WASHINGTON — The U.S. economy may be sturdier than many analysts had assumed.

Employers added a surprisingly strong 204,000 jobs in October despite the 16-day government shutdown, the Labor Department said Friday. And they did a lot more hiring in August and September than previously thought.

Not only that, but activity at service companies and factories accelerated last month.

Unemployment rose to 7.3 percent from 7.2 percent in September. But that was probably because furloughed federal workers were temporarily counted as unemployed.

“It’s amazing how resilient the economy has been in the face of numerous shocks,” said Joe LaVorgna, chief U.S. economist at Deutsche Bank.

Analysts say the economy might be able to sustain its improvement.

They note that job gains of recent months, combined with modest increases in pay, could encourage more spending in coming months. Growing demand for homes should support construction. Auto sales are likely to stay strong because many Americans are buying cars after putting off big purchases since the recession struck nearly six years ago.

And with the nationwide average for gasoline at $3.21 – the lowest since December 2011 – consumers have a little more money to spend.

Job growth is a major factor for the Federal Reserve in deciding when to reduce its economic stimulus. The Fed has been buying bonds to keep long-term interest rates low and encourage borrowing and spending.

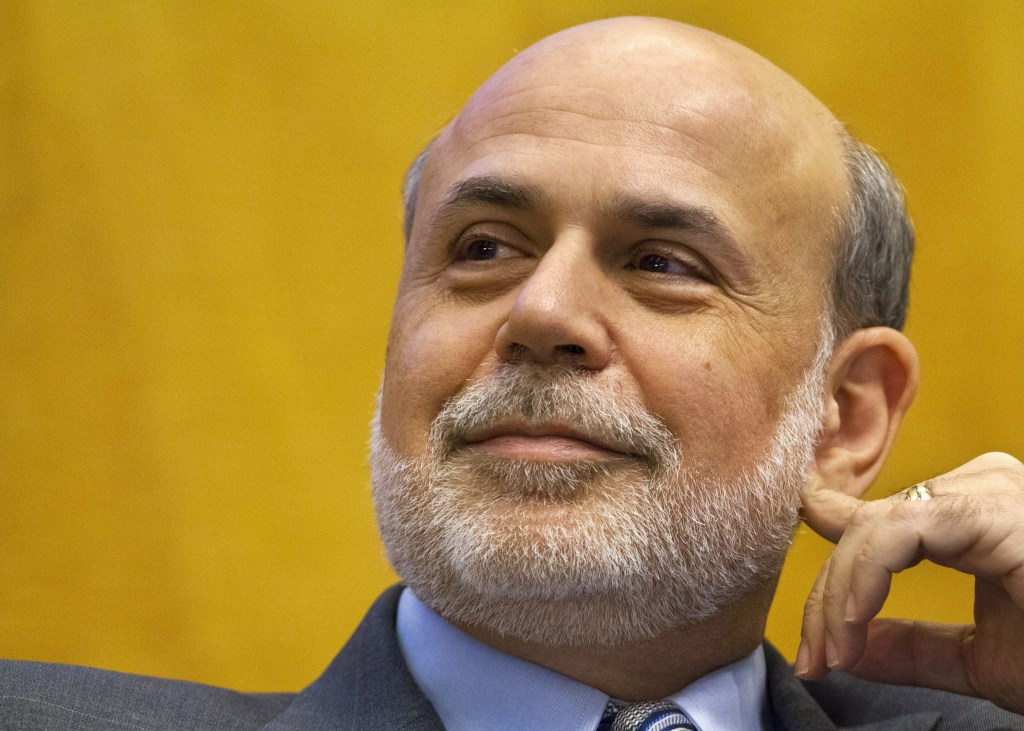

In related news, Chairman Ben Bernanke said Friday that the Federal Reserve is drafting rules to close large insolvent banks without bringing down the broader financial system, one of many steps regulators must take to prevent another financial crisis.

Bernanke said the absence of a process to deal with systemically important institutions in 2008 left regulators facing the “terrible choices of a bailout or allowing a potentially destabilizing collapse.” His comments were made at a conference sponsored by the International Monetary Fund.

The financial overhaul law passed by Congress in 2010 gave regulators better tools to close down large financial institutions, he said. The Fed and other regulators are working to implement those rules now.

“Our continuing challenge is to make financial crises far less likely and, if they happen, far less costly,” Bernanke said.

The Dow Jones industrial average surged 167 points to close at a record high Friday after the jobs report came out.

But the yield on the 10-year Treasury note climbed to 2.75 percent from 2.60 percent late Thursday, indicating some investors are worried the Fed might pull back on its bond-buying soon.

For some employers outside the Beltway, the government shutdown scarcely mattered.

Bob Duncan, founder and chief executive of Dallas-based American Leather, said his company is on track for a third straight year of steady revenue gains. American Leather custom-builds sofas, recliners and other furniture for Crate and Barrel and many smaller chains.

Duncan has boosted his 400-member workforce by about 2 percent in the past three months.

“I think everyone’s kind of numb to it,” Duncan said, referring to the budget battles in Washington.

More important to Duncan has been a spate of remodeling by hotel chains, many of which had postponed upgrades until recently. Sales have risen as a result.

Economists differed over how the robust jobs report might influence the Fed. Some said it probably isn’t sufficient for the Fed to slow its $85-billion-a-month bond-buying program when it meets Dec. 17-18.

“The one month of job growth is not enough to allow them to pull the trigger,” said Patrick O’Keefe, director of economic research at CohnReznick.

But Paul Ashworth, chief U.S. economist at Capital Economics, disagreed, writing in a research note: “In our opinion, the data would justify the Fed reducing the pace of its asset purchases in December.”

The report showed that employers added an average of 202,000 jobs a month from August through October – up sharply from an average of 146,000 from May through July. And they added 45,000 more jobs in August and 15,000 more in September than the government previously estimated.

Private businesses added 212,000 jobs last month. That was the most since February. By contrast, federal government jobs fell by 12,000.

Many retailers are optimistic about consumers’ willingness to spend more during the holiday shopping season. Walmart is hiring 55,000 seasonal workers, up from 50,000 last year.

One troubling detail in the report: The percentage of Americans working or looking for work fell to a 35-year low.

That figure may have been temporarily worsened by the shutdown. Even so, it suggests many Americans are discouraged about their prospects of finding a job.

Nearly 4.1 million Americans have been out of work for six months or more. That figure has tripled since the recession began in December 2007. The long-term unemployed represent more than a third of the 11.3 million people out of work.

About 1.3 million of the long-term jobless will lose their unemployment benefits by year’s end unless Congress renews an emergency benefits program, according to the National Employment Law Project. The emergency program provides up to 37 additional weeks of aid in most states on top of the 26 weeks that states typically dispense.

Edward Magda fears he will be one of them. He lives near Atlantic City, N.J., and has been a tile installer for 32 years. But the weak economy has left him unemployed.

In the past, he helped build hotels and resorts for Bally’s, Hilton and Revel. But now, “this is the worst I’ve ever seen it,” said Magda, 58.

About 800,000 government workers were furloughed for all or part of the Oct. 1-16 shutdown.

Many were counted as unemployed for the purposes of calculating the unemployment rate. But because they were ultimately paid for their time off, the furloughed workers were still counted as employed by a separate government survey that calculates job growth.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.