A recently adopted law intended to speed up the foreclosure process in Maine will be particularly effective at ridding neighborhoods of vacant homes that are not being maintained, state officials say.

But representatives of the state’s lending industry say the law, which takes effect Aug. 1, is bereft of any sweeping changes in the process that would reduce the number of foreclosed properties still hampering Maine’s housing market.

The law, originally known as L.D. 1389 and sponsored by Rep. Jarrod Crockett, R-Bethel, was signed into law by Gov. Paul LePage in April. It is based on a comprehensive report issued in January by Attorney General Janet T. Mills that described the state of Maine’s foreclosure problem and offered several recommendations for improving it.

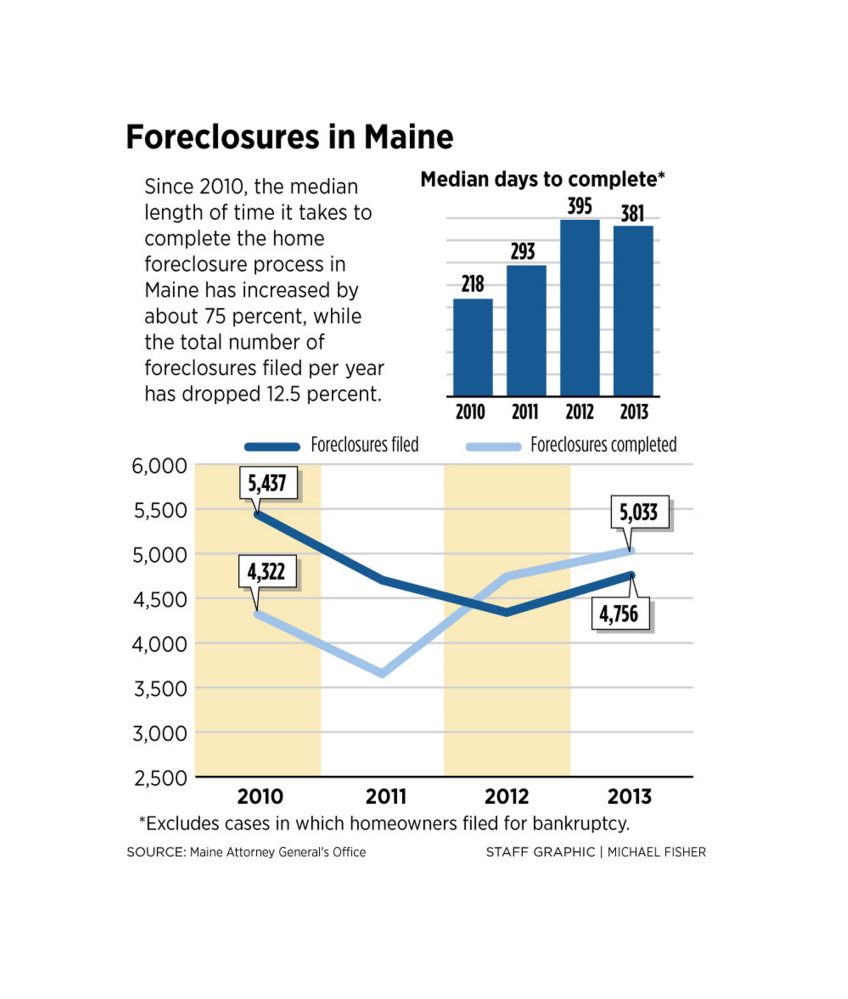

“The data we collected shows that the housing crisis is still rippling through Maine,” Mills said. “Maine courts saw 4,756 foreclosure filings in 2013, up from 4,339 the year before.”

Additionally, roughly 4 percent of Maine homes with a mortgage were in foreclosure as of September 2013 versus the national average of 2.3 percent, according to the AG’s report. The state has still not recovered from the recession, and Maine families and communities continue to suffer, Mills said.

One of the most troubling statistics revealed in the report was that the median length of time it took to complete a home foreclosure increased by 75 percent between 2010 and 2013, from 218 days to 381 days.

As a result, a backlog of pending foreclosures has bogged down the court system, strained the state’s financial resources and forced many homeowners and lenders to wait months for a hearing, state officials said.

It also has contributed to neighborhood blight, because foreclosed homes can remain vacant and unmaintained for months, they said. In addition, it has hurt the housing market, because sales of foreclosed homes can drag down the value of all homes in surrounding areas.

“Having homes going through foreclosure is bad for communities,” said Lloyd LaFountain, superintendent of the state Bureau of Financial Institutions.

The law makes a number of changes to the home foreclosure process:

• It strengthens the role of mediation in the process by incorporating the National Mortgage Settlement standards, which stem from a massive mortgage fraud lawsuit filed by most states, including Maine, against the country’s five largest banks, which resulted in a $25 billion settlement.

• It establishes an expedited process to deal with abandoned properties. However, the details of that process are left largely up to the courts.

• It shortens the challenge period from the current 15 years to five years for property subject to municipal tax liens recorded after Oct. 13.

• It authorizes the state Bureau of Consumer Credit Protection to regulate property-preservation entities operating on behalf of lenders.

• It increases standards and training requirements for foreclosure mediators.

• It also protects funding for housing counselors, who help delinquent homeowners through the foreclosure process, by closing a loophole that allowed foreclosing banks to avoid paying the full real estate transfer tax when the transfer was done with an affiliated entity.

Mills said her goal was to take the best parts from eight or nine different bills introduced during the 2013 legislative session that all dealt with foreclosures in some way. She met with several industry and nonprofit groups that had an interest in the issue and held two public hearings before drafting the report on which the new law was based.

“I spent hundreds of hours,” Mills said. “My staff spent hundreds of hours.”

One major focus of the law is beefing up mediation, she said, because it has proven to be popular and effective. The courts created a foreclosure diversion program in 2009 to expedite cases by focusing on mediation. Of the 3,791 mediated cases processed from 2010 to 2012, 54 percent were dismissed. In 2013, 21 percent of the 1,687 mediated cases were dismissed.

Mediators try to find a more positive outcome to a pending foreclosure such as a loan modification, if the homeowner qualifies; a short sale, in which the lender agrees to sell the home to a third party for less than the balance owed on the mortgage; or “cash for keys,” in which the lender pays the homeowner to sign the home over to the bank without going through the foreclosure process.

State judicial branch spokeswoman Mary Anne Lynch said Mills undertook a “gigantic task” and did a good job of involving all the interested parties, including government and court officials, banking-industry groups and homeowner advocates.

“I think that this is going to be a very helpful law,” Lynch said.

But Christopher Pinkham, president of the Maine Bankers Association, said the law falls far short of making the changes necessary to push Maine’s foreclosures through the legal process more quickly.

“It’s sort of a housekeeping legislation,” Pinkham said. “It didn’t really attack some of the bigger issues.”

Those issues include a court system overloaded with foreclosure cases, a shortage of mediators and “the extraordinary length of time the foreclosure process takes in Maine,” he said.

Maine is among the five states in which the process moves the most slowly, and the law does very little to change that situation, Pinkham said.

With no sign that Maine foreclosure filings will decrease in the near future, the state needs to go further in providing resources and streamlining the judicial process, he said.

“We ought to be coming out of this better than we are,” Pinkham said. “Frankly, the system is overwhelmed.”

Mills disagreed. She said there are many aspects of Maine’s existing foreclosure laws that work well and do not need to be changed.

“There didn’t seem to be any need to overhaul the process,” she said.

J. Craig Anderson can be contacted at 207-791-6390 or at:

Twitter: jcraiganderson

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.