After months of anticipation, the designers of a new digital currency backed by Facebook said they plan to launch their product as early as next year.

Calibra, a newly formed Facebook subsidiary, says its goal is to provide financial services to billions of people around the world who lack access to banking, a large portion of whom are women in developing countries. The toll for that lack of access is a heavy one: About 70 percent of small businesses in developing countries don’t have access to credit, Facebook said, and migrant workers lose $25 billion every year to service fees and other costs as they send money they’ve earned in one country to their loved ones at home.

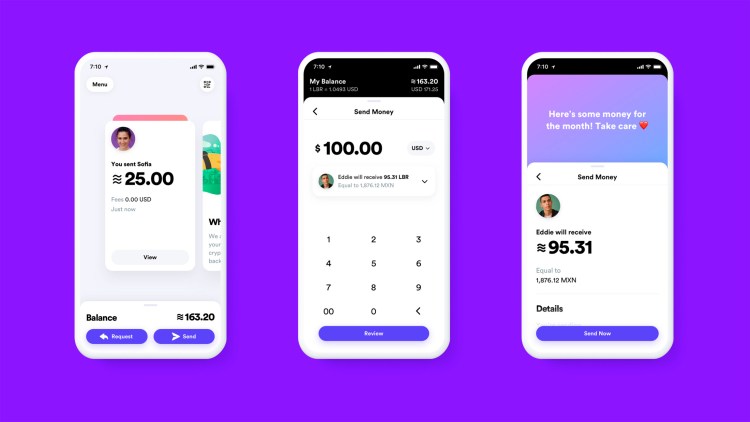

A cryptocurrency could eliminate many of those costs, and with plans to have the currency available in a digital wallet available in Messenger and WhatsApp, in addition to a stand-alone app, Calibra’s Libra currency could bring cryptocurrency into the mainstream, to say nothing of making Facebook, with its 2.4 billion users around the world, a major international banking resource.

“Money, justice and freedom really is the spirit of this new project,” said Dante Disparte, head of policy and communications for the Libra Association.

Facebook’s idea is simple but would be revolutionary if it comes to pass: to make transferring money as easy as sending a message on Facebook, a digital space where billions of people already conduct personal business among family members and friends, developers say. In time, Facebook hopes to roll out additional services through Calibra, such as paying bills with one click, buying a cup of coffee with the scan of a code or even using the currency to ride public transit.

“From the beginning, Calibra will let you send Libra to almost anyone with a smartphone, as easily and instantly as you might send a text message and at low to no cost,” Calibra said in a statement.

When it comes to keeping users’ money and information secure, Facebook said it will use the same verification and anti-fraud processes used by banks and credit cards, along with automated systems to monitor activity and detect fraud. The data from Calibra’s transactions will be kept separate from the data Facebook collects from users of its other services and won’t be used to improve Facebook’s ad targeting.

Kevin Weil, Calibra’s vice president of product who formerly oversaw Instagram Stories, Facebook’s own iteration of Snapchat, acknowledged that it may take time for the social media giant to gain the trust of the currency’s potential users, though he also noted that trust of Facebook varies widely around the world.

To improve that trust, he said, Calibra will include real-time, messaging-based customer service, where users can address problems with their account or even begin by asking basic questions about how the currency works.

“Your social data on Facebook is kept separate from Calibra data,” Weil added. “This is not about improving ad targeting. We’re trying to draw a bright red line.”

Cybersecurity and privacy expert Mike Chapple, an associate teaching professor of information technology, analytics and operations at the University of Notre Dame’s Mendoza College of Business, said Libra’s design may preserve the privacy of transactions, preventing outsiders from peering in, but Facebook’s role gives the company the ability “to penetrate that veil of privacy.”

“While Facebook promises that they won’t access information from the currency’s digital wallets ‘without customer consent,’ there are no technical barriers to them doing so,” he added. “As with many technological innovations, Libra offers us a trade-off between privacy and convenience.”

Along with Facebook, Libra is backed by 28 companies and nonprofits that include finance and tech giants such as MasterCard and Uber.

That is intended to give it an advantage over other cryptocurrencies such as bitcoin, whose value can vary wildly. It climbed to $9,300 on Monday – its highest level in 13 months, up 148 percent this year. But it at one point in February it was worth less than $4,000.

Facebook’s stock jumped on the announcement, climbing more than 2 percent in premarket trading on Tuesday before leveling out by early afternoon.

Chapple said that while the price of bitcoin is determined by market demand, leading to enormous volatility, Libra is backed by a financial reserve that mixes the world’s major stable currencies. That stability, he said, should offer the currency utility for consumers rather than a gamble for investors.

Because Libra is “user-friendly,” Chapple continued, it also won’t require the specialized software or technical savvy required to purchase cryptocurrencies like bitcoin.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.