AUGUSTA – Gov. Paul LePage’s proposals to eliminate municipal revenue sharing and end property tax exemptions for larger nonprofit organizations appear to be in trouble with state lawmakers.

On Thursday, members of the Legislature’s Taxation Committee voted unanimously to recommend that Maine state government continue to provide $62.5 million in revenue sharing to municipalities for the next two years in response to concerns that LePage’s proposed cuts would force cities and towns to increase property taxes.

The committee also voted unanimously to recommend against the LePage administration’s plan to allow towns to assess taxes on nonprofits with more than $500,000 in property value. Although touted by the LePage administration as a way to offset lost revenue-sharing dollars, the proposal prompted an outcry from the nonprofit sector and among municipal leaders in small towns without large nonprofit organizations.

“The hearing we held on revenue sharing was quite compelling,” Rep. Adam Goode, a Bangor Democrat who co-chairs the Taxation Committee, said Friday. “People came from all over the state.”

Eric Conrad, spokesman for the Maine Municipal Association, which represents municipal officials at the State House, said community leaders from throughout the state made clear that eliminating revenue sharing would pressure communities to increase property taxes.

“We are cautiously optimistic,” Conrad said of the committee vote. “Obviously, things can happen between now and mid-June but we do feel like the message is out there” about impacts on property taxes.

STILL WORKING ON TAX CHANGES

The committee has yet to finalize its recommendation on Le-Page’s proposals to reduce the income tax, eliminate the estate tax, and increase and broaden the sales tax. Those three components form the backbone of the sweeping tax overhaul package in LePage’s two-year, $6.5 billion budget, which would go into effect July 1.

Sen. Earle McCormick, a Republican from West Gardiner who co-chairs the Taxation Committee, said he believes that an income tax cut will “absolutely” be part of the final recommendation to the Appropriations Committee.

“That was the whole focus of the package, to make Maine more attractive compared to other states,” McCormick said Friday.

The Taxation Committee was expected to finish work on the budget proposal Monday and send its recommendations to the Appropriations Committee.

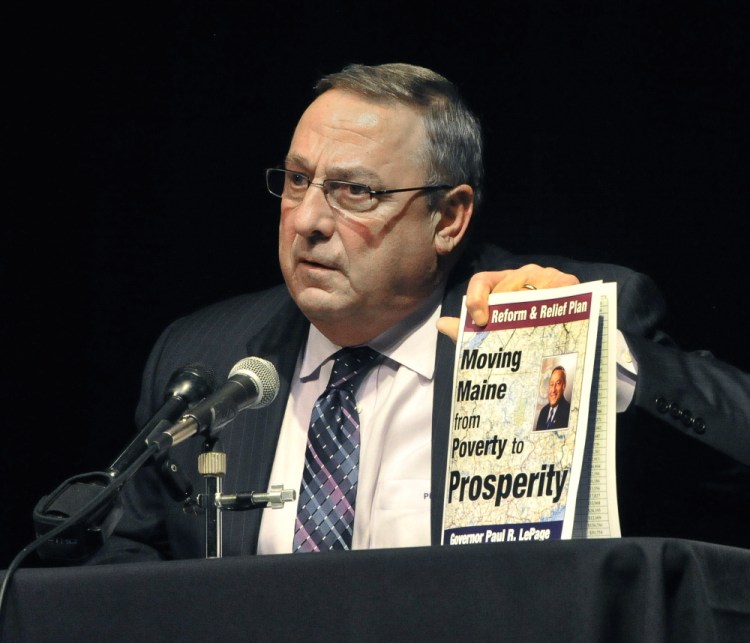

LePage continues to fight for his budget proposals and has indicated that he will use his political leverage – whether with the veto pen or other methods – to pressure lawmakers to go along with his plans.

At the same time, LePage has on several occasions appeared resigned to seeing lawmakers reject key portions of his proposal, including the elimination of municipal revenue sharing.

“This budget I am coming out with, it is being blasted by all of the town leaders around the state over revenue sharing,” LePage said Friday, in remarks at a Maine State Chamber of Commerce forum on energy in Augusta. “Revenue sharing in the state of Maine is $62.5 million. I am trying to give back $1.3 billion. If anybody told me before I started this that giving back $1.3 billion was going to be this difficult, I would raise taxes. You can’t make this stuff up.”

LePage introduced his sweeping tax overhaul proposals two months after being re-elected in November on a pledge to lower Mainers’ tax burden and make the state more attractive to businesses.

The two-year budget plan, as originally written, proposes cutting the top income tax rate from 7.95 percent to 5.75 percent and eliminating the estate tax and income taxes on military pensions.

REVERSAL FOR REPUBLICANS

To help offset those revenue losses, LePage proposed increasing the sales tax rate to 6.5 percent from 5.5 percent and applying sales and use taxes to hundreds more goods and services. That plan is similar to a Democrat-drafted proposal that passed in the Legislature in 2009 only to be reversed at the ballot box a year later after a “people’s veto” campaign led by Republicans.

A former Waterville mayor, LePage is now sharply critical of municipal spending and is again aiming to eliminate the revenue sharing program that sends money back to municipalities to lower property taxes.

Speaking at a forum in Saco on Thursday, LePage said revenue sharing has not kept property taxes low and argued that Mainers would benefit more from his long-term plan to eliminate the state income tax by 2020.

It was LePage’s plan to tax nonprofits with more than $500,000 in assessed value that encountered the most vocal resistance at the forum in Saco. After LePage said his plan would affect largely private colleges and hospitals, audience members responded that it could force domestic violence groups, summer camps and other small nonprofits to scale back programs.

“The nonprofits won’t get taxed,” LePage said. “I’ve already been told the Legislature is going to take it out, so don’t worry about it.”

LAWMAKERS FACE VETOES

The town hall-style forum came to an abrupt end shortly afterward when Joanne Twomey, a former Biddeford mayor and Democratic ex-lawmaker, angrily confronted LePage and tossed a jar of Vaseline on the stage near LePage’s feet. Le-Page’s security detail and other police whisked Twomey out the door, and the forum was declared over.

While LePage appears resigned to lose some aspects of his budget plan to the legislative process, he is vowing to fight for other aspects of his plan. For instance, LePage hinted this week that he will veto some bills unless lawmakers go along with his proposals, presumably his income tax cuts.

Goode, the Democratic co-chair of the Taxation Committee, said he expects the final budget package to include some form of income tax cuts. He said Democrats and Republicans on the committee may present a divided recommendation to the Appropriations Committee on those tax cuts and on the proposed sales tax increase.

Sen. Linda Valentino of Saco, a Democrat on the Appropriations Committee, said Thursday night that it was too early to say what will or will not be in the final budget.

“It is going to be a balancing act with different compromises made along the way,” Valentino said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.