DETROIT — Stronger-than-expected new vehicle sales in February put the auto industry on track for its second consecutive annual sales record.

Ford sold 20.2 percent more new vehicles in February than a year earlier, helped by a surge in business with fleet customers, who accounted for more than one-third of all Ford sales. Ford also sold more than 60,000 F-Series pickup trucks, up 10 percent from February 2015.

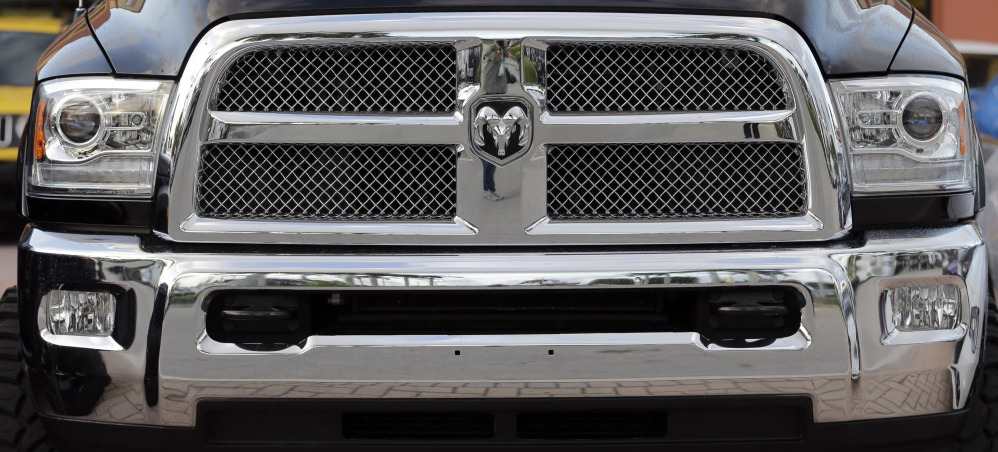

Fiat Chrysler Automobiles posted a 12 percent gain, while General Motors sales fell 1.5 percent as it cut back on fleet sales.

Toyota’s sales rose 4.1 percent on strong sales of its RAV4 compact SUV (up 16 percent), the 4Runner midsize SUV (up 32 percent) and the Tacoma midsize pickup truck (up 14.5 percent). The Lexus luxury brand was up 1 percent.

Nissan Group posted a 10.5 percent increase, fueled by a 12.9 percent improvement at its Nissan division that more than offset an 11 percent decline at the Infiniti luxury brand. American Honda sales jumped 12.8 percent as its top-selling car models, the Civic and Accord, rose 32 percent and 19 percent, respectively.

Hyundai reported a 1 percent sales increase on the strength of the Sonata midsize sedan, and sales of the Tucson crossover utility vehicle nearly doubled to 7,336.

Low gas prices, easy credit and the quadrennial calendar quirk that is Leap Day helped boost sales. There also were February sales along the Atlantic seaboard that were deferred from January when a massive winter storm hit that region and caused some dealerships to close for several days.

Americans bought or leased 1.34 million vehicles last month, which translated to an annual sales rate of 17.5 million, about the same as in January.

“The impact of millennials is significant too,” said Eric Lyman, vice president for industry insights at TrueCar.com. “They’re getting jobs and getting out of the parents’ houses.”

The numbers contributed to one of the sharpest increases in most U.S. stock indexes this year. The Dow Jones industrial average soared 348.58 points to close at 16,865.08. The Standard & Poor’s 500 index gained 46.12 to close at 1,978.35.

Kelley Blue Book Senior Analyst Karl Brauer said some manufacturers are relying more heavily on incentives, but the fundamental factors, including pent-up demand and easy credit, remain in place.

IHS Automotive predicts Americans will buy or lease 17.8 million new vehicles this year, up from 17.5 million last year.

But because sales in both January and February were even stronger than analysts expected, the torrid pace is likely to cool later this year.

“We would expect the second half of the year to show more modest growth, as 2016 sales are forecast for a more temperate growth rate of 2.1 percent compared with 2015’s 6 percent,” said Stephanie Brinley, IHS Automotive senior analyst. “For most companies SUVs continue to see stronger growth than car sales, with Honda proving an exception to the trend on strong Civic and Accord sales.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.