State lawmakers gave a mixed reception Wednesday to an ongoing independent review of the state’s school funding formula, including suggestions that would affect student-teacher ratios, teachers’ pay and the number of school administrators.

Lawmakers had little to say about a recommendation to beef up a program designed to offer property-tax relief to low-income residents in school districts with high property values.

That’s because the Legislature eliminated the program while enacting the state’s current two-year budget.

The California-based consultant Picus & Associates was commissioned by the Legislature last year as part of a $450,000 review of the state’s education funding formula, which often is criticized for perceived flaws and inequity. Picus presented its most recent findings Wednesday to the Legislature’s Education Committee.

Among is recommendations is strengthening the state’s “circuit breaker” program to help offset the formula’s burden on low-income residents in school districts with high property values. Another calls for recalibrating the Essential Programs and Services funding model with an “evidence-based” model that assigns state funding based on students’ performance.

Several committee members were critical of the approach and its potential impact on student-teacher ratios and school administrators. Some lawmakers said the evidence-based model would be too reliant on standardized test scores.

Rep. Brian Hubbell, D-Bar Harbor, said the model is flawed because standardized tests aren’t an accurate indicator of students’ achievement.

Rep. Victoria Kornfield, D-Bangor, said she was “unimpressed” with some of the analysis, saying it was colored by the consultants’ preference for the evidence-based model.

“It’s like you’re the judge in the cake-baking contest and you’ve come up with your own recipe that you think is the best,” Kornfield said.

Lawmakers were receptive to other recommendations, but worried about the associated costs.

Rep. Peter Johnson, R-Greenville, said Essential Programs and Services is supposed to represent “the minimum” state education funding. “This is something other than minimum.”

Rep. Matthew Pouliot, R-Augusta, said some of the recommendations appear designed to “spend more money on education, but not actually improve results.”

Maine is one of more than 40 states that use property valuation to calculate school funding. Districts with higher property values often receive less state aid, a model that critics say doesn’t always reflect low-income residents’ ability to pay property taxes if a town raises taxes to pay for school funding.

Picus & Associates suggested providing direct property-tax relief to low- or fixed-income residents. Maine had two such programs, a homestead exemption that subtracts $10,000 from the assessed value of a Mainer’s home for the purpose of assessing property taxes and the circuit breaker, which provided up to a $1,600 credit to Mainers whose property taxes exceeded 4 percent of their total household income.

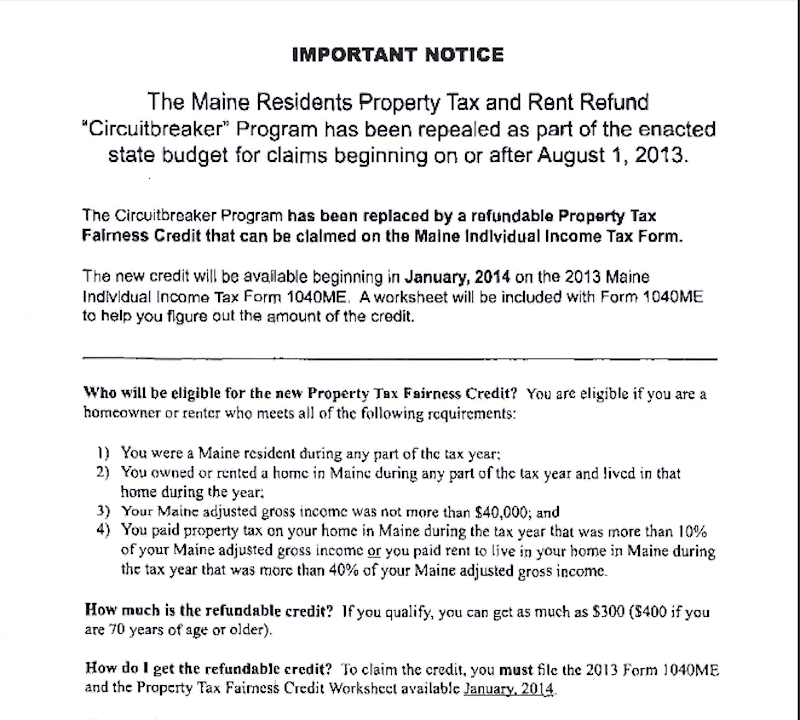

Lawmakers repealed and replaced the program in the last session, in response to Gov. Paul LePage’s proposal to limit circuit breaker to people 65 or older and veterans, and to generate additional revenue to balance the biennial budget.

The Legislature settled on a property tax fairness credit that provides less relief than the circuit breaker. It provides qualifying Mainers as much as $300 a year credit, or $400 if they are older than 70.

The governor’s proposal and the Legislature’s budget are at odds with one recommendation by Picus to address the imbalance resulting from the state’s current school funding formula.

The model, adopted in 2004, is largely calculated on prescribed staff-to-pupil ratios, geographic factors and an assessment of enrollment. Property values determine how much each community should contribute and the state pays for the rest.

Earlier this year, Picus & Associates reported that Maine’s per-pupil expenditures for K-12 education were among the highest in the United States, but low compared with the rest of New England.

It also found that while school funding grew in recent years, students’ performance has been relatively flat. Test scores compared with the rest of the country are relatively strong, the report said, but about average in New England.

According to recent U.S. Census data, from 1999-2000 to 2009-2010 state and local revenue for public K-12 education in Maine grew from $1.62 billion to $2.35 billion, 45 percent. During the same period, state and local revenue for K-12 education in all 50 states increased by 49.4 percent.

From 1999-2000 to 2009-10, Maine’s per pupil expenditures grew from $7,595 to $12,259, an increase of 61.4 percent. Average per pupil expenditures on a national level increased from $6,836 to $10,600, a 55.1 percent increase.

Wednesday’s review also touched on teachers’ salaries, teacher-student ratios and recommended administrators per district.

Picus recommended one principal per 450 students in elementary and middle schools and one principal per 600 high school students. The state’s funding formula prescribes one principal per 305 students in elementary and middle school and one per 315 students in high school.

Lawmakers will continue evaluating the study this year and potentially adopt some of its recommendations.

Steve Mistler can be contacted at 620-7016 or at:

smistler@pressherald.com

Twitter: @stevemistler

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.