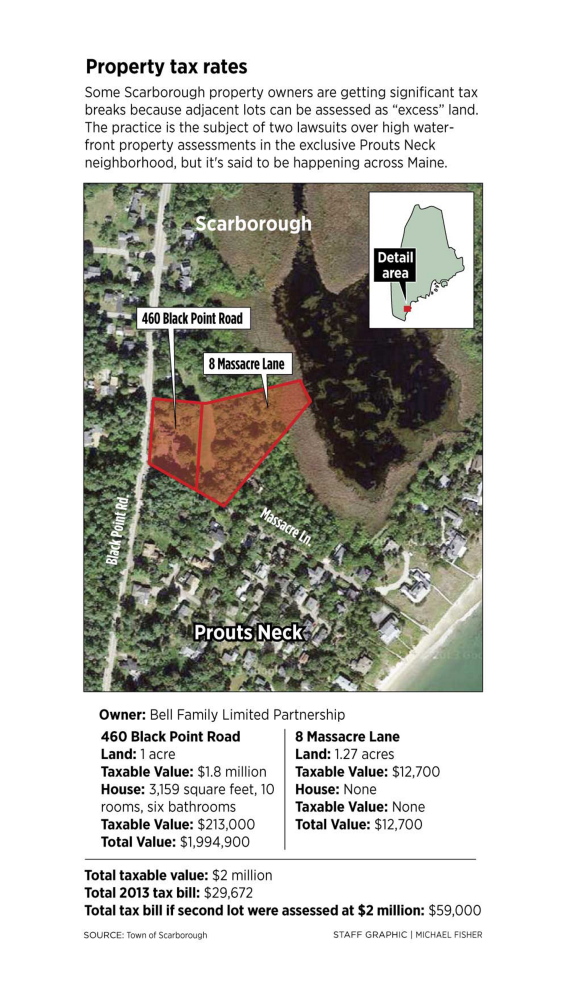

SCARBOROUGH — A vacant one-acre lot near the ocean here normally would be valued at about $2 million for tax purposes. But instead, the land at 8 Massacre Lane is assessed at a value of $12,700.

The reason? The owner of the lot also owns the house next door, and asked the town for what’s known as an “excess land” tax reduction, saving about $30,000 on the 2013 property tax bill.

Now, a continuing controversy over waterfront property tax assessments in this town has focused attention on the little-known but widespread practice in Maine of giving tax breaks on adjacent lots owned by the same person or entity. The practice, although permitted by state officials, is the subject of two recent lawsuits filed by 17 property owners in the exclusive Prouts Neck neighborhood.

The landowners claim the former town assessor discriminated against them when he increased land values in waterfront areas in 2012. Some nearby property owners, on the other hand, were immune to the full impact of the increase because they own adjacent lots that are considered “excess land” for assessment purposes. Critics say the practice violates the state constitution.

For more than 30 years, if a Scarborough homeowner asked the town assessor to value two lots as if they were one, the assessor would assess the secondary lot at less than fair-market value based on its highest and best use. The tax break has been applied to at least 110 properties across town, but it’s unclear how much tax revenue is represented by the reduced assessments or what cost has been passed on to other taxpayers.

Assessment reductions can range from a few thousand dollars on inland parcels to a few million on waterfront properties. In waterfront neighborhoods, where half-acre lots sell for $2 million to $4 million, depending on the view, having a parcel assessed as “excess land” can save a property owner $30,000 to $60,000 or more in yearly taxes.

In one case on Prouts Neck, a vacant one-acre lot at 8 Massacre Lane is assessed at $12,700, a fraction of the normal one-acre assessment of about $2 million. That’s because it was merged for tax purposes with the house lot next door at 460 Black Point Road in 1990. Because the assessed value was lowered, the owner of both parcels, Bell Family Limited Partnership, saved about $30,000 on its 2013 tax bill.

“It’s selective assessment,” said George Sprague, a retired Massachusetts judge who saw the assessed value of his half-acre lot on Jocelyn Road increase nearly 15 percent, from $3.4 million to $3.9 million, after the town recently increased some coastal property assessments. The annual tax bill for his summer home jumped from $46,209 in 2011 to $54,842 in 2012.

“It violates the Maine state constitution, as I read it,” Sprague said. “We’re subsidizing people who have more land but are taxed less.”

Sprague is one of eight Prouts Neck plaintiffs represented by Jonathan Block, a lawyer with Pierce Atwood who filed a lawsuit April 24 in Cumberland County Superior Court. A similar lawsuit was filed the same day by lawyer William Dale of Jensen Baird, who represents an additional nine Prouts Neck property owners. The lawsuits also question stagnant assessments on more than a dozen properties near Piper Shores, a waterfront area where the town assessor hasn’t increased land values.

According to the state constitution, property taxes must be assessed equally according to fair market value. Block and Dale say the “excess land” tax break is unconstitutional because it disregards fair market value, is granted only to those who know enough to ask for it, and forces other property owners to pay higher taxes.

“You have to go down and ask for it,” Block said. “Then other property owners pay more because you pay less.”

Efforts to reach the owners of the Massacre Lane property and other lots with reduced assessments were unsuccessful.

The practice of assessing adjacent lots as “excess land” came to light during Board of Assessment Review hearings on property tax appeals last November, December and January. Testifying were former Town Assessor Paul Lesperance, who retired last year, current Town Assessor William Healey and David Ledew, director of the Property Tax Division at Maine Revenue Services.

All three said the practice of combining lots with shared ownership for assessment purposes is common across the state. When this happens, towns assess the additional land as if it’s a lesser used or unused part of a larger building lot.

They pointed to a state law, Title 36, Section 701-A, that allows contiguously owned parcels to be combined for assessment purposes. The law stipulates that it applies to “unimproved acreage in excess of an improved house lot … when each parcel is 5 or more acres (and) the owner gives written consent to the assessor.” It doesn’t say that parcels may be combined this way to reduce property assessments.

“It is done,” Ledew told the assessment board, according to a video recording of the Dec. 10 hearing. Ledew indicated that he was uncomfortable speaking publicly about the practice, saying, “There are times you want to turn the mic off and speak freely.”

Ledew said his office regularly gets questions about combining parcels, and three pages in the state’s assessment manual are dedicated to the process. He said state law indicates that “parcels should be separately assessed” and “we used to teach that quite solidly to assessors.” If people can’t afford to pay taxes on two properties, they should have to let one be acquired by the municipality for tax purposes, he said.

Still, Ledew said, “It’s quite common for municipalities to combine contiguous parcels. … We instruct assessors to proceed with caution.”

Dale, who invited Ledew and questioned him during the hearing, said he was shocked by what he heard.

“For a state official to say that it’s OK to finagle things that way, I was dumbfounded,” the attorney said. “I thought he was going to say it’s grossly inappropriate.”

It became apparent during the hearing that few municipalities adhere to the five-acre requirement in 701-A. However, Ledew declined to be interviewed for this story, even to clarify his comments at the hearing, because of the pending court cases. A lawsuit filed in January, involving several residents of Pine Point and Higgins Beach, also is pending in Superior Court.

Healey, the current town assessor, said “it’s strongly recommended (by state officials) that acreage not be a restriction” in granting requests to combine contiguously owned lots for assessment purposes. And while some may see combining lots and reducing assessments as unfair to other taxpayers, it’s a practice that must be done for wealthy landowners if it’s done for others.

“You have to be consistently unfair,” Healey said.

In an interview at his office, Healey said the practices of combining lots and assessing “excess land” are handled in similar ways across the state, though he acknowledged that assessors have a great deal of leeway in what’s often described as the “art” of determining market value. Before taking the assessor’s job in Scarborough last year, Healey worked in Yarmouth and Cumberland, as well as North Yarmouth, Old Orchard Beach and Denmark.

Healey also acknowledged that some Scarborough lots may have been wrongly combined for reduced assessment.

In one case, 1 and 2 Bohemia Way, waterfront lots off Jocelyn Road in Prouts Neck, were combined for tax purposes in 1992 even though there was a house on each of the two half-acre lots, so neither was “unimproved” as required by law. The property was owned at the time by the Timpson family. Their $4 million land assessment in 2011 likely would have been about $1 million higher if the lots had been assessed separately.

NFL Commissioner Roger Goodell bought both Bohemia Way properties for $5.9 million in 2011, when their total assessed value was just over $4.5 million, Healey said. Goodell razed one house and built a 19-room mansion with a guest house. He’s leasing the other house, which has 13 rooms and an assessed value of $289,000, back to the Timpson family for 15 years, according to deed documents.

Goodell’s property does not now get an “excess land” reduction. The latest total assessed value of Goodell’s property is $7.4 million, including $4.75 million for just over an acre of land.

To help Healey keep track of combined lots going forward, he’s requiring property owners to file a formal request if they want to continue receiving the tax benefit. In February, he sent a letter and a simple form to 109 property owners who have combined lots.

Some gladly filled out the form, he said, while others declined. Property owners who fail to respond before 2014 tax bills go out in August will have to wait until next year to request combined lots and a reduced assessment, he said. Parcels that are combined for assessment purposes will appear as single lots on tax maps.

The form warns that combining parcels for assessment purposes “could potentially impact division and/or development of the parcel in the future,” but Healey said the document has little legal value other than to help him create a record of residents’ requests.

While the practice of reducing assessments on so-called excess land is apparently common, assessors in different communities have different procedures and standards.

Falmouth Assessor Anne Gregory said she requires property owners to submit a formal letter requesting that lots be combined for assessment. Saco Assessor James Thomas said he requires property owners to file an affidavit that’s attached to the deed. He said he wouldn’t allow a buildable lot, like the one on Massacre Lane in Prouts Neck, to be combined with another lot.

To help address wider concerns in Scarborough about the fairness and accuracy of assessments, Healey said he’s seeking $500,000 to buy new assessing software and hire an outside firm to conduct a door-to-door revaluation. The last revaluation based on a physical inspections was done in 1995, followed by a statistical update of property values in 2005.

Town voters will be asked to approve the expenditure on the November ballot.

Kelley Bouchard can be contacted at 791-6328 or at:

Twitter: KelleyBouchard

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.