiner for three years, and around two months ago he thought he had found a buyer.

But that was before the developer heard the quote for flood insurance on the property.

The buyer expected to pay about $2,000 a year for flood insurance. The actual price tag: nearly $20,000.

“That quote literally made everything come to a screeching halt,” said Dustin Slocum, the Brunswick-based developer hoping to purchase Hillman’s building to house the Gardiner Food Co-op.

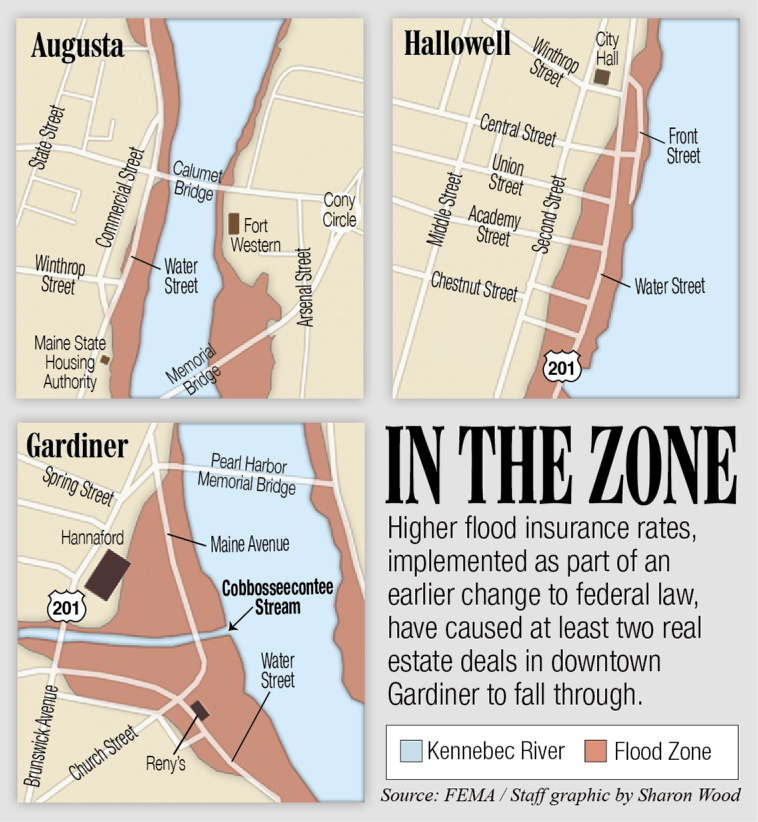

It’s at least the second real estate sale in downtown Gardiner that fell through this year because of high flood insurance premiums caused by a federal law passed in 2012 to try to return the flood insurance program to solid financial footing.

Although lawmakers updated the law in March to halt most of the steep increases, the subsidized rates for older buildings in the flood plain are still expected to slowly increase until they reflect the actual risk of the properties. Buildings receive subsidized rates if built before the end of 1974 or before the community adopted its first flood map. Most towns and cities in Kennebec County first adopted flood maps around 1980 or later.

For properties well below the flood plain, such as Hillman’s and the rest of the downtowns of Gardiner and Hallowell, those deal-squashing rates could be the new reality in less than two decades if the Federal Emergency Management Agency increases them as much as the new law allows and if nothing is done to mitigate the flood risks.

ANOTHER DEAL DOOMED

An insurance agent in Augusta who provided a flood insurance quote that led to the unraveling of another real estate deal in downtown Gardiner, Ryan Madore, said he doesn’t expect premiums to continue to rise that much.

Madore, a senior account executive at United Insurance, said the building for sale on Water Street in Gardiner had a flood insurance quote of roughly $2,700 annually in 2012. The quote for that same property jumped to $26,000 for a prospective buyer this year because of the 2012 law.

Now, after the recent changes returned the subsidies starting May 1, the annual premium for flood insurance is $2,200.

Madore said he doesn’t think FEMA will raise the rates that much again because it would be impossible to operate or purchase downtown buildings with such high increases.

“That was my major concern,” Madore said. “Whether it’s Hallowell or Augusta or Gardiner, every community that I know of is working so hard to rejuvenate and bring business to their downtown, and it’s certainly a major issue to have flood insurance premiums get that astronomical. It becomes cost-prohibitive to own any property downtown.”

However, the state coordinator for the federal flood insurance program said it’s not clear from the guidance provided by FEMA how much flood insurance rates will increase for subsidized properties.

“We’re definitely going to have to be watching this,” said program coordinator Sue Baker.

REDUCED RISK

Flood insurance is required for buildings in the flood plains with mortgages. It’s not required once the mortgage is paid off or if an owner purchases with cash or gets private financing from the previous owner.

More than 35 percent of the roughly 9,200 flood insurance policies in Maine receive some type of subsidized rate, according to Baker. Most of the roughly 3,300 of the subsidized policies will see increases, but elevation certificates showing lower risks could slow or prevent the increases, she said.

The new law requires increases of at least 5 percent a year for most subsidized premiums and allows up to 18 percent increases for most buildings.

Baker said she doesn’t yet know how high the rates will increase each year for property owners. For a building with a $2,000 subsidized premium, the owner could see a rate of $20,000 a year in about 15 years if FEMA increased the rate 18 percent annually.

The only thing communities and building owners can do is try to mitigate the risks by taking steps such as flood-proofing the buildings, Baker said.

“In this day and age, you’ve got to mitigate the problem to change the rates,” she said.

Nate Rudy, director of economic and community development for the city of Gardiner, said he’s looking to find out what type of federal grants are available for flood plain mitigation, especially in historic downtowns like Gardiner.

He said the immediate, acute need for the city is to ensure property sales aren’t falling apart because of flood insurance changes, but the city also needs to look for ways to lower the risk of flooding in its downtown buildings.

“I’m hoping that in the long term we will find the leadership we need to reassess the way this program is administered, so it doesn’t represent a grave threat to downtowns like Gardiner,” Rudy said.

Paul Koenig can be contacted at 621-5663 or at:

pkoenig@centralmaine.com

Twitter: @paul_koenig

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.