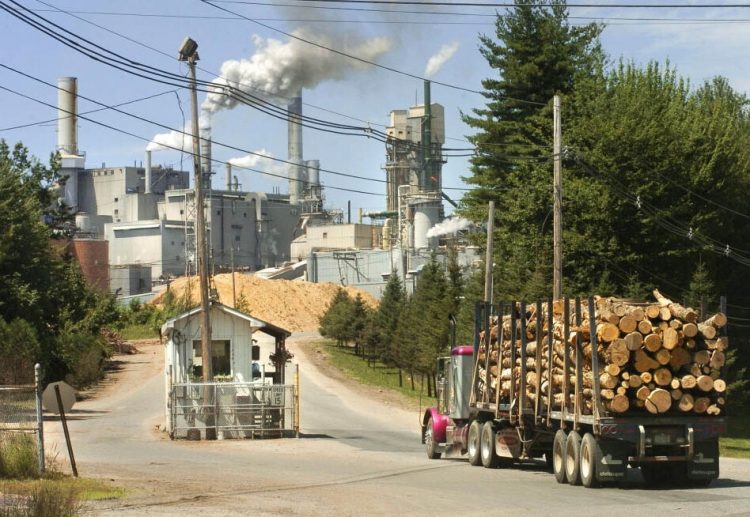

The Verso Corp. plans to invest $120 million in three pulp and paper mills, including significant upgrades to its Androscoggin Mill in Jay.

The Miamisburg, Ohio, company announced the two-year capital plan in a quarterly earnings conference call Thursday morning.

Interim CEO Leslie Lederer said the company wants to make more packaging and specialty products to reduce its reliance on graphic paper.

A focus of the plan appears to be major spending on two paper machines at the mill in Jay where roughly 500 people are employed.

“We plan to invest a portion of this allocation in the Androscoggin Mill, which we believe will improve the quality and reduce the cost of our unbleached containerboard and kraft paper grades on the No. 3 machine at Androscoggin and to increase capacity of specialty products on our paper machine No. 4,” Lederer said.

Adding specialty paper capacity to its mill in Stevens Point, Wisconsin, and a recycled fiber packaging operation at its mill in Duluth, Minnesota, are also part of the investment proposal.

Company officials would not provide further details about its capital plan during the Thursday call. A company spokeswoman said she had nothing to add to the earnings call, declining to answer questions about how much was going to be invested in the Jay mill and if new jobs would be created there.

Verso hopes the changes will reduce its revenue dependency on graphic paper, such as printing and writing paper, a market that has contracted sharply in recent years. Instead, it wants to focus on packaging and specialty products.

Graphic paper currently makes up about 59 percent of the company’s revenue. Verso wants to reduce that to 44 percent through the investment program.

Last year Verso restarted the No. 3 machine and rehired 120 workers to produce packaging products, and upgraded the No. 4 machine to make labels and other adhesive products.

The No. 3 machine has been used at a high capacity since its restart and upgrading the machine should allow the company more flexibility and new products such as multi-wall paper bags, said Michael Weinhold, Verso president of Graphic and Specialty Papers.

The entire pulp and paper industry generally is moving away from the shrinking graphic paper market and into other products, said Shawn Baker, vice president of research at Forisk, a consulting firm in Athens, Georgia.

Digitization has reduced the need for writing and printing paper, but demand for packaging and specialty products such as labels has grown with shipping and commerce businesses, Baker said.

“As general consumers shift their preferences, a lot of the industry is looking for opportunities to repurpose existing capacity into something that has a better outlook,” Baker said.

It is unclear if the industry-wide trend is nearing a break-even point between capacity and demand, especially for packaging, Baker said. In recent years, mills in Rumford, Skowhegan, Old Town and other Maine communities have been modified or expanded to produce products other than coated paper, the longtime bread-and-butter product of Maine mills.

“We have seen a lot of people make these announcements and try to move these things forward,” Baker said. “Printing and writing is shrinking – it is still reasonably profitable, but it is shrinking.”

COMPANY IN TRANSITION

Verso had $602 million in sales in the second quarter of 2019, and ran an operating loss of $112 million, according to its quarterly report. It expects sales to pick up in the third quarter, but estimates they will remain below last year.

Debt repayment last year has freed up cash from operations Verso can use for new investment, Lederer said.

In June, Verso announced it had hired an outside firm to explore a possible merger, asset sale, stock repurchase and joint venture, among other strategic alternatives.

Responding to an analyst’s observation that Lederer has an incentive to sell the company, the interim CEO said the investment plan was intended to improve performance for shareholders.

The capital plan had been approved by the board and the projects exceeded the minimum return requirement for new investment, Lederer said.

“My incentive is to provide shareholders value, at this point we have not announced any sale of the company, therefore we have to make sure we have options that are available to provide shareholder benefit,” Lederer said. “At this point in time, we are focusing on strategic initiatives to improve the company’s performance away from graphic products.”

The company’s stock has been on a slide this year, dropping from a high of more than $34 per share to $13 at the close of business Thursday.

Verso shuttered its other Maine mill in Bucksport in 2014 and went through bankruptcy reorganization two years later. In April, the company closed its mill in Luke, Maryland, citing declining demand for coated paper and rising costs, including those from new state environmental rules. Verso’s other mills can produce the same paper, the company said at the time.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.