WASHINGTON — Donald Trump told The Associated Press this week “there’s nothing to learn” from all those income tax returns he won’t release until an ongoing audit wraps up.

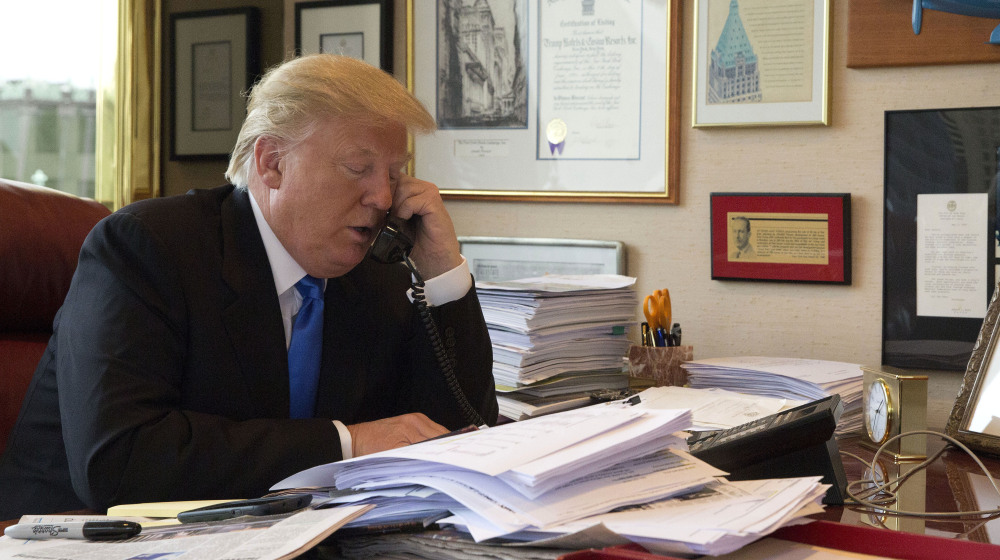

But tax experts say the feet-high stack of returns that he’s posed with for photos could provide significant insights about the presumptive Republican nominee – new details on his income and wealth, how much he gives to charity, the health of his businesses and, overall, how Trump plays the tax game.

Trump’s tax returns wouldn’t give a full picture of his wealth, since people don’t have to report assets. But they would provide fresh clues about the financial life of the richest-ever presidential candidate. Tax returns could reveal whether Trump has been overstating – or understating – his income. On a press release with his financial disclosure form released last year, for example, Trump put his 2014 income at $362 million, excluding certain items like interest and dividends. But that figure appeared to include revenue that wouldn’t count as taxable income. For example, Trump’s disclosure form included $4.3 million in “golf-related revenue” over 18 months from his course in Scotland. But the course lost more than $2 million in 2014 after its costs were taken into account. Depending on how it’s reported, a significantly smaller income figure on Trump’s Form 1040 than on his financial disclosure could be a fresh sign that his personal fortune, too, is less than the more than $10 billion that he’s claimed.

The documents would also shed light on his tax liabilities.

Trump, with trademark modesty, said that “nobody knows more about taxes than I do – maybe in the history of the world.” And he’s been clear that he tries to pay “as little as possible.”

Tax experts say he might even have owed no income taxes in one or more recent years by using real estate depreciation provisions and carrying forward business operating losses from previous years. Such losses can be carried forward up to 20 years on personal taxes. Author David Cay Johnston, in his book “Temples of Chance,” found that Trump reported negative income early on in his business career. According to documents unearthed by Johnston, Trump in 1977 made $118,530 and paid $42,386 in taxes; in 1978 reported negative income of $406,379 and paid nothing, and in 1979 reported negative income of $3.4 million and again paid no taxes.

Another issue is the value of the Trump brand name, which he licenses far and wide. The billionaire estimated his personal brand and marketing deals at $3.3 billion when he announced his candidacy last year, but Forbes magazine knocked that down to a much more modest estimate of $125 million. Trump’s tax returns could reveal how much licensing income he receives, providing new clues about the true value of his brand.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.