Wal-Mart said it will not join Apple’s new mobile payment system and will continue developing a separate one, setting up a high-profile race to define how Americans will pay for products in the future.

The contest between the world’s most valuable company and the world’s largest retailer has the potential to create competing systems, confusing shoppers who already look askance at using their smartphones and other gadgets to pay for goods. Yet with two such powerful advocates behind this technology, consumers may eventually find it difficult to hold on to their old-fashioned credit cards and wallets.

The two giants hold tremendous sway over the marketplace. Apple has put a smartphone in the hands of tens of millions of people in the United States and has partnered with a broad coalition of the country’s biggest banks, credit card companies and prominent retailers, including Disney, McDonald’s and Macy’s, to launch its mobile payment system, called Apple Pay.

Wal-Mart has a far bigger customer base – hundreds of millions of people shop at its stores every week. And the retailing giant is one of dozens of well-known brands that have rallied behind a different mobile payment method called CurrentC. Others include Target, 7-Eleven, Southwest Airlines, the Gap and Shell gas stations.

“There will be a dominant player to come out of CurrentC versus Apple. I’m not willing to handicap either one right now … you’ve got major players in CurrentC, you’ve got eight of the top banks and credit card issuers in Apple Pay,” said Michael Archer, a partner at retail consultancy Kurt Salmon Associates. “The interest level in the space is always going to be challenged if there are competing players. The opportunity, and maybe a need, for convergence is there.”

Apple Pay is set to launch next month. The pilot for CurrentC began this month; the nationwide roll-out is expected next year.

Officials at Wal-Mart declined to comment beyond a statement saying that they have no plans to join Apple Pay. Apple did not return multiple requests for comment about Wal-Mart’s decision.

Retailers may have greater financial incentive to join CurrentC than Apple Pay.

If broadly adopted, CurrentC could impose a radical change on the credit and debit card system. Customers can either load cash into the app or allow the app to take funds directly out of a checking or savings account – it cannot be linked to a credit card. That means Wal-Mart and other retailers would avoid paying “swipe” fees – the money merchants pay banks every time a shopper swipes a credit or debit card. The stores plan to use those savings to offer discounts to consumers who adopt the system. The network of retailers is also expected to cover the cost of fraudulent purchases, which generally are paid for by banks today.

Perhaps not surprisingly, Apple announced this week that every major bank and the three primary credit card companies had joined Apple Pay.

Both CurrentC and Apple Pay require shoppers to pay for goods and services using an app on their smartphones. Such systems are touted to be more secure than credit cards, which are particularly vulnerable because the account number, expiration date and security code easily can be stolen and used for fraudulent purchases.

But the two systems have key differences.

CurrentC works on any smartphone, not just the iPhone, so it has a larger potential market. And when a shopper is ready to buy a product, the CurrentC app creates a type of bar code – called a QR code – that can be recognized by most checkout scanners today.

Apple Pay uses a chip that sends signals a short distance through the air using technology called near-field communication, or NFC. But only 10 percent of merchants have sensors that can read such signals, and such devices can cost about $500 to install. However, retailers have been ordered by credit card companies to upgrade their registers to models that probably will include NFC technology.

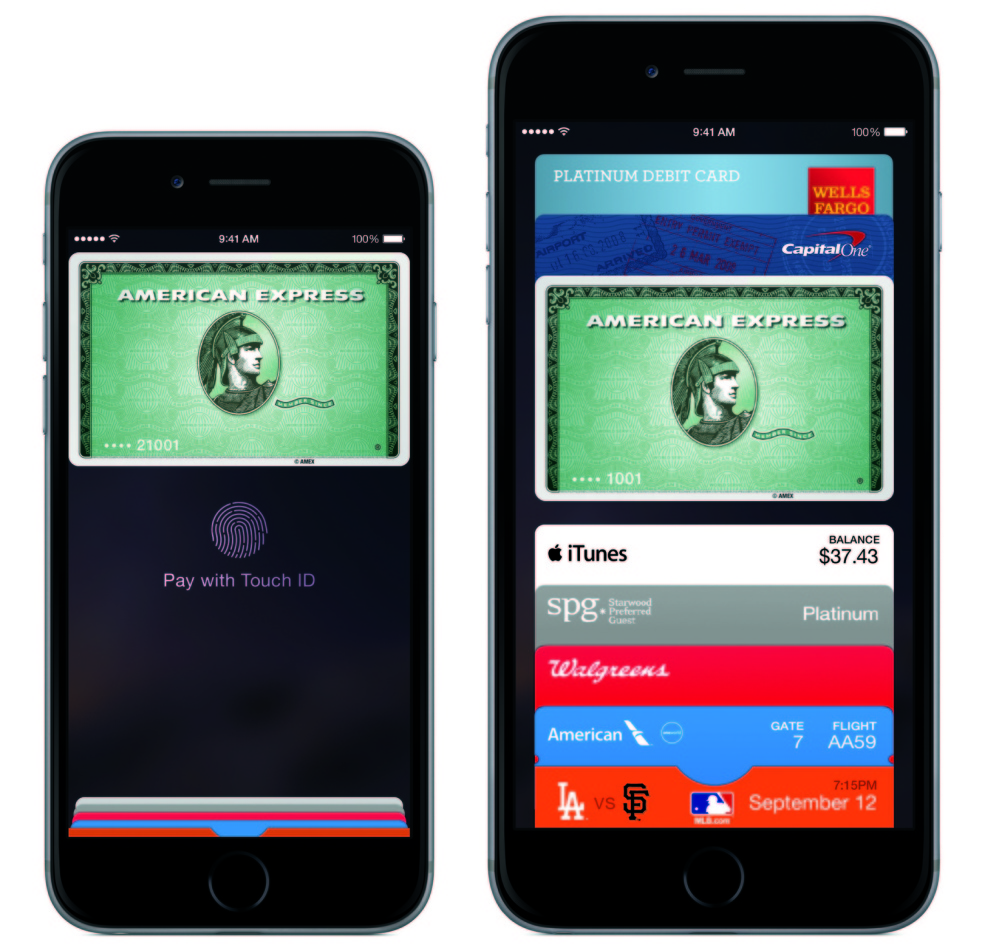

Apple’s system allows users to load their credit and debit cards onto an iPhone. A consumer would merely need to hold the smartphone close to a NFC sensor and confirm the purchase with a fingerprint scan.

Apple has said that it has no interest in tracking the purchases shoppers make through Apple Pay. Company executives said this week that the details of any transaction would be known only by shoppers and their financial firms. CurrentC’s organizers have not said whether retailers will track purchases made with their system, but many analysts expect them to do so. Many chains already track customers’ shopping behavior through loyalty cards or even by monitoring how they move through store aisles.

James Wester, research director of global payments at IDC Financial Insights, said Apple’s entrance into mobile payments will expand the market to the benefit of all involved. But he added that CurrentC has an edge because the money retailers are saving by cutting banks and credit card companies out of the equation will give them room to offer discounts, rewards or loyalty programs that could drive sales.

“Just because Apple is now responsible for us getting to this tipping point doesn’t mean Apple is necessarily going to win,” Wester said. “But Apple is really good at user experience and has loyal customers. … That’s something you can’t discount.”

On the other hand, it’s an open question whether consumers will trust either system with their most personal financial information. It’s possible that neither will draw enough consumers toward a digital payment alternative that has had many fits and starts. Google and other companies have mobile wallet systems that have failed to gain traction.

“While these two platforms are big enablers, that does not automatically guarantee success. We still need to see whether consumers will find the value proposition enough to start using the system,” said Rajesh Kandaswamy, a research director at Gartner, a technology research firm.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.