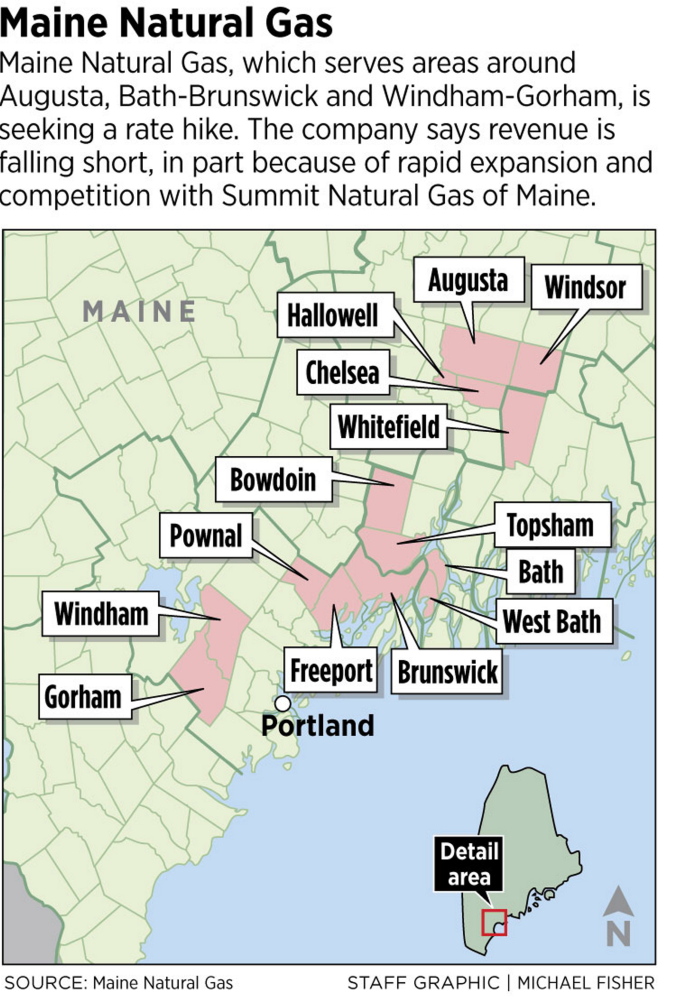

Maine Natural Gas, which is growing at a record pace in its service areas around Augusta, Bath-Brunswick and Windham-Gorham, is seeking a sizable rate increase as part of a proposed three-year rate plan.

The company says it needs more than $10 million in additional revenue over the next three years to improve the safety and reliability of its distribution system, expand customer services and bring earnings in line with industry standards. Maine Natural Gas hasn’t raised rates since 2011. It has suffered low earnings for years, and had a negative return on equity in 2014, according to documents filed in March at the Maine Public Utilities Commission.

No date has been set for a public hearing. But at an initial case conference on Tuesday, lawyers for Maine Natural Gas sought to have a decision by Dec. 1, to adjust rates for the winter heating season.

The request comes as thousands of Mainers are converting to natural gas each year, lured by the promise of prices that are lower and more stable than heating oil. Although the ongoing slump in crude oil prices has put oil heat on par with natural gas for now, long-term projections have the state’s local gas distributors – Maine Natural Gas, Unitil, Bangor Gas Co. and Summit Natural Gas of Maine – scrambling to lay pipe and hook up new customers.

PAYING TO BUILD INFRASTRUCTURE

Maine Natural Gas is a subsidiary of Iberdrola USA, the Spanish energy conglomerate that also owns Central Maine Power Co. The company has grown 100 percent since 2010, and now serves 4,200 customers in 11 communities. It added 700 new customers last year and expects to maintain that pace “for the foreseeable future,” according to its filing.

The rate case centers on the cost of distributing gas, which includes installing and maintaining underground pipes and serving customers. Distribution costs account for up to one-third of an average home bill. If Maine Natural Gas gets all the money it’s seeking, a typical home customer could see the delivery portion of an average monthly bill rise from nearly $59 today to $130 in 2018, according to the documents.

But the biggest driver on a gas bill is supply. The wholesale price of gas is always changing, and the PUC allows supply costs to be passed along to customers, with no profit for distribution companies.

Taken together, Maine Natural Gas’ total bill, including service charges, distribution and gas supply, could go from $175 a month to $220 in a typical home, or from $2,101 a year to $2,644 a year. The average home burns 1,120 therms of gas a year, the company says in its filing.

Although the PUC doesn’t regulate supply costs, debate over supply may play an outsized role in this rate case.

Maine Natural Gas is proposing to defer some of the higher return on equity it’s seeking to the third year of the rate plan. It’s working to sign a firm gas-supply price contract with Spectra Energy, which is expanding pipeline capacity in New England through a project called Atlantic Bridge. The expansion is expected to lower wholesale rates in the region in 2017. Those lower rates will help offset the increase in delivery rates, Maine Natural Gas says, essentially smoothing the impact on customers.

“It’s not definitely a lock right now, but we expect to negotiate a good rate for Atlantic Bridge,” said Dan Hucko, a Maine Natural Gas spokesman.

But that assumption is likely to be challenged. While new supplies of domestic gas may lower wholesale prices, it’s also possible those savings could be diminished by lower output from offshore Canadian wells, according to Tim Schneider, Maine’s public advocate.

“We just don’t know,” he said of supply costs. “And for us, it’s not relevant to the overall merits of the rate request.”

Another facet of this case is the impact of competition.

Maine Natural Gas has had a history of prudent investment since starting up in 1998, expanding slowly to serve big customers and capturing homes along the way. But its strategy has been tested since 2013, when the PUC approved Summit’s bid to also serve the Augusta and Hallowell area. It’s unusual for two local gas providers to lay pipe in the same communities.

Summit came in with an aggressive build-out plan, which has led to a battle for customers among the two companies. Responding to questions from the Portland Press Herald, Hucko said Maine Natural Gas will have invested $50 million by year’s end to expand in Augusta, Freeport and Bath.

In Augusta, the company spent $23 million to build a 10-mile lateral line from Windsor to hook up the new MaineGeneral Medical Center, according to media reports.

Hucko said the company was forced to negotiate discounted rate contracts with some large customers, which further hurt revenue goals.

“We ran a deficit in 2013, which was caused by our planned, long-term investment to expand our system into Augusta, where we also encountered some very rare and fairly strong competition,” Hucko noted.

Those and other investments will be scrutinized in the rate case, as will the relationship between the company’s costs and its stated earnings woes.

“That’s the work of a rate case,” Schneider said, “to figure out why and whether those costs were fairly incurred. We want to find out what’s driving those costs and whether those costs are prudent.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.