Venture capital investment in Maine startups topped $16 million during the second quarter of 2014, a significant increase from the same quarter last year, according to a new industry report.

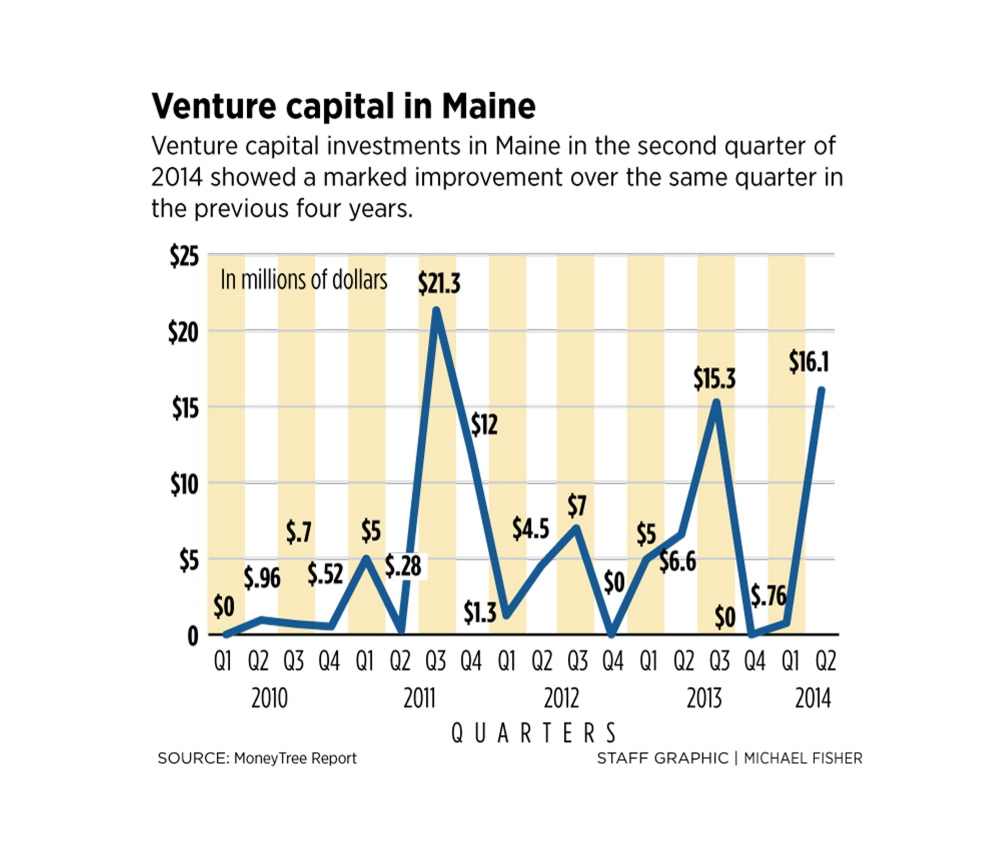

Venture capitalists, who typically put money into in early-stage companies, invested nearly $16.1 million in two Maine startups during the second quarter, according to the MoneyTree Report, compiled by PricewaterhouseCoopers and the National Venture Capital Association using data from Thomson Reuters. That is the highest quarterly total since the third quarter of 2011, when venture capitalists poured more than $21.3 million into two Maine startups.

Completing two deals a quarter is comparable with the past several years, but the $16.1 million in 2014’s second quarter is 144 percent more than a year earlier and more than 21 times the $758,000 of venture capital invested during 2014’s first quarter, according to the report.

“Any time $16 million gets invested in Maine, that’s a good thing,” said Tim Agnew, principal at Masthead Venture Partners in Portland. “It’s going to create some jobs and have a multiplier impact, so it’s fantastic.”

One quarter’s data isn’t enough to draw conclusions about a burgeoning trend, Agnew said. Because Maine is a small state, the amount of venture capital activity is unpredictable, which explains why some quarters see more money invested than others.

Agnew does see some positive signs, though.

“I do think there is quite a bit of money around in Maine looking at deals from a variety of sources, primarily from angel investors,” Agnew said. “There’s also more interest in mission investing on the part of foundations that are looking for ways to put some capital to work in ways that benefit the state. I think that’s a very positive trend that will grow over the next couple of years.”

The MoneyTree Report doesn’t list details about individual deals, but the large majority of the nearly $16.1 million was most likely invested in Portland biotech firm Putney Inc., which raised $16 million in a Series D round in June, according to a filing with the U.S. Securities and Exchange Commission.

Nationally, venture capitalists invested $13 billion in 1,114 deals during the second quarter of 2014, the highest single-quarter national total since 2001, according to the MoneyTree Report.

“Not since the early 2000s have we witnessed this level of quarterly investment activity. Despite being over $15 billion below the peak, you can’t ignore the historical significance of venture investment during the second quarter,” Bobby Franklin, president and CEO of the National Venture Capital Association, said in a written statement.

The software industry received the most attention from venture capitalists, with software companies receiving $6.1 billion in investment during the second quarter. One software company alone raised $1.2 billion, which makes it the largest single quarterly deal reported by the MoneyTree Report since it began tracking venture capital deals in 1995. That company is Uber, the San Francisco-based ride-share app that is reportedly exploring Portland as a market.

“Investments going into companies with disruptive technologies remained strong in the second quarter, and (venture capital) investing is on pace to exceed the $30 billion invested in 2013,” Mark McCaffrey, global software leader and technology partner at PricewaterhouseCoopers, said in a written statement.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.