The world’s largest cold-storage company has been chosen to build a modern refrigerated warehouse on the Portland waterfront, providing the port with a critical missing element to compete with larger, more congested ports on the Eastern Seaboard.

The state will lease a 6.3-acre site to Americold, which will design the warehouse, fund its construction and operate it. The project is part of a state-led effort to make the port more competitive with other ports and to boost Maine’s seafood, agriculture, and food and beverage industries.

The Maine Port Authority announced Monday that Americold Logistics LLC won the bid to develop the site, located adjacent to the expanded International Marine Terminal on West Commercial Street. The proposed cost of the project, which is scheduled to be completed in 2017, was not disclosed.

Americold already operates a 63-year-old cold-storage warehouse on Read Street in Portland. Company officials say they’re evaluating whether to close that outmoded facility or keep it open for overflow and long-term storage. Americold is partnering on the project with Eimskip, the Icelandic shipping company that made Portland its North American headquarters in 2013. Eimskip will be both an investor and an anchor tenant.

There is currently a shortage of cold-storage warehouse space in Maine, prompting many of the state’s food producers and processors to ship their products out of state for storage.

Eimskip primarily ships frozen fish from Europe to the United States through Portland. While Eimskip now stores some of its imported seafood at the Americold facility on Read Street, the company trucks most of its fish to cold-storage warehouses in the Boston area.

A new warehouse on the Portland waterfront will allow that fish to stay here, where local fish processors can add value, said Keith Goldsmith, chief commercial officer at Americold.

From Portland, products can then be shipped directly to customers, Goldsmith said. The warehouse’s waterfront location means its customers will have the choice to ship products via truck, train or container ship, he said.

It also means the port will have the same infrastructure – although on a smaller scale – as the East Coast’s major ports, he said.

“We think it provides Portland everything it needs to compete,” Goldsmith said.

The logistical efficiencies will encourage existing companies to expand here and may attract new processing companies, he said.

Americold expects to break ground on the project in the fourth quarter of 2016 and complete construction in the third quarter of 2017.

John Henshaw, executive director of the Maine Port Authority, described Americold’s proposal as comprehensive.

“It really covered all the bases,” he said. “It demonstrated a knowledge of the market.”

The proposal was one of two submitted for consideration by the port authority. Eastern Impact LLC of Portland, the lead entity in a consortium put together for the project, also submitted a bid.

VETERAN MANAGER FOR FACILITY

Michelle Brooks, general manager of the Americold facility on Read Street, will manage the new warehouse.

Brooks’ late father, Frank Wagner Jr., was a superintendent at Americold when it opened in 1952 and went on to become general manager before retiring in the late 1980s.

Brooks said the city’s port – which a century ago was among the nation’s busiest – was stagnant when she was growing up in the 1960s and 1970s.

“I think it’s just great to get a working waterfront going again,” she said.

The new warehouse will encompass 150,000 square feet – a capacity that can hold up to 15,000 pallets of goods – and have room for expansion.

The warehouse will be the same size as the Read Street facility, which is the largest public cold-storage warehouse in the state but can’t provide the level of automation and temperature control available in a modern facility, state officials have said. New warehouses use robotics and store different foods in separate areas cooled to specific temperatures. Also, the new warehouse will use freon refrigerants rather than ammonia. Freon is safer for both employees and food, said Pat Ballard, vice president of business development for Americold.

SETTING THE TABLE FOR GROWTH

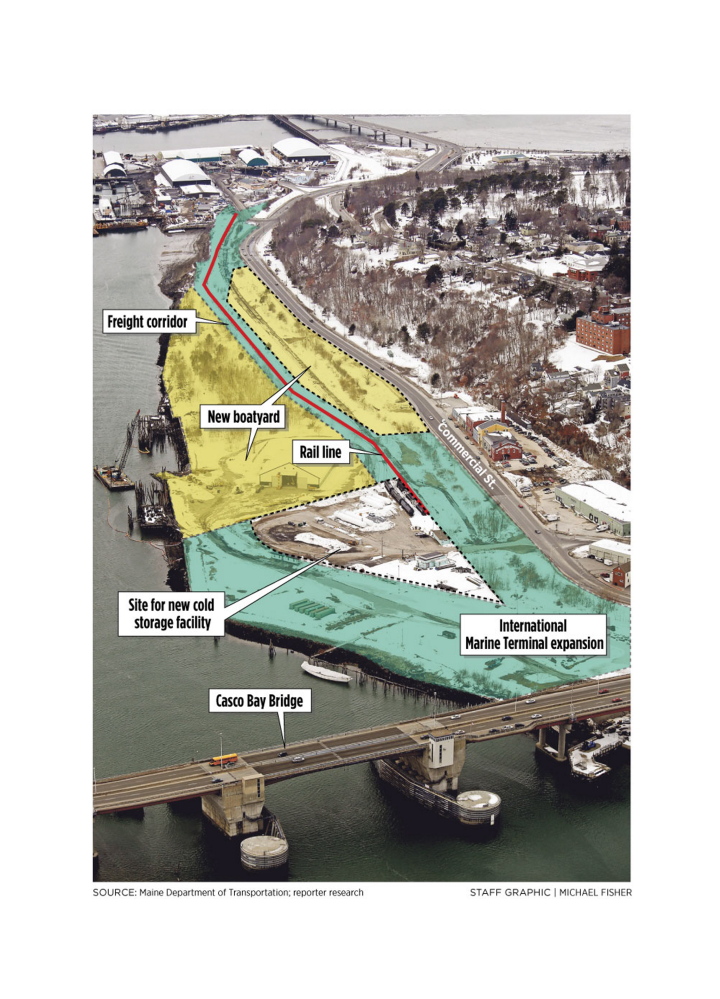

Henshaw, the port authority director, said a cold-storage facility on the waterfront will leverage the state’s substantial investments in the area. It’s now expanding the International Marine Terminal westward, so it connects with a freight rail line. Crews are building a 750-foot long, 75-foot wide concrete pad to support trucks that will haul containers between ships and freight trains. As part of that project, the state is building a yard for trucks to store containers.

To facilitate the expansion, the state paid $7.2 million for an 18-acre parcel, which includes the 6.3 acres set aside for the warehouse.

The cold-storage warehouse will be built at the site currently occupied by a tenant, NGL Supply Terminal Co., which operates a liquid propane terminal on half of the 6.3-acre site.

The propane company has sought to build a new facility in Rigby Yard in South Portland, but has run into local opposition. The company continues to look at that site as well as others, Henshaw said. He expects the propane company will shift to a new location by next summer, a move that the state will pay for.

Yucaipa Cos., a private-equity firm based in Los Angeles, owns Americold. Two Yucaipa investment funds own 25.3 percent of Eimskip, according to Eimskip’s 2014 annual report.

The cold-storage industry is expanding because of growing consumer demand for chilled food products, such as seafood, fruits and vegetables, and dairy products such as yogurt. According to the International Association of Refrigerated Warehouses, the global volume of refrigerated space has grown nearly 8 percent over the past year to meet a rising demand from food producers.

Cold storage, a $4.8 billion industry in the U.S., is benefiting from a rebounding economy and higher consumption, which increase trade and the need for refrigerated space, according to IBISWorld, a research firm. It says the refrigerated-storage industry dipped during the recession, but since 2010 has seen double-digit annual growth.

Send questions/comments to the editors.

Comments are no longer available on this story