WASHINGTON – The U.S. economy showed in April that it’s healthier than many had feared, adding a solid 165,000 jobs and driving the unemployment rate down a notch to a four-year low of 7.5 percent.

Not only that, but many more people were hired in February and March than previously thought, the Labor Department said Friday. The job gains came despite a global slowdown, Social Security tax increases and federal spending cuts, which some have thought would drag on the economy.

The stock market soared on the news. The Dow Jones industrial average closed up 142 points, or nearly 1 percent, after briefly breaking 15,000 for the first time in history.

Coming after a poor March jobs report and some recent data showing economic weakness, the figures helped ease fears that U.S. hiring might be slumping for a fourth straight year. The job market is benefiting from a resurgent housing market, rising consumer confidence and the Federal Reserve’s stimulus actions, which have helped lower borrowing costs and lift the stock market.

“Businesses haven’t lost confidence yet,” said Sung Won Sohn, an economist at the Martin Smith School of Business at California State University. “Consumers are feeling better. The decent employment gains will add to the optimism and help lift future spending.”

The Labor Department revised upward its estimate of job gains in February and March by a combined 114,000. It now says employers added 332,000 jobs in February and 138,000 in March.

The economy has created an average of 208,000 jobs a month from November through April — well above the monthly average of 138,000 for the previous six months.

The unemployment rate edged down from 7.6 percent in March and has fallen 0.4 percentage point since the start of the year, although it remains high. The Fed has said it plans to keep short-term interest rates at record lows at least until unemployment falls to 6.5 percent.

One cautionary note in the employment report: Most of the biggest job gains were in lower-paying fields, such as hotels and restaurants, which added 45,000 jobs, and retail, which added 29,000. Temporary-help firms gained 31,000 positions.

By contrast, construction companies and governments cut jobs. Manufacturing employment was flat.

Some higher-paying sectors added workers. Professional and technical services, which include accounting, engineering and architecture, added 23,000 jobs. Education and health services gained 44,000.

Average hourly pay rose, but the average workweek for private-sector employees dipped 0.2 hour to 34.4 hours. That meant average weekly paychecks declined.

But over the past year, total pay after adjusting for inflation is up a healthy 2.1 percent, economists said. That should help boost consumer spending in coming months.

The job growth is occurring while the U.S. economy is growing modestly but steadily. It grew at a 2.5 percent annual rate in the January-March quarter, fueled by the strongest consumer spending in two years.

The housing recovery is helping drive more hiring. Rising home sales and construction help create jobs and increase spending on furniture, landscaping and other services.

One company that’s benefited is SolarCity, based in San Mateo, Calif. Rising home building has helped increase demand for the solar-power systems the company installs in homes and businesses.

CEO Lyndon Rive said SolarCity added 177 jobs in April and will welcome its 3,000th employee Monday. It is hiring engineers, installers and administrative support staff and still has 400 openings.

Consumers have been spending more even though their take-home pay was shrunk this year by a Social Security tax increase. On top of that, the economy has been under pressure from the across-the-board government spending cuts that began taking effect March 1. And some small and midsize companies are concerned about new requirements under the federal health care law.

Americans’ confidence in the economy jumped last month, lifted by a brighter outlook for hiring and expectations for higher pay, according to the Conference Board, a research group. Cheaper gasoline, the booming stock market and rising home values are also no doubt making people more confident.

Home prices rose 9.3 percent in February compared with a year ago, the most in nearly seven years, according to the Standard & Poor’s/Case-Shiller 20-city index.

Still, prices nationwide remain about 30 percent below their peak during the housing bubble in 2006. They’re back only to where they were in 2003.

Yet the global economy, by contrast, is slowing. The European Union warned Friday that the 17 countries that use the euro will shrink by a collective 0.4 percent this year. And unemployment in the eurozone is expected to hit an average of 12.2 percent. In Greece and Spain, it is forecast to reach 27 percent.

Fed Chairman Ben Bernanke and European Central Bank President Mario Draghi have suggested that governments need to focus on stimulating growth and not just on spending cuts and deficit reduction.

Economists have forecast that the U.S. economy will grow roughly 2 percent this year, below last year’s 2.2 percent. The Congressional Budget Office has estimated that the tax increases and government spending cuts will have shaved about 1.25 percentage points from growth this year. That means that without those measures, the economy could have grown a strong 3.3 percent in 2013.

In April’s employment report, more Americans said they had part-time jobs even though they wanted full-time work. That figure rose 278,000 to 7.9 million, reversing a steep drop the previous month.

Some economists worry that restaurants, retailers and other companies are hiring more part-timers in preparation for the start of health care reform. Companies with more than 50 full-time employees in 2013 will be required to provide health insurance to their full-time staff next year.

Retailers, restaurants and hotels added 48,000 more jobs in February than previously reported. They accounted for three-quarters of that month’s revision.

The government revises each month’s job totals twice in the following two months. The revisions occur because many companies in the survey submit their responses late.

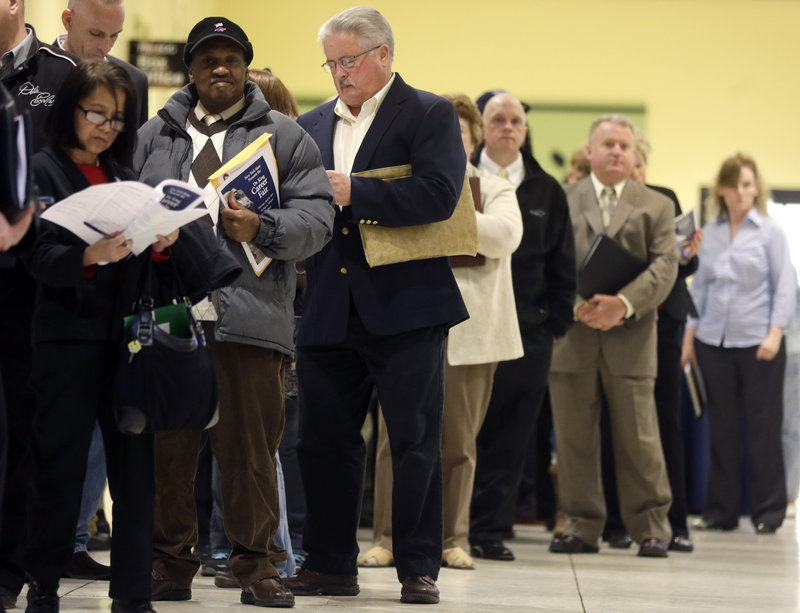

Friday’s report said the number of people who have been unemployed for more than six months dropped 258,000 to 4.4 million. Over the past year, the number of long-term unemployed has declined by 687,000.

Some analysts cautioned that April’s job gains don’t necessarily point to faster hiring ahead.

“There is little sign in these data to suggest that a marked acceleration in monthly job creation in the months ahead is in the cards,” said Scott Anderson, chief economist at Bank of the West.

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.