The Portland Press Herald’s editorial board has written numerous editorials on Maine tax reform over the past several months, including one recently related to the hearings on tax reform by the Legislature’s taxation committee.

I was one of the individuals asked to speak to the committee over two days. While many of the individuals repeated myths about Maine taxes based on their very limited tax experience, I based my opinions on the facts and 30 years of tax experience as a former corporate tax director and certified public accountant.

This newspaper’s editorials have been based on incorrect facts or myths reinforced by the majority of Maine taxpayers, legislators, economists and business groups that don’t understand the details of Maine’s tax structure.

Most continue to grossly overstate the impact of income tax and understate the impact of property taxes.

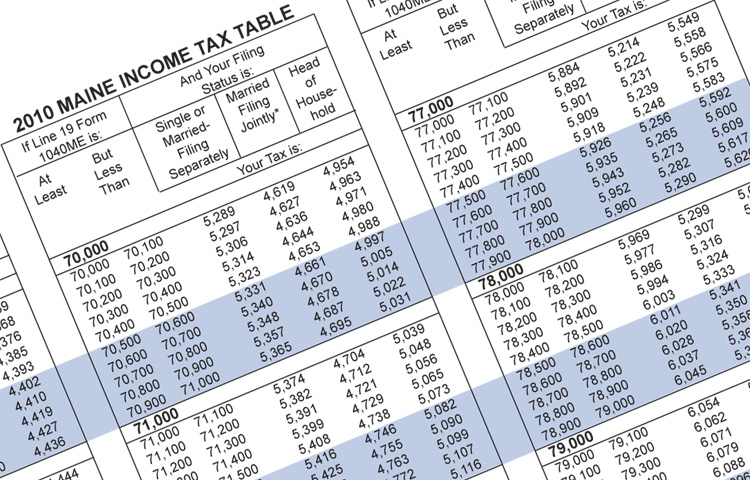

Maine Revenue Services reported to the taxation committee that for the year 2009, state and local taxes on income and consumption were about the same, at 28.3 percent and 28.4 percent, of the total tax collections respectively, while property tax represented 42.7 percent of the $5 billion total.

Based on year 2007 data from the U.S. Census Bureau, Maine’s property tax collections ranked as sixth-highest out of the 50 states and the District of Columbia, based on its percentage of income.

This compared to income taxes that ranked 17th-highest and consumption taxes that ranked 21st-highest, which debunks the myth that Maine’s consumption taxes are very low as compared to other states.

The revenue service data for the year 2009 reveal that the mix of taxes paid by the top 1 percent of Maine residents and the bottom 99 percent are very different.

The bottom 99 percent pay about the same in income and consumption taxes, but pay significantly more in property taxes. On the other hand, the top 1 percent pay more in income taxes than both the consumption and property taxes combined.

The data also illustrate that the top 1 percent pay state and local taxes at a combined effective tax rate that is 35 percent lower than the effective tax rate of the bottom 99 percent.

In total, Maine’s tax structure is significantly regressive.

Many business leaders, economists and this newspaper have suggested that tax reform should include reducing the top income tax rate and increasing sales taxes.

This would reduce the total taxes paid by the top 1 percent and increase total taxes for the bottom 99 percent. With the top 1 percent (who average more than $700,000 a year in income) paying taxes at an effective tax rate that is 35 percent less than the bottom 99 percent, why would any reasonable tax reform include cutting income taxes for the top 1 percent?

Many economists and business leaders argue that Maine’s top marginal tax rate of 8.5 percent was a major deterrent to small business economic growth. In response to this myth, the Legislature just reduced the top marginal tax rate starting in 2013 from 8.5 to 7.95 percent.

Others have suggested that a flat income tax rate around 4.5 percent without deductions would be beneficial to small business development. The facts show that to be false, as this would result in a tax increase for 95 percent of small businesses.

The revenue service data for 2009 reveal that 95 percent of Maine residents had an effective income tax rate below 4.5 percent. In addition, even the top 1 percent of Mainers had an average effective income tax rate of only 5.3 percent and only a 4 percent net cash cost when you factor in the impact of the federal income tax deduction of the Maine tax.

With the 2013 income tax cuts passed this year, the effective tax rate will go down even more. Why would more income tax rate reductions be needed to incent small business? Why did the Legislature increase property tax by $22 million to help fund these income tax cuts for the top 1 percent?

The Maine Legislature has established Pine Tree Zones that drastically reduce income taxes and other taxes based on business expansion and job creation. To date, these tax incentives have had very little impact, so why would dropping the top income tax rate for all taxpayers without any connection to job creation or economic development make any sense?

It’s time for this newspaper to research the facts before it writes another editorial on tax reform.

— Special to the Press Herald

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.