WASHINGTON – Economists are rethinking their projections that the U.S. economy should rebound in the second half of the year following Friday’s glum government report that showed weaker-than-expected growth of just 1.3 percent from April to June.

The anemic numbers reported by the Bureau of Economic Analysis for the second quarter underscored concerns about the sluggish pace of recovery in an increasingly fragile economy. The BEA also revised downward its earlier estimate of growth for the first three months of the year — from 1.9 percent down to only 0.4 percent. All percentages are annual rates.

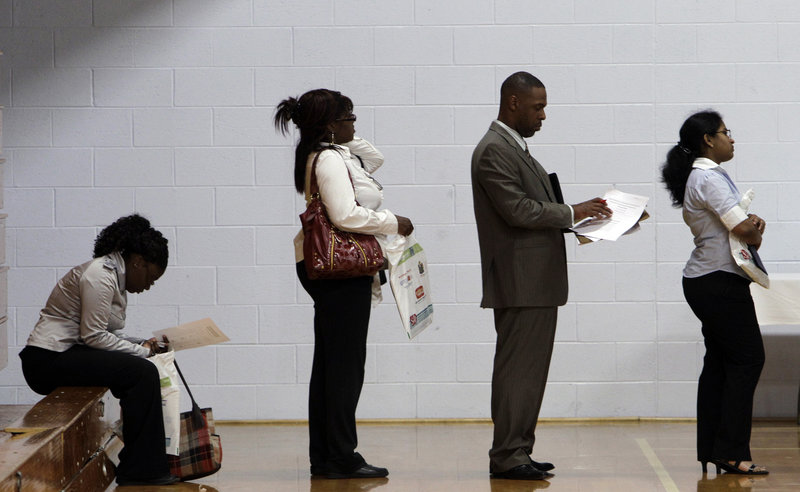

The new numbers show that the first half of the year recorded the slowest growth since the United States pulled out of recession in June 2009. Those numbers explain why the unemployment rate remains high, at 9.2 percent in June.

“I think the economy should reaccelerate. But the revisions cast some doubt on the strength of reacceleration in the economy, and the economy stalled out in the first half of the year,” said Mark Zandi, chief economist for forecaster Moody’s Analytics. “The damage from the surge in energy prices and other things that weighed on growth was more serious and may make it more difficult to gain traction.”

The BEA, part of the Commerce Department, also unveiled a revision of data covering the past three years, which showed that the Great Recession was even worse than thought in late 2008 and early 2009.

The weak second-quarter report Friday was expected by economists, who warned of pressure from high energy prices and spillover effects from the devastating earthquake and tsunami in Japan that disrupted the global supply chain for many manufacturers.

Less expected was the sharp downward revision of growth for the first three months of 2011. That suggests the economy was already slowing before the current political crisis in Washington over raising the debt ceiling and slashing future spending, which surely isn’t boosting confidence during the current quarter, which ends on Sept. 30.

Adding to the grim report, the Reuters/University of Michigan consumer sentiment index was released Friday and showed a drop of 7.8 points to 63.7. That’s the lowest level since March 2009 and underscores why consumers continue to pinch pennies.

The White House didn’t try to sugarcoat the GDP numbers.

“This report underscores the need for bipartisan action to help the private sector and the economy grow — such as measures to extend the payroll tax cut and unemployment insurance, pass the pending free-trade agreements with re-employment assistance for displaced workers, and create an infrastructure bank to help put Americans back to work,” said Austan Goolsbee, the head of the White House Council of Economic Advisers.

State and local spending continued to decline sharply from April through June, falling 3.4 percent, the same as in the first three months of the year. Federal spending was up 2.2 percent after plunging 9.4 percent in the first three months of the year.The new numbers show that the first half of the year recorded the slowest growth since the United States pulled out of recession in June 2009.

Copy the Story Link

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.