At Marina ManLand near the Los Angeles airport, plastic surgeon Grant Stevens advertises his sports bar-like practice with an image of a man on a leather couch, having a highball and smoking a cigar. It seems to be working: Stevens claims he is “doing more male surgery than ever before in my entire career.”

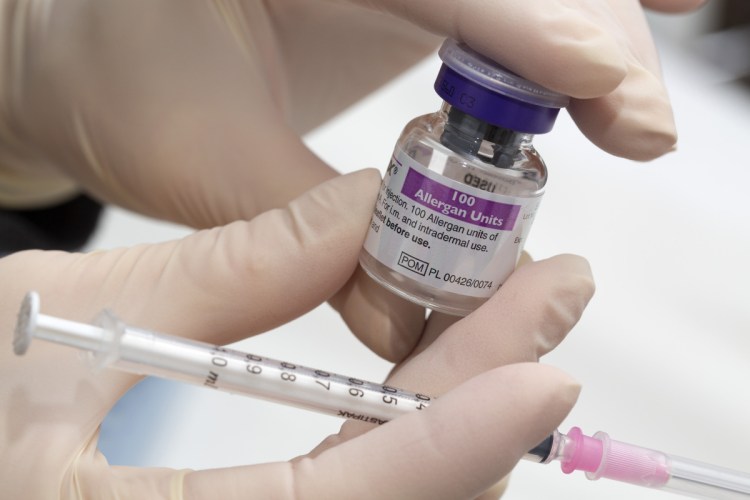

ManLand is emblematic as the distributors of drugs such as Botox, Dysport and Xeomin step up their efforts to sell cosmetic drugs to men. None may be more prominent than Allergan’s push to market what the media has dubbed Brotox. In April, the drugmaker rolled out print, television and social media ads during baseball games and the Stanley Cup finals in an attempt to lure male customers.

“We’ve had campaigns over the past several years but not quite on this scale,” said Bill Meury, chief commercial officer at Allergan. He would not disclose the size of the investment but said it was “significant.”

Men are only a tiny piece of the medical aesthetics market. They received nearly 470,000 injections of wrinkle-smoothing toxins in 2017, compared with more than 7.2 million for women, according to the American Society of Plastic Surgeons. While male injections have increased almost fivefold since 2000, they’re growing far more slowly than injections in women.

Allergan and its competitors are trying to figure out how to win men over more quickly. Nestlé Skin Health’s Galderma, which markets rival injection Dysport domestically, has been targeting men for about two years through a man-specific website. It reports a 45 percent increase in men enrolling in its loyalty program in the 12 months leading up to May, outpacing growth in female loyalty sign-ups. Merz Pharma cheekily markets its Xeomin frown-line injections to “Xeo-Men” through brochures and a website it launched in 2016.

Allergan may have an advantage with Botox.

“It’s an iconic brand,” Meury said at the Bank of America Merrill Lynch health care conference in May.

Even so, it’s an iconic brand that resonates mostly with women. A web page that Allergan created addresses myths, such as the belief that Botox is only for women. “Nope, think again,” the website says, noting that Botox has been approved for cosmetic uses since 2002 and that “you’ll still look like you” after the injections.

Allergan’s Brent Saunders isn’t just the company’s chief executive officer, he’s a client. Soon after he got the top job, colleagues surprised him at a sales meeting, injecting him on stage. Saunders said he continues to use the product.

About 10 percent of Botox’s cosmetic customers are men and “there’s been a fairly steady increase in the number of men that are receiving Botox year-over-year,” Meury said. The company wouldn’t disclose further details.

On average, male Botox customers are about 42, Meury said, though some are as young as their 20s. It’s a starting point for selling the company’s other products, such as its fat-reduction treatment or its double-chin injection.

The drug brought in $3.17 billion in sales in 2017. It’s Allergan’s best-seller and a critical moneymaker at a time when the company is under pressure after another top drug lost patent protection.

A more rigorous pitch for Botox makes sense, said Umer Raffat, an analyst at Evercore ISI, noting that Allergan has said for years that it would increase its focus on men. Considering that its competitors have also launched male-specific marketing efforts, “there’s no reason why they shouldn’t be doing this,” Raffat said. Even so, it’s not likely to spur monumental change in Allergan’s customer mix.

“Could this be an incremental growth driver? Sure,” Raffat said. “Could it be some dramatic thing? I don’t really see it that way.”

Allergan shares have gained 5.8 percent this year, trailing peers, as the drugmaker has faced calls to sell assets or overhaul its board.

Getting men to consider a Botox treatment is one thing; getting them to the doctor’s office is another.

Men “have zero idea, zero awareness of these aesthetic procedures,” said Terrence Keaney, founder of a dermatology practice in Arlington, Va., called SkinDC. About half of his aesthetic patients are men, he said. Many of his patients arrive through word-of-mouth or are referred by other physicians.

“Until recently, these companies haven’t invested any effort in educating male patients,” Keaney said.

In some pockets of the U.S., the drug already has a foothold among men. New York’s trendy Chelsea neighborhood is home to more than 300 art galleries, Google’s second-largest office and Chelsea Skin & Laser, a dermatology practice popular with men. Michael Eidelman, its medical director, has served on an Allergan advisory board and said he’s seeing men arrive at his office more assured and confident about getting facial injections.

One of his longtime patients, Stephen Hayes, said during a recent afternoon appointment that people often ask how the 55-year-old avoids looking, well, 55 years old. He’s been getting wrinkle-smoothing injections for several years.

“Male friends maybe made a couple of jokes about it,” Hayes said. “Many of them are getting the procedure now.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.