President Trump’s decision Thursday to impose crippling tariffs on the imports of steel and aluminum took many by surprise – particularly investors, as the Dow Jones closed the day’s trading down more than 400 points.

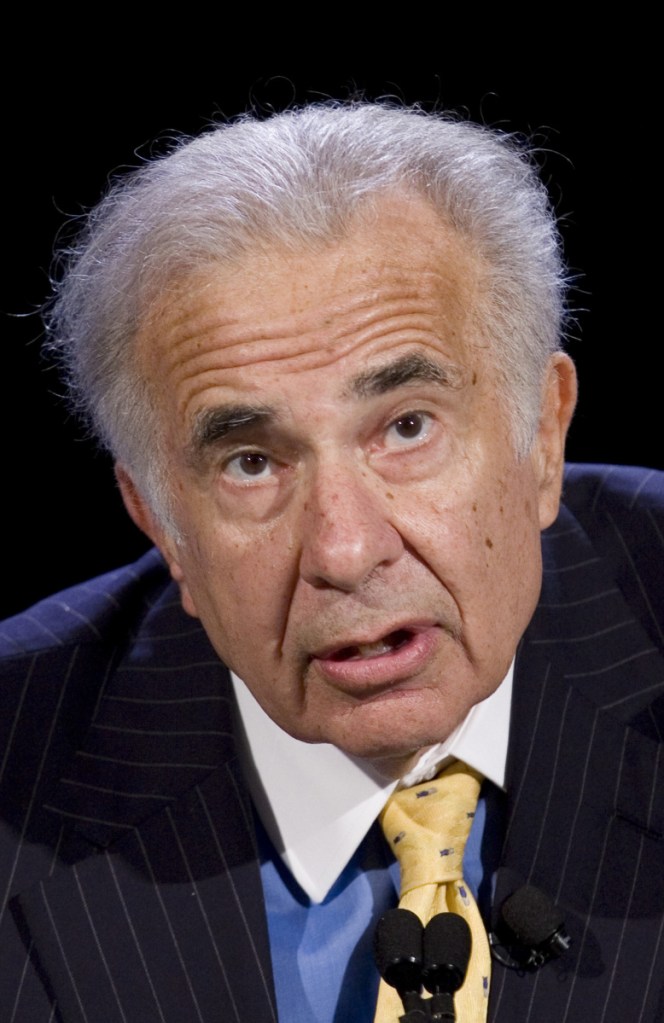

But one billionaire investor and former Trump adviser, Carl Icahn, was seemingly unvexed, having dumped a million shares tied to the steel industry a week before the president announced 25 percent for foreign-made steel.

A Feb. 22 SEC filing shows Icahn sold off his $31.3 million stake in the Manitowoc Co., which is a leading global manufacturer of cranes for heavy construction based in Manitowoc, Wis. Since Trump’s announcement Thursday, Manitowoc’s stock has plummeted to about $26. Icahn – who has had majority interest in several companies – had sold his shares for about $32 to $34 each, according to the filing.

Icahn had not actively traded any Manitowoc stock since January 2015, according to regulatory filings.

The tariffs are Trump’s response to a determination by the Commerce Department earlier this month that increasing import volumes posed a risk to U.S. national security. Trump’s decision, which leans on a little-used provision of U.S. trade law, has now caused other countries to retaliate against U.S. exports. The European Union, for example, is considering duties on U.S. imports worth about $3.5 billion if the White House enacts its tariffs, Reuters reported Friday.

Trump and Icahn’s history is one of friends turned foes turned friends. In 1988, when Trump paid $11 million to host a heavyweight title fight between Mike Tyson and Michael Spinks in Atlantic City, New Jersey, Trump took Icahn, known at the time for his series of hostile corporate takeovers, backstage to meet Tyson. During the announcer’s roll call of famous guests, Icahn was called Trump’s “good friend,” according to the New Yorker.

In the early 1990s, Icahn headed the deal that allowed Trump to keep some of his ownership of his Taj Mahal casino during its first bout with bankruptcy. Trump’s share of the casino, about 50 percent, was a generous one, but Icahn articulated that investors could still boot Trump. Many thought Icahn had outmaneuvered Trump, according to The Washington Post’s Drew Harwell.

By 2010, Trump Entertainment Resorts was flooded with debt, and Icahn pushed to take over, saying Trump’s brand had become a “disadvantage.”

Tensions appeared to have eased by the time Trump ran for president, as he called Icahn one of the “great businessmen of the world,” smart enough to tackle U.S. negotiations with China. In return, Icahn endorsed Trump, saying the country would be “lucky” to have him in the Oval Office, Harwell reported.

Though Icahn no longer advises Trump in a formal role, the two reportedly still talk. Icahn resigned from his position as a “special adviser” to Trump on regulatory reform in August.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.