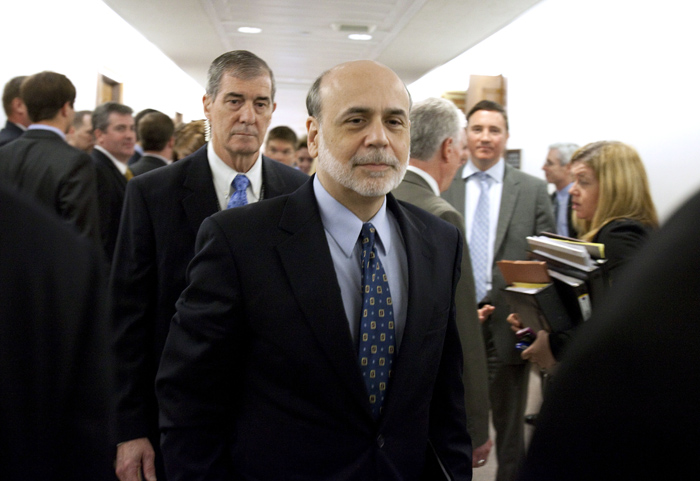

WASHINGTON — Federal Reserve Chairman Ben Bernanke noted today that the job market and the economy have weakened in recent weeks. But he said the main reasons are higher gas prices and the Japan crises – factors that should ease in coming months – and predicted growth would strengthen later this year.

Bernanke made no mention of any new steps the Fed might take to boost the economy. The Fed’s $600 billion Treasury bond-buying program is ending this month. The program was intended to keep interest rates low to strengthen the economy. But critics said it raised the risk of high inflation.

The Fed chairman said the economy still needs the benefit of low interest rates.

Stocks fell after Bernanke began speaking. The Dow Jones industrial average erased gains made earlier in the day and closed down for the fifth straight day, as did broader indexes.

Bernanke noted the May jobs report released last week was disappointing. It showed the unemployment rate rose to 9.1 percent and the economy added just 54,000 jobs, the fewest in eight months. But he said he expected job creation and overall economic growth would rebound in coming months.

“Overall, the economic recovery appears to be continuing at a moderate pace, albeit at a rate that is both uneven across sectors and frustratingly slow from the perspective of millions of unemployed and underemployed workers,” Bernanke said in his remarks to an international banking conference in Atlanta.

Bernanke said the central bank would not consider the recovery to be well established “until we see a sustained period of stronger job creation.”

He repeated a pledge that central bank officials have been making for more than two years: that they will keep interest rates at record lows “for an extended period.”

Bernanke said that consumer inflation has jumped 3.5 percent in the six months ending in April — well above the average of less than 1 percent over the preceding two years. But he noted that most of the increase has been caused by higher gas prices, which have been creeping down in recent weeks. Excluding food and energy, inflation has been tame, he noted.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.