LOS ANGELES — More accustomed to allocating money by the million, the federal government is stepping up efforts to make loans as small as a few hundred dollars to some of the nation’s tiniest companies.

The goal is to create jobs, one little loan at a time.

“In this environment, every job is crucial,” said Eric Zarnikow, who helps run the Small Business Administration’s loan programs. For every loan, he says, 1½ jobs are created or retained.

In Southern California, these so-called microloans will help a San Fernando Valley dental laboratory hire an assistant to make crowns and bridges and will enable an Orange County woman to sell gourmet ice cream sandwiches from a used food truck. A car-sharing company used one of these loans recently to pay for a marketing campaign.

Although it is known primarily for guaranteeing private loans for up to $5.5 million, the SBA microloan program also works through not-for-profit community lenders to make tiny loans directly to small businesses with federal money. Now that program is growing significantly.

Over the last 18 months, Congress has tripled the amount available for microloans to $75 million nationwide. This week, the SBA moved to funnel more of that money to the lenders that grant the loans and increased the maximum amount of the loans themselves. Borrowers can now get up to $50,000 at a time, up from $35,000 previously.

In Southern California, one of the largest microlenders is Valley Economic Development Center Inc. in Van Nuys. Microloans there average about $12,000 each, said the organization’s president, Roberto Barragan. He expects to use the new federal money to make loans to local businesses that are desperate for cash. For now, he figures, most of the microloans will remain small.

Andre B. Murray, a photographer based in Burbank, said he is expecting a check for his microloan soon. He plans to use the $8,600 loan to buy digital video equipment.

“I could take that $8,600 loan with the equipment that I’m going to be getting, and I can turn that into $50,000 over the course of a year once I really get out there,” Murray said. He plans to add videography to the still photography that has been the mainstay of his company, the Bern Agency.

“The tiny loans really tend to help the really small, small businesses,” said Zarnikow of the SBA. “In a lot of cases the small businesses may have no alternative, or the alternative may be pretty expensive.”

Microloans are also known to Americans as the incredibly tiny loans — as small as $50 — that investors make to people in developing countries.

In the United States, even the microloans are considerably larger than overseas, mostly because the costs of living and of setting up a business are so much higher here. The loans are made through not-for-profit community lenders, with money from the SBA. Along with each loan, borrowers receive training on how to develop and run their businesses.

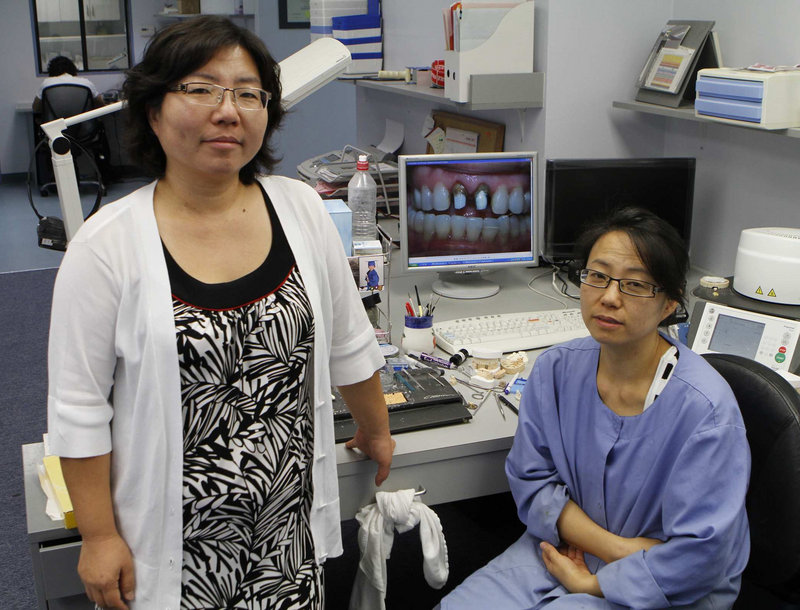

Sisters Janet and Kay Lee are borrowing $17,000 – just enough to pay off debts at their San Fernando Valley dental laboratory and hire a part-time technician.

“We’re using it for a new person and for the equipment he will use,” said Janet Lee, whose company, Polar Esthetics, makes dental crowns and bridges.

The sisters will pay 10 percent interest on the loan. The only other way they could have borrowed that money would have been to use a credit card – at a 29 percent interest rate, according to their lender, Valley Economic Development Center.

For small firms, a loan as small as $5,000 can mean the difference between making payroll or not, said Barragan. In the rough economy, even microloans are hard to come by, he said.

“Three years ago when money was easy, if I didn’t approve a loan for $25,000, they were mad,” Barragan said. “Now, if I approve them for $10,000, they’re happy campers.”

In good times, half the microloans he made were for startup companies, Barragan said. Now, most go to existing firms for whom cash or credit is tight.

Microloan applicants often do not have the credit or collateral that would be required by a traditional bank, said Stacey Sanchez, who makes the tiny loans in Orange County, San Diego and parts of Riverside and San Bernardino counties through the not-for-profit lender CDC Small Business Finance.

“There’s no one at a bank to understand that you may have been out of work – that’s not cost-effective for the banks,” she said. “You either have the credit score or that’s that.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.