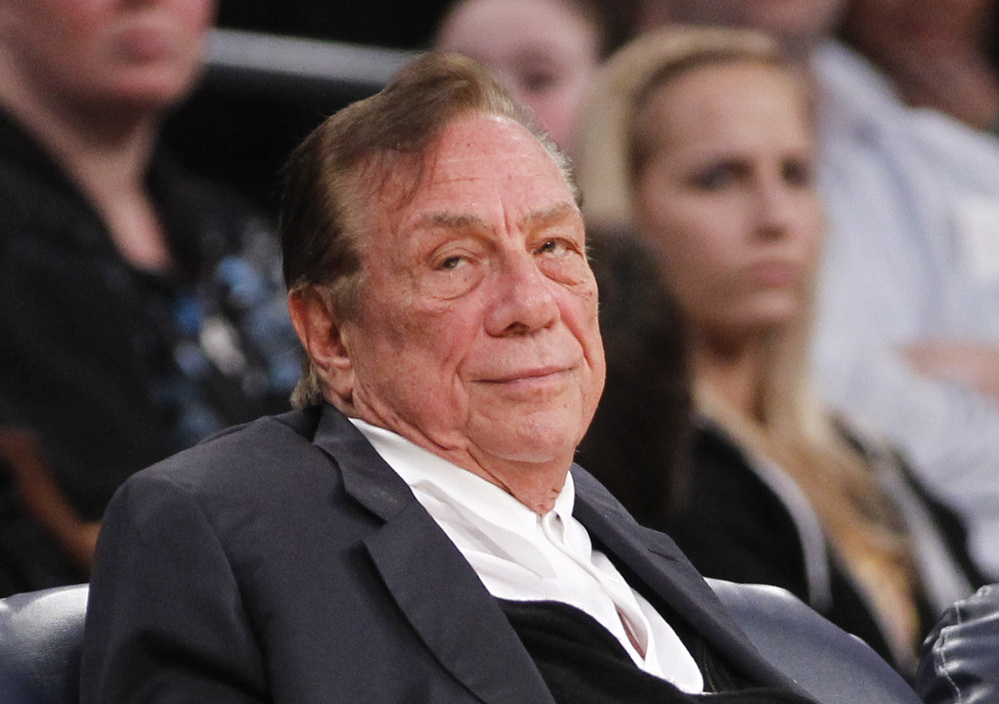

LOS ANGELES — Donald Sterling’s move to dismantle a family trust in order to block the sale of the Los Angeles Clippers could cause three banks to call for repayment of $480 million in loans and force the billionaire to sell part of his apartment empire, his chief financial officer testified Monday.

Darren Schield, also controller for Beverly Hills Properties, pointed to the possible “severe consequences” of Sterling revoking the Sterling Family Trust that owns the NBA team and the real estate portfolio. Schield acknowledged, however, that none of the banks have recalled their loans.

The testimony came in a probate trial in Los Angeles Superior Court, where Shelly Sterling has gone to ask a judge to affirm her takeover of the trust because of her husband’s mental incapacity, and her subsequent $2 billion sale of the team to former Microsoft chief executive Steve Ballmer.

Shelly Sterling’s lawyers also want Judge Michael Levanas to issue an order to make her transaction with Ballmer essentially appeal-proof.

The testimony by Schield was intended to show that the sale of the Clippers needs to go through to preserve the value of the Sterling Family Trust. Shelly Sterling testified earlier in the trial that she planned to use some of the proceeds of the sale to repay loans from Bank of America, City National Bank and Union Bank.

An attorney for Donald Sterling sharply rebutted the notion that the loans would be recalled and property sold to repay them. “It’s never going to happen,” Max Blecher said outside court. “They will fix it first. It’s just a parade of horribles they are trying to bring out. But it will be fixed.”

Schield described working for the Sterlings for more than 20 years and overseeing a real estate empire of about 10,000 units in 150 buildings. He said the Sterling trust had a $350 million line of credit with Bank of America, a $100 million loan with Union Bank and $30 million in outstanding debt with City National Bank.

Donald Sterling revoked the family trust on June 9, hoping to stop the deal his wife struck 11 days earlier to sell the Clippers.

Schield testified that he warned Donald Sterling: “A revocation of the trust could be a breach of the loans covenants and could, at some point, lead to a default on our loans.” Schield said he also cautioned another Sterling attorney, Bobby Samini, that a revocation “would open up a Pandora’s box and there would be severe consequences” for the business.

Levanas would not allow Schield to offer hearsay testimony about what the banks might do, but Shelly Sterling’s attorneys suggested that Bank of America was preparing to declare a default. Schield testified that the loan with the bank is well below market rate and the bank might want to arrange a better deal.

Without the sale of the Clippers to repay the loans, Schield suggested, the family would have to unload real estate quickly and possibly at a cut rate. “I think there would be an impact on the Los Angeles real estate market,” he testified. “I don’t know if we could sell that many apartments.”

Under cross-examination by Blecher, Schield acknowledged that there could be several other, less onerous outcomes for the family, such as a restoration of the trust, establishment of new loans with other lenders or taking the company public.

Donald Sterling’s representatives have said that he has been such a good customer over many decades — never late with a payment — that lenders want to keep him happy.

Sterling’s financial boss was not asked the odds of the various outcomes, though he did express skepticism about Sterling going into business with others. “There are huge reputational issues,” Schield testified. “I don’t know if anyone would want to go in partnership with us right now.”

A trial that has included Donald Sterling’s vitriolic testimony against the NBA and other opponents is rapidly drawing to a close, with the proceedings focused on narrower legal issues. With no other witnesses available Monday, court adjourned early. Scheduled to testify Tuesday are Dick Parsons, the interim executive appointed by the NBA to oversee the Clippers; Dean Bonham, a sports marketing expert; and Shelly Sterling.

Closing arguments are set for Monday. Ballmer’s attorney, Adam Streisand, has asked the judge to rule as quickly as possible to meet an Aug. 15 deadline set for the completion of the sale. The deadline could be extended, though the NBA has said it will move to seize the Clippers if a new owner is not put in place by Sept. 15.

NBA Commissioner Adam Silver fined Sterling $2.5 million, banned him from the league and moved to have the league’s Board of Governors vote to strip him of the team after Sterling was recorded telling a female companion not to bring black people to Clippers games. The NBA canceled the vote after Shelly Sterling made the sales agreement with Ballmer.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.