A new analysis by the state’s budget bureau projecting a $756 million revenue deficit in the next two-year budget is likely to renew debate over the sustainability of tax cuts that were passed, but not entirely paid for, by the current Legislature.

The income tax cuts were passed on a two-thirds vote and touted by Republicans as the largest in Maine history. The bill won’t come due until 2013, when lawmakers will have to figure out how to offset the estimated $342 million cost in the budget that takes effect July 1.

The estimate accounts for nearly half of the revenue deficit forecasted by the state’s budget bureau.

Deficit projections have become common in recent years. The current one is well below the $1.17 billion projected in 2010. And it’s based partially on education spending that’s mandated by state law but routinely bypassed by state lawmakers.

Nonetheless, the projected gap and the LePage administration’s spending priorities likely foreshadow some tough choices for lawmakers when the Legislature convenes next year.

Democrats say the tax cuts are reckless and will likely lead to reduced education spending, higher property taxes because of a reduction in state aid to municipalities, and the elimination of health care benefits for low-income Mainers.

Republicans counter that the projected budget gap is less than in previous years because of reforms passed under their leadership.

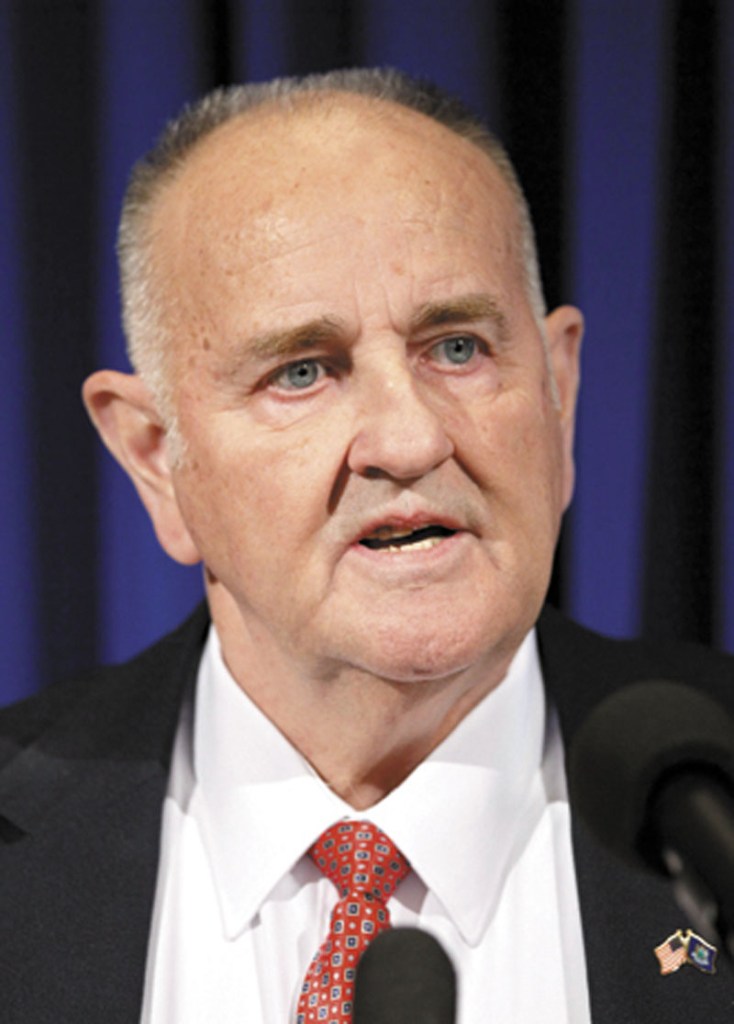

State finance chief Sawin Millett said reforms to welfare and the state retirees’ pension system put the state in a position to cover the tax cuts and sustainable spending.

The cuts lower the top income-tax rate from 8.5 percent to 7.95 percent and eliminate income taxes for about 70,000 Mainers.

“The tax cuts passed in the last Legislature are compounding the (revenue deficit),” said Rep. Peggy Rotundo, D-Lewiston, the lead Democrat on the Legislature’s budget-writing committee. “These are tax cuts that mostly benefit the wealthy at the expense of health for the elderly, the disabled and the most vulnerable.”

Millett countered that spending reforms will help to offset the tax cuts.

The pension changes, passed in 2011 when Republicans took control, have reduced the revenue deficit, Millett said.

The projected shortfall is also predicated on the state fulfilling its obligation to fund 55 percent of public education. The state has never met the requirement, which was established in 2004. It now funds about 45 percent of public education. If lawmakers maintain that level of spending in the next budget, the projected revenue gap will be reduced by $253 million — more than a third.

The state also is supposed to pay cities and towns 5.1 percent of all sales and income tax revenue. Previous legislatures have temporarily curtailed that spending to bridge budget shortfalls; the LePage administration has made reducing the payments a matter of policy.

In 2011, at Gov. Paul LePage’s request, the Legislature lowered the municipal revenue sharing to 3.5 percent. The governor has indicated that he plans to maintain that spending level. If he does and the next Legislature goes along with it, the revenue deficit will shrink by another $95.8 million.

Democrats say property taxpayers ultimately pay the cost of reduced revenue for municipalities, particularly if towns and cities want to maintain services and education funding.

Millett said another $160.9 million in cuts to MaineCare, the state’s Medicaid program, would also lower the projected deficit.

Still unsettled are $63.8 million worth of Medicaid reductions that were passed by Republicans this year but still don’t have federal approval.

LePage has suggested that more MaineCare reductions are coming. Millett said Tuesday that the revenue analysis showed that while recent reforms to MaineCare lowered state spending, more are needed to prevent future budget shortfalls.

Given that position and LePage’s refusal to raise taxes, it’s likely that next year’s budget debates will look much like those that took place over the past two years.

For now, state officials are playing down the revenue analysis by the state budget bureau. The study is released every two years to help the governor draft a two-year budget. Its projections could change when the state’s revenue forecasting committee meets in November.

“It’s important to watch,” Millett said, “but I’m reminding everyone that it’s like a poll, a snapshot in time.”

Staff Writer Steve Mistler can be contacted at 791-6345 or at:

smistler@mainetoday.com

twitter/stevemistler

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.