WASHINGTON – The Federal Reserve said Wednesday that the U.S. economy has strengthened but still needs the Fed’s extraordinary support to help lower high unemployment.

In a statement after a two-day meeting, the Fed stood by its plan to keep short-term interest rates at record lows at least until unemployment falls to 6.5 percent, as long as the inflation outlook remains mild. And it said it would continue buying $85 billion a month in bonds indefinitely to keep long-term borrowing costs down.

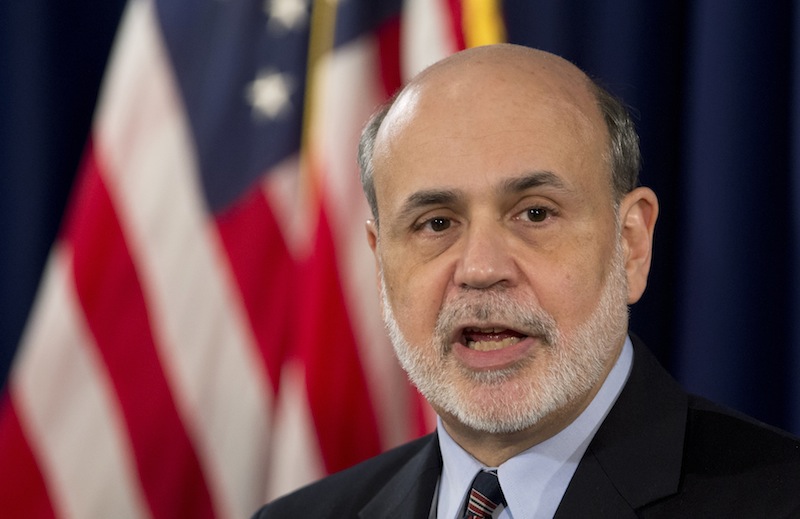

Speaking at a news conference, Chairman Ben Bernanke stressed that while the economy has improved, the Fed won’t ease its aggressive stimulus policies until it’s convinced the economic gains can be sustained. An unemployment rate of 6.5 percent is a threshold, not a “trigger,” for a possible rate increase, he said.

Bernanke also said the Fed might vary the size of its monthly bond purchases depending on whether or how much the job market improves. The unemployment rate has fallen to a four-year low of 7.7 percent, among many signs of a healthier economy.

“We are seeing improvement,” Bernanke said. “One thing we would need is to see this is not temporary improvement.”

Investors seemed pleased with the Fed’s decision to maintain its low-interest rate policies indefinitely for now. The Dow Jones industrial average closed up about 56 points.

Bernanke was asked at his news conference whether the flare-up in Cyprus signals that the U.S. financial system might be more vulnerable than bank “stress tests” have shown. He sought to downplay the dangers posed by the tiny Mediterranean nation. Bernanke said that “at this point,” he sees no major risks to the U.S. financial system or economy.

The Fed noted in its statement that the U.S. job market has improved, consumer spending and business investment have increased and the housing market has strengthened. But its latest economic forecasts, also released Wednesday, showthe Fed doesn’t expect unemployment to reach 6.5 percent until 2015.

The Fed also cautioned that government spending cuts and tax increases could slow the economy. It predicts growth won’t exceed 2.8 percent this year, slightly lower than its December forecast of 3 percent.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.