As L.L. Bean moves ahead with plans for a $110 million renovation and expansion of its corporate headquarters in Freeport, town officials are contemplating whether to grant a $10 million tax break to the renowned outdoor retailer for the project’s development.

Company executives last week presented a proposal to the Town Council for a new tax increment financing district for the planned headquarters expansion, The Forecaster reported. The district would help offset L.L. Bean’s future property tax costs over the next 30 years.

In exchange for the tax incentive, the retailer vowed to clean up a polluted stream, create a public trail into the downtown area and build an events center for the community.

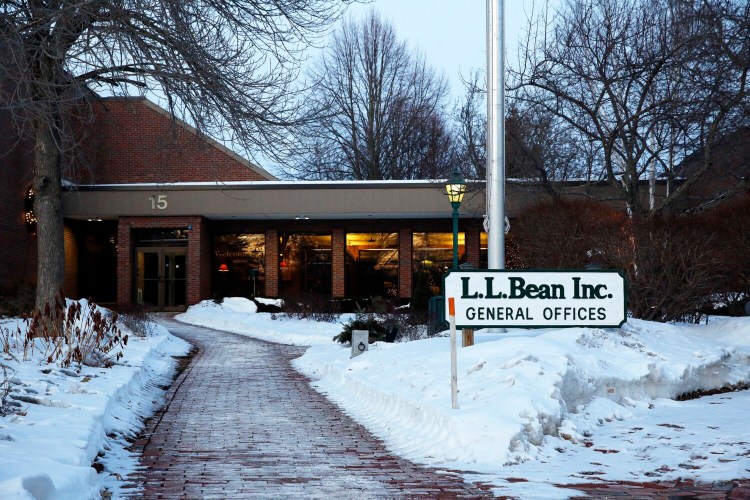

L.L. Bean told the council it had considered relocating its headquarters outside of Freeport, but decided last year to stay in the town instead and renovate its 50-year-old offices. The company now plans to develop a 400,000-square-foot office complex in three phases on the existing headquarters site, just off Main Street a few blocks from the company’s retail campus. It hopes to complete the project by 2024.

The company received conditional approval for the $110 million project – $80 million for construction plus $30 million for furniture and equipment – from the town’s project design board in July. However, the proposed tax break is still under discussion.

A tax increment financing district is a municipal arrangement in which new property tax revenue from a developer, such as a local employer building or expanding its offices, is sheltered for up to 30 years. The new revenue that is generated from the developed property’s increased tax value is set aside to be spent on economic development or community projects, or it can be given back to the developer as a property tax break.

L.L.Bean’s proposal, which has not been finalized, is to receive $10 million in property tax breaks over a 30-year period, totaling about $333,000 a year.

In return, the company said it intends to build stormwater improvements to help restore a nearby polluted stream, create a multi-use public trail alongside Route 1 leading to downtown Freeport, and build a 900-seat conference and events center available for community events.

All told, the headquarters expansion project would generate $25 million in new tax revenue for Freeport over the course of the agreement, the company estimated.

Keith McBride, director of the Freeport Economic Development Corp., outside Town Hall on Thursday. L.L. Bean is asking Freeport for a $10 million tax break. Ben McCanna/Staff Photographer

Keith McBride, executive director of the nonprofit Freeport Economic Development Corp., said a final deal has not been negotiated. McBride said his agency plans to make a recommendation to the Town Council regarding whether to approve the proposed tax district.

“I intend to be really frank with the council,” McBride said. “If I can’t come up with the numbers that show it is going to be worth it, we’re not going to recommend the council pass it.”

L.L. Bean’s proposal focuses on two of the town’s priorities: cleaning up Concord Brook, a polluted stream that runs east of Route 1 and behind the headquarters, and improving outdoor recreation in the town, McBride said. Freeport stands to receive millions of dollars to spend on those projects through a tax increment financing district, often referred to as a TIF district.

“The problem with this is that ‘TIF’ has become a word that means corporate welfare, which is completely inaccurate,” McBride said. “If you had asked people in town (for) the highest priority, I think you’d hear a lot of people say environmental improvement and lot of people would say outdoor recreation. Without the L.L. Bean expansion, those will take a lot longer and more direct taxpayer money.”

L.L. Bean told town officials of its plans to stay in Freeport and expand its headquarters about a year ago, McBride said. The town was unaware that the company previously had scouted places to relocate, he added.

“I don’t think anyone in town government was involved in that at all,” McBride said. “That process happened without anyone realizing they were doing it.”

L.L. Bean has occupied its current headquarters for 50 years. The building, originally designed as a warehouse and factory, is reaching the end of its useful life, said company spokeswoman Carolyn Beem in an email. About 845 employees work at the offices.

The town values the property, including buildings and parking lot, at about $32.7 million, according to tax records.

“As any organization does with a project of this scale and size, we did our due diligence in understanding what locations and facilities may best serve our needs,” Beem said about the now-discarded search for alternate locations. “A part of that process was casting a wide net. We’re excited and committed to remaining in Freeport, and are thankful for the strong partnership we have with the town and community.”

In 2018, Freeport returned about $1.2 million in taxes to private companies through five TIF districts in the town, according to its most recent annual financial report.

That makes Freeport the No. 2 Cumberland County municipality in terms of offering commercial tax breaks, according to a Portland Press Herald analysis of financial reports for 10 communities. The tax breaks work out to about $157 per town resident annually.

While those property tax breaks are higher than in other nearby cities and towns, Freeport Town Manager Peter Joseph said they have provided various benefits, including parking, stormwater improvements and public housing.

The bulk of the tax breaks, totaling $1.1 million, were given to Berenson Associates, the company behind Freeport Village Station, a shopping plaza off Main Street. That deal helped cover the cost of building a free public parking lot at the site, Joseph said. The largest of three Berenson TIF districts expires in 2028.

“Although they are payments to corporations or non-profits in some cases, we get public benefits,” Joseph said. “We’ve leveraged those TIFs to increase commercial development, which in turn reduced taxes for the general public. When the TIF expires and goes back onto the tax rolls, it generates taxes every single year.”

Freeport’s property tax rate, $14.30 per $1,000 of property valuation, is one of the lowest in the county, he added.

L.L. Bean is the biggest taxpayer in Freeport. The company’s headquarters, warehouse and delivery center, retail stores and other facilities are worth almost $193 million, roughly 10 percent of the town’s entire property tax base. L.L. Bean pays roughly $2.8 million a year in property taxes.

Tax increment financing is the only substantial economic development tool available to Maine cities and towns, said Dan Stevenson, Westbrook’s economic development director and former head of the state’s TIF program.

About 72 percent of the TIF districts in Maine include a credit enhancement agreement that returns some tax dollars to developers, according to a master list maintained by the Department of Economic and Community Development. The department approves local tax districts.

Last year, Gorham agreed to a 20-year plan to give back 55 percent of the taxes on a new $11 million manufacturing facility to its owner, Harvey Performance Co. In 2018, Westbrook approved an extension of a tax break for veterinary technology firm Idexx Laboratories that returns property taxes to the company in the amount of $1 million a year until 2037.

Although the public understanding of TIFs usually turns to tax incentives for private companies, placing new development within a TIF district also shields that new tax revenue from state, county and school tax formulas, Stevenson said.

Without sheltering that new revenue, towns and cities could pay more in taxes or receive less from state tax revenue sharing. That’s why in the case of a large-scale development, municipal officials sometimes create a TIF district even when a company doesn’t request a tax break, Stevenson said.

While he was unfamiliar with the details of the L.L. Bean proposal, Stevenson said the company appears to be asking for a modest return compared with the scale of its investment.

“At face value, I don’t see any issues with that at all,” he said. “It does not raise my eyebrows one bit.”

McBride, the Freeport economic development head, said it would not be the first time L.L. Bean has received tax benefits for new development. A previous TIF district helped the company develop its downtown retail campus, he said.

McBride noted that L.L. Bean has been an integral part of downtown Freeport since the company was founded in 1912.

“If this was just another company coming forward saying, ‘We don’t like taxes,’ the answer would be no,” he said. “The town and L.L. Bean have been partners in this for so long, it is just a natural progression of what is already in place.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.