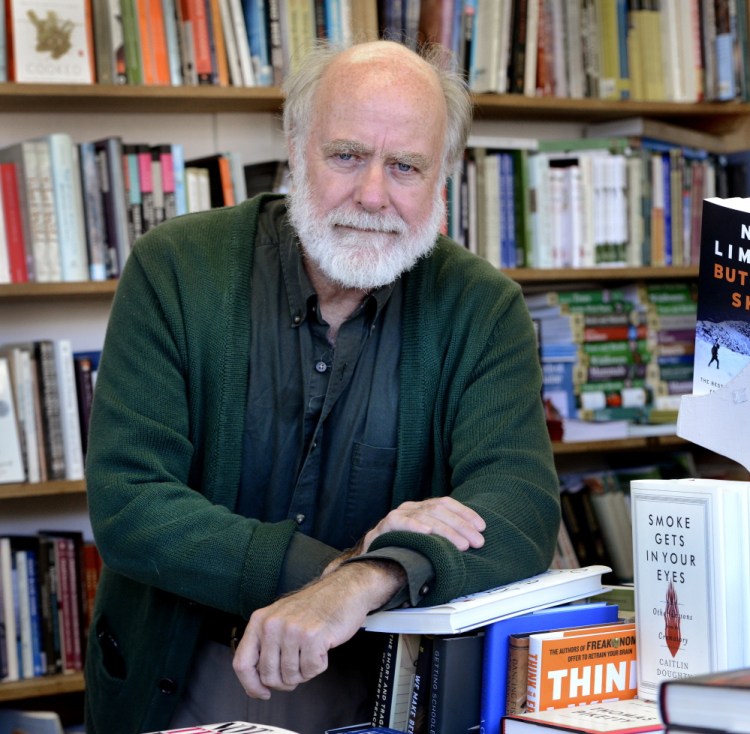

Going back to college as a 40-year-old, Barry Rodrigue had a plan to get a double Ph.D. in order to land a dream job. To an extent, it worked.

But it took a decade of school and $180,000 in student loans to get those degrees: a master’s in history from University of Maine, a Ph.D. in geography from Universite Laval in Quebec and another Ph.D. in historical archeology and history from UMaine.

Rodrigue, a Fulbright scholar, was hired right out of graduate school by the University of Southern Maine in 2000, but the student loan payments ate up about 40 percent of his $33,000 paycheck, burdening his young family.

“It was a huge drain on our household finances,” said Rodrigue. The payments have eased in recent years, with legislation that capped payments based on income, so now his payments are about 10 percent of his income.

But his debt still hovers around $180,000 because the payments just service the interest.

And as of last month, he’s out of a job.

Rodrigue, an associate professor of arts and humanities, is one of the seven professors laid off after the trustees cut three academic programs at USM last month.

Student loan payments can only be deferred, never discharged, even in bankruptcy. A recent federal report said an increasing number of retirees are seeing their Social Security garnished as they carry federal student loan debt into retirement.

Meanwhile, Rodrigue is trying to figure out how to pay his own debt, and if possible, help out his college-age son, who has $20,000 in college debt of his own.

“We’ll deal with it,” he said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.