Since 2002, Maine employers have paid $24 million for insurance coverage against a major terrorist attack, courtesy of a federal law passed after 9/11 to stabilize the insurance industry.

The law, known as the Terrorism Risk Insurance Act, or TRIA, is set to expire at the end of 2014. Congress is debating its reauthorization amid arguments by proponents who say the act protects businesses from excessive increases in workers’ compensation rates, and by opponents who call it corporate welfare.

Here in Maine, local insurance experts say if TRIA is not reauthorized, Maine employers could see a steep increase in their workers’ comp insurance premiums.

“This thing is a sleeping giant,” said John Leonard, CEO of the Maine Employers’ Mutual Insurance Co., commonly referred to as MEMIC. “Every policyholder should be totally aware of the consequences if TRIA is not renewed.”

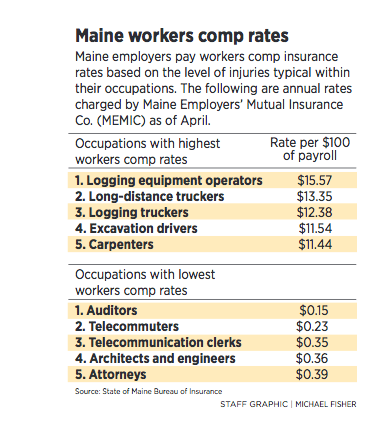

Although the law affects all types of insurance, its greatest impact in Maine is expected in workers’ comp, which provides benefits to a worker who is injured on the job and is required of almost every employer. Maine held the distinction of having the highest workers’ comp rates in the country until the state adopted new laws in 1992. Since then, the rates have moderated.

Leonard, whose company holds more than 60 percent of the workers’ comp market in Maine, said it’s impossible to know how much rates might be affected if the law is allowed to expire, but the potential is significant.

FEDERAL BACKSTOP for insurers

When two airliners flew into the World Trade Center on Sept. 11, 2001, the insurance industry was unprepared. The attack resulted in $23 billion in insured losses, according to a report from the Cato Institute, a right-leaning think tank.

Property insurers got spooked and started to refuse terrorism coverage, said Dana Kerr, an associate professor of risk management and insurance in the University of Southern Maine School of Business. But unlike property insurers, workers’ comp insurers couldn’t refuse to offer terrorism coverage. After 9/11, workers’ comp insurers started increasing premiums to cover potential losses from a similar event.

The original 2002 TRIA bill was pitched in Congress as a temporary fix to give the insurance industry some breathing room as it recovered from 9/11 and time to adjust actuarial tables to add the risk of terrorism.

The bill created a federal reinsurance program that provides a public-private cost-sharing arrangement in the event of a catastrophic terrorism event. Under the TRIA program, insurance carriers are liable for up to $100 million. Beyond that, the federal government would pick up most of the tab by tapping a fund financed with a surcharge on workers’ comp premiums. Since it was signed into law in 2002, TRIA has never been used. Congress has reauthorized it twice, in 2005 and 2007.

AN ABSTRACT CONCEPT IN MAINE

Each state determined its own workers’ comp surcharge. In Maine, the TRIA surcharge equals 0.01 percent of a company’s payroll, according to the Maine Bureau of Insurance. For example, if a company’s annual payroll is $5 million, the terrorism surcharge it pays on top of its workers’ comp premium is $500. The total of the TRIA fund in Maine stands at $24 million.

“I think the average businessperson has probably forgotten all about TRIA, and what it is and what it’s designed to do,” said Peter Gore at the Maine State Chamber of Commerce.

Gore acknowledges the concept is pretty abstract to the typical businessperson since the threat of terrorism isn’t at the top of the mind of most Maine employers. But the program is seeking to address the larger, interconnected aspect of the insurance market. Without TRIA, if one large national carrier is hit with billions in losses from a terrorism event, that impact would ripple throughout the market, including policyholders in Maine, Gore says.

The state chamber hasn’t taken an official position on TRIA reauthorization, but Gore said he supports it.

NECESSITY, OR CORPORATE WELFARE?

Some proponents of the government reinsurance program believe it should be made permanent.

“I think that was optimistic and naive,” Paul Sighinolfi, executive director of the Maine Workers’ Compensation Board, said of the idea that this would be a temporary fix. “I think it’s bigger than the industry is capable of handling on its own, frankly, and I think the industry now knows that. . . . Not that I’m a fan of big government, but I think this is one case where the government should protect people.”

Opponents of reauthorization have called the program corporate welfare.

“The insurance market is capable of providing terrorism risk coverage without a federal loss backstop,” Robert J. Rhee, a law professor at the University of Maryland, wrote in a 2013 policy brief for the Cato Institute.

His evidence? The fact the industry bounced back after the losses incurred in the wake of 9/11.

“Even an event like 9/11, which was extreme and unexpected, did not cause systemic insolvency crisis in the insurance market. Since insurers and private industry can shoulder their own losses, government financial support is an unwarranted subsidy for insurers and commercial policyholders,” Rhee wrote.

Kerr, from USM, disagrees.

“Those saying it’s welfare for insurance companies don’t really understand how the insurance mechanism works, how that market operates,” Kerr said. “They have to be able to predict what’s going to happen in the future in order to provide their product. That’s hard enough to do with auto insurance, let alone something as unpredictable as a terrorism event.”

As a professor, Kerr is accustomed to using analogies to explain to students how insurance companies work. Consider, he said, that you are a lawnmower manufacturer.

“You want to cover your costs of production, then mark up for a profit. (Insurance companies’) cost of production are their losses that they haven’t paid out yet,” he said. “The difficult task for insurance companies is determining what the cost of production is and then hope that it’s accurate. That’s the challenge.”

Insurance companies can use statistical models to predict the chances you’ll get into a car accident, or that one of your employees will fall off a ladder, or even if a hurricane will damage your building. But they still can’t build a predictive model for terrorist events, which makes it next to impossible to set a premium, Kerr said. The fact that no large-scale terrorism event has happened in the United States since 9/11 doesn’t make it any easier.

MEMIC EXPOSED IN OTHER STATES

If there is another terrorist attack, it wouldn’t have to happen in Maine for Maine employers to be affected. MEMIC has expanded to other states.

“So if there’s a terrorist event (elsewhere), it could still affect workers’ comp premiums here in Maine if it creates a financial strain on MEMIC and its capital,” Kerr said.

Leonard acknowledges that MEMIC’s presence outside Maine exposes it to additional risk for terrorist attack. It has avoided entering the New York City market for that very reason, he said.

MEMIC underwent an exercise in November 2013 simulating what would happen if there were a significant terrorism event in areas where it has policyholders. While an attack in Millinocket would have less of a bottom-line impact than one in downtown Portland, Leonard said the exercise showed the company’s exposure from such an event would not sink the company.

“We learned we were in pretty good shape as a company,” he said.

POSITIONS ON EXTENSION VARY

A bill in the U.S. Senate would extend the program for another seven years. Sen. Angus King, a Maine independent, supports extending the program, and Republican Sen. Susan Collins remains undecided, according to their respective spokespeople.

Another reauthorization bill is working its way through the House of Representatives. Unlike the Senate version, which would maintain the program largely as it is, the House bill would shift more risk and exposure back onto the private sector.

U.S. Rep. Mike Michaud, a Democrat who represents Maine’s 2nd District, supports reauthorization (he was a co-sponsor of the original 2002 bill that created the program). U.S. Rep. Chellie Pingree, D-1st District, is waiting for more information to come out of the financial services committee before making a decision, according to their spokespeople.

Whit Richardson can be contacted at 791-6463 or at:

wrichardson@pressherald.com

Twitter: @whit_richardson

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.