Maine’s residential mortgage lending industry bears little resemblance to its prerecession version as changing conditions have shuffled the deck of top lenders and created new choices for borrowers.

Gone is the dominance of mega-banks such as Bank of America, and in their place are regional community banks and non-bank lenders that specialize in home mortgages.

Two of the biggest non-bank players in Maine today are South Portland-based Residential Mortgage Services Inc. and Detroit-based Quicken Loans Inc., both of which have risen from the ashes of the Great Recession.

In July 2009, Bank of America was the top mortgage lender in Cumberland County, according to county records. In July 2016, Residential Mortgage Services was the top lender, followed by Bangor Savings Bank. Bank of America barely cracked the top 10.

“Dodd-Frank changed the landscape for residential lending – forever,” said Maine Bankers Association CEO Christopher Pinkham, referring to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. “The largest financial institutions have said, … ‘We’re getting out of that business.’ ”

The purpose of Dodd-Frank was to improve the country’s financial stability by increasing transparency and accountability in the financial system and protecting consumers from abusive bank practices. Among other things, it added new regulations for banks and organizations that issue residential mortgage loans.

In its wake, big national banks have shifted their focus away from originating home mortgages. Instead, they have decided to largely forgo the regulatory red tape by purchasing loans originated by third parties. Their exodus from the market has created opportunities for both community banks and non-bank lenders.

SHIFTING DYNAMIC

With major banks backing out of home mortgage originations, a group of innovative non-bank companies have risen to prominence within the industry.

Residential Mortgage Services, or RMS, has become a tremendous success story in Maine. The South Portland company was founded in 1991 as a small mortgage brokerage, and it was converted into a home mortgage lender in 2001.

Michael Ianno, executive vice president of retail production at Residential Mortgage Services.

Now the company has nearly 900 employees working at 70 branch locations from Bangor to Virginia Beach. Most of its growth has happened in the wake of the financial crisis, said Michael Ianno, the company’s executive vice president of retail production.

“We’re one of the few that survived,” Ianno said. “We actually grew through it.”

Ianno attributed the growth of RMS to its singular focus on mortgages and its ability to process loan applications in person, over the phone or online.

“We just deliver superior customer service,” he said. “This is all we do.”

In 2016, RMS originated nearly 17,500 home purchase and refinance mortgages, worth a total of $3.83 billion, Ianno said.

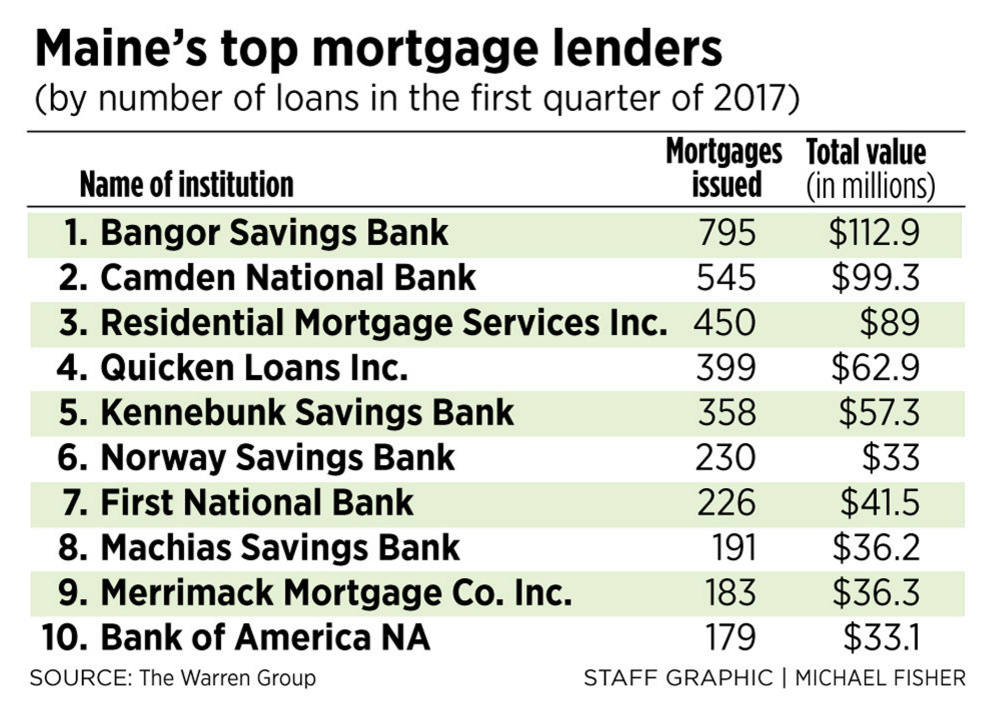

In Maine, RMS originated 450 mortgages valued at $89 million in the first quarter, the third-highest among all mortgage lenders in the state. It was surpassed only by Bangor Savings Bank with 795 loans worth $112.9 million, and Camden National Bank with 545 loans worth $99.3 million, according to Boston-based real estate and financial data provider The Warren Group.

Some banking industry representatives expressed concern that non-bank lenders aren’t as heavily regulated as banks.

“No one really knows what their level of compliance or noncompliance is,” Pinkham said.

But Ianno took issue with the claim. He said loans originated by RMS meet the same strict standards as bank-issued mortgages, as evidenced by the fact that it sells 90 percent of its loans to major banks and government-sponsored enterprises such as the Federal National Mortgage Association, or Fannie Mae.

Ianno acknowledged that non-bank lenders have a reputation for being major contributors to the 2008 financial crisis, which began with an erosion of underwriting standards and companies issuing loans to homebuyers who could not realistically afford to pay them back.

However, he said all financial institutions, including traditional banks, share responsibility for the crisis, and that regulators have imposed new rules to prevent another catastrophe.

“The credit standards are so much stricter today,” Ianno said.

MORTGAGES GO ONLINE

Another non-bank mortgage lender that has risen to prominence in Maine since the financial crisis is Detroit-based Quicken Loans, which operates online under the brand name Rocket Mortgage.

The company advertises aggressively online, targeting millennials and others who turn to the internet to conduct their research before applying for a home loan. Typing “mortgage loan” into a Google search brings up Rocket Mortgage as one of the top results.

Bill Emerson, vice chairman of Rock Holdings Inc., the parent company of Quicken Loans, said the company did about $96 billion of mortgage loan originations in 2016. In Maine, Quicken Loans originated 399 mortgages valued at $62.9 million in the first quarter, the fourth-highest among lenders in the state.

A large percentage of Rocket Mortgage customers are first-time homebuyers who are unfamiliar with the application process and may be apprehensive about it, Emerson said. The company has designed a simple, user-friendly online application process that is designed to improve transparency and eliminate the applicant’s anxiety. The average time to complete the application is just nine minutes, he said.

“We decided many years ago that the way the loan process works is broken,” Emerson said, and the company set out to fix it.

Pinkham said he is skeptical about the ability of online lenders such as Rocket Mortgage to provide excellent customer service, especially if something goes wrong with the application process. However, he acknowledged that a growing number of consumers want the ability to conduct all of their financial transactions online, and that traditional banks need to provide that ability if they want to compete.

One Maine-based bank that recently launched its own online mortgage application is Camden National, the state’s second-biggest mortgage lender in the first quarter. Others are likely to follow suit.

“There’s no way Camden is going to put that kind of money into that kind of product unless they have already established that that’s what people want,” Pinkham said.

A NEW FRONTIER?

Camden National President and CEO Greg Dufour said the online mortgage product, called MortgageTouch, is the latest step in the bank’s efforts to “build a digital gateway” to banking services.

In the past, mortgage applications always have been paper-intensive, he said, but now banks can access all of the verification data needed to complete the application process digitally. It reduces the application time down to about 15 minutes, Dufour said.

The primary driver of digital applications is customer demand, he said. To compete with companies such as Quicken Loans and the larger banks, Camden National decided it needed to add the online option.

“What we have found is that millennials are much more open to using technology (such as computers and mobile devices) for financial transactions,” Dufour said. “They’re very comfortable with that.”

The goal is not to replace face-to-face transactions but to provide an online alternative for those who would rather not visit a bank branch, he said, adding that Camden National is committed to growing its mortgage business and does not want to lose market share to online-only lenders.

“We have to really compete head-to-head with big companies, technology-wise,” Dufour said.

Bangor Savings, Maine’s largest mortgage lender in the first quarter, also offers an online mortgage application. Company Senior Vice President and Director of Mortgage Lending Bruce Ocko said Bangor Savings’ strategy is to distinguish itself from competitors by offering both high-tech and high-touch options for customers. The product itself is almost irrelevant.

“We’re all selling a widget,” Ocko said. “Our 30-year fixed rate is the same as their 30-year fixed rate.”

Therefore, the only way to gain market share is to provide the best customer experience, he said. Banks such as Bangor Savings and Camden National also promote their charitable contributions to local communities to make customers feel good about using their services.

“Millennials care about social responsibility,” Ocko said. “Does the lender give to the local community?”

There is nothing new about non-bank lenders, said Joe Ferris, director of mortgage lending at Androscoggin Bank. They were major players in the market before the financial crisis, and then most of them were crushed or absorbed in the aftermath. Now, they’re back.

Smaller banks such as Androscoggin don’t need to compete head-to-head with the big banks and non-banks to do a healthy business, he said, and there is a lot more to running a bank than issuing home mortgages.

For example, while Androscoggin does not offer the latest online home mortgage application software, it does provide an online lending system for small commercial loans. Ferris said the product has been very successful.

“I’m going to go where they’re not going,” he said.

J. Craig Anderson can be contacted at 791-6390 or at:

Twitter: jcraiganderson

Send questions/comments to the editors.

Comments are no longer available on this story