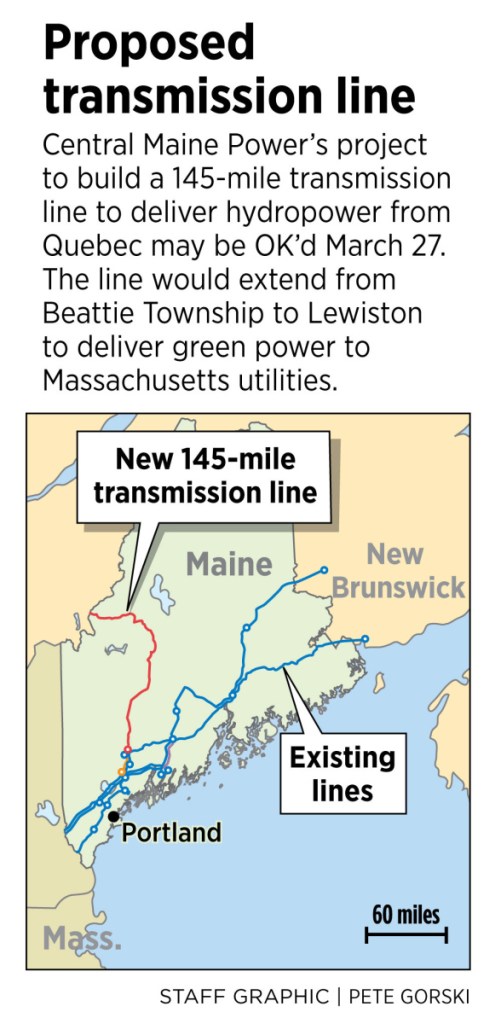

New opposition is ramping up to Central Maine Power’s proposal to build a 145-mile transmission line through western Maine, coming from interests who own fossil-fuel power plants in the state, as well as those who want to build wind and solar farms.

Power-line projects predictably draw fire from environmental and recreational quarters. But these adversaries, which include major energy companies, claim that a line with the capacity to carry 1,200 megawatts of Canadian hydro power to Massachusetts may be a bad deal for Maine electric customers.

A trio of companies, which together own one-third of Maine’s generating capacity, say subsidized power from Canada could upend New England’s competitive, wholesale electric market and make some existing power plants in Maine too costly to run when they’re needed. They also say a big slug of power from Hydro-Quebec over a high-voltage, direct current line will make it technically difficult for new Maine-based wind and solar to connect to the region’s electric grid.

These companies and others are seeking to intervene in an approval-review process underway at the Maine Public Utilities Commission. It’s an unexpected challenge for the $950 million line, called New England Clean Energy Connect.

“It is abundantly clear,” the three companies say in their filing at the PUC, “that the project has been proposed solely to meet a Massachusetts policy goal; it has nothing to do with meeting the needs of Maine ratepayers, and the primary long-term benefits of the project will accrue to Hydro-Quebec and CMP shareholders.”

The companies are Calpine Corp., which owns a large natural gas-fired station in Westbrook and is in the early stages of developing a wind farm in Greenwood; Dynegy Inc., the largest power generator in New England and the owner of Casco Bay Energy Facility, a natural gas-fired plant in Veazie; and Bucksport Generation LLC, which owns a gas-diesel-biomass plant next to the former paper mill in Bucksport.

But a spokesman for Avangrid, CMP’s parent company, says it’s ironic that these plant owners are complaining, because they’ve been the beneficiaries of high electric prices in New England. Each of them, said John Carroll, profit when extreme weather leads to spikes in natural gas prices. Canadian hydro, he said, would have a dampening effect on that trend.

“You’re hearing from companies that make money burning natural gas to make electricity, and they see some of their opportunity at risk,” Carroll said.

Although the eventual impact on ratepayers is unclear, CMP has estimated that the Hydro-Quebec line will lower electricity costs in New England by $3.9 billion over a 20-year period, saving Maine customers $40 million a year. It also would reduce carbon dioxide emissions, CMP estimates, equivalent to taking 296,000 cars off the road.

A 1,200-megawatt line could provide power for more than 1 million homes.

At the PUC, CMP already has sought to limit the involvement of another energy company, NextEra Energy Resources. NextEra is the majority owner of the 827-megawatt Wyman Station oil-fired plant in Yarmouth. The energy company is also trying to develop wind, solar and storage projects in Maine. It says the direct-current specifications of CMP’s line will impede its ability to connect those projects to export power to southern New England, a goal that would be easier to achieve in a transmission corridor with alternating-current lines.

DEADLINE APPROACHES

This dispute is gaining momentum at a pivotal time.

A 2016 Massachusetts law led to a process of soliciting proposals to supply huge amounts of offshore and land-based renewable energy to the Bay State. Developers with 46 projects worth billions of dollars responded.

In January, Massachusetts chose to negotiate with the developer of Northern Pass, a 1,090-megawatt line that would carry power more than 190 miles from the Canadian border into New Hampshire. CMP’s proposal didn’t make the cut, at the time.

But in a surprise development, New Hampshire’s siting committee voted unanimously on Feb. 1 to deny a certificate for the Northern Pass project. Massachusetts then gave Northern Pass until March 27 to win an approval. But based on a further delay last week at the New Hampshire siting committee, that deadline seems all but impossible.

At the same time, Massachusetts utilities began negotiating with CMP, as a backup choice.

As March 27 approaches, energy interests are anxiously watching to see if Massachusetts will deliver a final blow to Northern Pass and officially put CMP in the lead position. To hedge their bets, companies such as Calpine now are belatedly trying to intervene in the PUC process in Maine.

CMP’s project is strongly supported by Gov. Paul LePage. Last month, his energy director, Steve McGrath, said LePage and the Maine Department of Environmental Protection’s commissioner had met with Massachusetts officials and that LePage would “push this right through” the permitting process.

That statement may be more hyperbole than policy. Public hearings at the PUC are set for early August, and with national energy companies pushing back, a robust legal challenge seems likely. Several federal agencies also need to grant permits. The entire review process its expected to run at least into early 2019. CMP hopes to begin construction soon after that.

NEW CAPACITY AND DEMAND

The three Maine generators are so-called merchant plants – they make money when they are called on to operate by the region’s grid operator. To be picked, they have to offer a competitive price for their power, based on the prices other generators are offering.

But if the PUC gives its approval for CMP’s power line project, the three generators argue in their filing, the “continued economic viability” of their Maine plants may become questionable.

Economic viability is a hot issue in utility circles these days, because some plants that aren’t big money makers still are needed at certain times to maintain reliable, 24/7 electric service.

Across the country, low natural gas prices have forced some plants to close and others to seek government subsidies to stay open. New York and Illinois adopted rules in 2016 to financially prop up some nuclear reactors. Connecticut is considering whether the Millstone nuclear plant deserves a subsidy. At the same time, ISO-New England has a special program that pays power plants, including Wyman Station in Yarmouth, to keep enough oil and liquefied natural gas in storage to respond at urgent times, such as during this winter’s arctic blast. The Wyman plant played an important role during the cold spell, when electric demand was spiking on the grid.

In January, ISO-New England released a fuel security study that looked at whether power plants in the six states have enough fuel on site to ensure reliable service throughout the winter. It found that in some cases, fuel shortages could lead to rolling blackouts if current trends continue – namely the growing demand for natural gas in a region with insufficient pipeline capacity. This study will be the subject of an Environmental and Energy Technology Council of Maine (E2Tech) forum March 29 in South Portland.

Reliability concerns can bolster arguments on both sides in the debate.

“We already have historically low (wholesale) power prices,” said John Flumerfelt, a spokesman for Calpine. “If you push much lower, you may have to bail out a nuclear power plant in Connecticut. If a plant isn’t supported by the competitive market, it just hurts the market. And that has consequences.”

Carroll countered that hydro power from Canada is a solution to the problem. Importing 1,200 megawatts of new capacity to the region makes the grid less vulnerable to fuel supply problems, he said.

Another issue before the PUC is whether approving an energy source from Canada goes against Maine energy policy to favor “renewable, efficient, and indigenous resources.”

A nonprofit corporation that represents the renewable energy industry and environmental advocates – Renew Northeast – is seeking to intervene on behalf of wind, solar and energy storage projects in Maine. The group promotes environmentally sustainable energy generation in the Northeast from indigenous resources and says CMP’s proposed line may hurt those projects. Notably, the clean-energy arm of CMP’s parent company, Avangrid Renewables, is a top-level member of this advocacy group.

“The HVDC (high-voltage, direct current) line may change the reliability of the transmission system and affect the economics of proposed renewable energy projects, because Maine’s transmission system is interconnected,” Renew Northeast says in its filing at the PUC.

Tux Turkel can be contacted at 791-6462 or at:

tturkel@pressherald.com

Twitter: TuxTurkel

Correction: Because of inaccurate information given to the Maine Sunday Telegram, this story was updated at 1 p.m. March 28 to correct the location of Calpine’s planned wind farm.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.