The real estate market in Portland may soon see an infusion of properties for sale, including numerous two- and three-family homes around the city and a private island refuge in Casco Bay.

They are among the nearly 100 properties that the city of Portland has acquired in recent years because the previous owners did not keep up with their taxes, and failed to catch up in time to prevent foreclosure.

Some of the former landowners owe more than $10,000, while others owe less than $100, according to city records. Many still occupy the buildings and even collect rent from tenants as they work with the city to pay off their debts and regain the titles. The total value of the holdings is at least $12 million, representing more than $500,000 in unpaid property taxes.

On Monday, the City Council will consider new, more aggressive rules that could lead to such properties being sold off in the future.

It’s not clear how many of the properties on the city’s current tax-acquired list would be put on the market, because some current occupants may still have a chance to regain ownership. But Michael Sosnowski, a real estate agent with the Maine Home Connection, said the city would have no problem selling the properties in today’s market, given that sales of single-family homes in Portland hit a record level in 2015, and sales are up 24 percent year-to-date in 2016. Properties in the East End and West End neighborhoods would be in especially high demand, he said.

“With inventory throughout the city at a very low level, each new property coming on the market is evaluated quickly,” he said. “Multiple offers on homes in Portland is not uncommon.”

Several property owners contacted last week declined to be interviewed for this story, saying only that they were working with the city to pay their back taxes and regain control of their properties, or that they believed they were still the rightful owners of their property. However, the city maintained that the list was accurate and reflected what the city owns.

City officials acknowledged that some property owners had payment plans, but could not provide specific information about which properties or which owners had received a tax abatement because of financial hardship.

In some cases, the last owners listed in city records have died, and it was unclear if they have heirs who might be working to regain ownership.

CHANGES FOR ACQUIRED PROPERTY

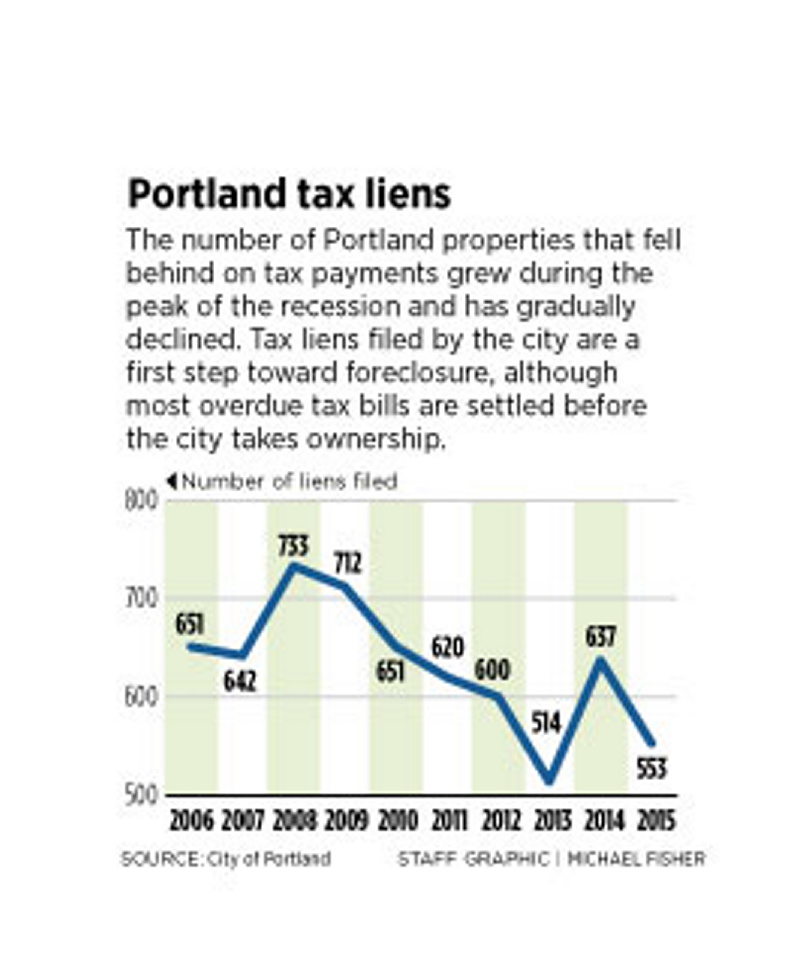

The Great Recession appears to have helped build the city’s inventory of tax-acquired properties. The number of tax liens, which is the first step in the foreclosure process, peaked in 2008 and 2009 at 733 and 712, respectively. In 2015, that number had dropped to 553. Still, these numbers represent a small percentage of the 22,500 tax bills the city issues annually, and few result in an actual foreclosure.

49 Mayo Street: Previous owner of three family home is listed as Veterans Affairs Administration. Portland is owed $10,879 in back taxes, according to city records.

A new city policy expected to be adopted Monday by the City Council would, among other things, no longer allow owners to enter into payment plans after their properties have been acquired by the city. It also would unravel an existing prohibition against selling properties that would result in the displacement of existing residents. The change would allow the city to either evict the existing residents, or sell the building as occupied, leaving the residents’ fate up to the new landowner.

City officials do not know exactly how many of the 60 or so units of housing on the current list are inhabited, nor can they say what will become of the existing residents. But the proposed changes come as low-income tenants have faced mass evictions driven by a housing shortage and hypercompetitive rental market, and officials say they are going to implement the new policy with a gentle hand.

“We are going to have a very compassionate approach,” said Greg Mitchell, the city’s economic development director, explaining that the city will first seek to settle up with existing debtors before putting the properties on the market. “We’re going to look at this on a case-by-case basis.”

Mitchell said those people already on a payment plan to reclaim ownership can keep those plans, provided they make regular payments. His economic development department will oversee any sales of tax-acquired properties.

It takes more than two years from the time an owner falls behind on taxes for the city to foreclose on a property. Several notices are sent to the property owner in the meantime, including a 30-day notice about an impending tax lien – a legal claim step that gets attached to the property until the debt is paid off. Owners are again notified when the lien is filed and are sent an impending foreclosure notice a year later before the city finally forecloses, or assumes ownership.

Although property owners in the future would no longer be able to set up payment plans after their property has been acquired by the city, Mitchell said owners will be given an additional 60 days to completely pay their back taxes before the property is sold.

CITY MANAGER MAY GET SALES AUTHORITY

The city’s inventory of tax-acquired properties has been building up over several years, because selling them is difficult under current rules. The process now involves an internal review by city officials and a public vetting by a council subcommittee. The full City Council has to vote to sell a property.

The proposed changes are designed to streamline that process, making it easier for the city to sell the properties. Instead of going before the council, the city manager would be authorized to sell certain properties.

78 Smith Street, at right: Previous owner of single family home died. Portland is owed $13,053 in back taxes, according to city records.

City Manager Jon Jennings has said it is unfair to allow some property owners to ignore their tax bills while others continue to pay.

“I don’t think it’s fair for some people to be in their homes and thumb their nose at paying taxes when everyone else is,” Jennings said in an interview.

The new policy would allow the manager to sell properties with three or fewer housing units and an assessed value of under $400,000 without the council’s permission. The sales price would have to cover the back taxes plus interest, along with the marketing costs, attorney’s fees and any other expenses.

The city would have many options when selling a property. It may retain a real estate broker to advertise the properties, offer the properties through a straight bid process, issue a request for proposals or hold an auction.

Vacant, undersized, non-buildable lots (under $5,000 in assessed value) may be offered to abutters, who will have 30 days to respond. Property owners within 500 feet will be notified of a potential sale and/or change of use.

Other properties, including larger apartment buildings and more valuable land, would still require the council’s endorsement.

Mitchell said staff would examine the vacant lots to see which ones should be retained as open space for the city, and which ones could be bundled and sold for development. He expected the first round of properties to be offered for sale later this spring or in early summer.

A GLIMPSE OF THE INVENTORY

About half of Portland’s tax-acquired property is vacant land that in some cases is too small to be developed.

The city’s inventory also includes 26 single-family homes, including a half-dozen in North Deering and four homes on Peaks Island. The city also has acquired 10 apartment buildings, including four three-unit buildings, six duplexes and two larger complexes with five and seven units.

Perhaps the most interesting property is a small Casco Bay island just north of Peaks Island.

Pumpkin Knob: Previous owner of this island and seasonal cottage lives out of state and could not be reached. Portland is owed $4,255 in unpaid taxes, according to city records.

Pumpkin Knob is a nearly 2-acre island of ledge and trees in Hussey Sound. It has a cottage and a dock and has been privately owned for as long as some longtime islanders can remember.

“Nobody ever thinks of Pumpkin Knob. It’s just there,” said Kim MacIsaac, who has lived on Peaks for more than 60 years. “It’s had numerous owners over the years. I haven’t been there since I was child. It’s covered in poison ivy.”

The legendary movie director John Ford, whose family lived in Cape Elizabeth and had a cottage on Peaks Island, is believed to have spent time on Pumpkin Knob and had an ownership interest in the small island at one point, she said.

It is now owned by a family that uses it for a summer retreat and recently passed it down to a new generation, said Tom Bergh, owner of Maine Island Kayak Co. on Peaks Island. “You see them quite a bit in the summer,” said Bergh, who said he did not know the owners by name.

The island has an assessed value of $444,000 and accounts for $4,255 in unpaid 2014 taxes, according to city records. The circumstances that led to the foreclosure, and whether the family is paying off the back taxes, were not clear. The last owner of record is David R. Titcomb. Calls made last week to a phone number listed for him were not returned.

POLICIES IN OTHER COMMUNITIES

Portland’s new policy would set it apart from its neighboring communities, which offer payment plans and refrain from displacing residents.

The South Portland City Council must vote to sell tax-acquired property, based on a recommendation from the Planning Board. City Manager Jim Gailey said South Portland currently has 37 properties, many of which are unbuildable. A few properties are occupied, but those property owners are on payment plans, he said.

“The council has had a longstanding policy that it would not remove people from the home and instructs city staff to work with the individual(s) to establish a payment plan to get caught up,” Gailey said in an email.

Westbrook City Administrator Jerre Bryant said the city has 80 tax-acquired properties, which are mostly residential. Although the city lacked a written policy, it has a standing practice of not displacing residents.

“The city works with and strongly encourages owners to set up payment plans, for both properties in lien and those that have foreclosed,” Bryant said in an email. “We have a number of ongoing payment plans. The city always allows the former owner to redeem residential property after foreclosure, either through payment plan or full cash redemption.”

Send questions/comments to the editors.

Comments are no longer available on this story