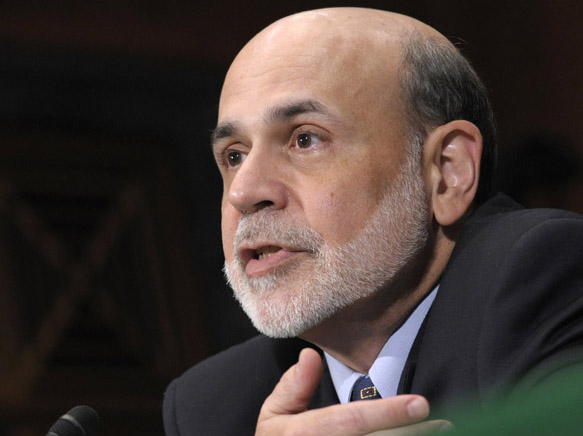

The economy is stalling. Republican presidential candidates are calling for his head. And as Federal Reserve Chairman Ben S. Bernanke took to a stage in Minneapolis on Thursday to give his latest thoughts on the nation’s economy, he knew that in just a few hours President Obama would be giving one of his most important speeches on the same topic.

If the heat is getting to the mild-mannered Fed chief, it didn’t show. Bernanke delivered a typically low-key speech and even sounded an upbeat note or two. But make no mistake: A ferocious amount of political pressure is building on Bernanke, who controls an agency designed to be independent of politics and is the one force in government that can act unilaterally to address some of the current economic woes.

He made no new promises Thursday, only emphasizing that the Fed still has tools left in its arsenal should the economy continue to suffer. The central bank’s policy committee is meeting Sept. 20-21, and, he said, is “prepared to employ these tools as appropriate to promote a stronger economic recovery.”

Those who know Bernanke well describe him as inclined to brush off the recent attacks and focus on making decisions based on economics. The former Princeton professor is no longer a novice Washington player, having weathered loud and constant criticism for the Fed’s role in a series of financial bailouts in 2008 and 2009.

“I don’t think anything is going to faze him after what he’s been through,” said Mark Gertler, an economist at New York University who has co-authored academic papers with Bernanke and has known him for decades. “I look at his demeanor, and more than anything, I see someone who is relaxed, not defensive and feels free to state the conclusion that his economic analysis leads him to.”

Indeed, Bernanke has now made a series of decisions knowing that they would draw political attacks, from the bailouts of Bear Stearns and AIG to last year’s decision to pump another $600 billion into the economy by buying bonds.

With the economy weakening and the administration and Congress locked in a stalemate about what to do, Bernanke is under deepening pressure to hold pat and not take any more extraordinary steps.

“I’d be looking for somebody new” in the Fed chairman’s job, former Massachusetts Gov. Mitt Romney said during Wednesday night’s debate among Republican presidential hopefuls, saying Bernanke has “over-inflated the amount of currency he’s created.”

Newt Gingrich went further, calling Bernanke “the most inflationary, dangerous and power-centered” Fed chairman in history. Gingrich also said he would fire Bernanke immediately. (In fact, the president can’t replace Bernanke until his term is up in January 2013.) Texas Gov. Rick Perry said last month that if Bernanke were to print more money before the election, it would be “treasonous.”

“Clearly the Republicans have politicized the Fed,” said Laurence Meyer, a former Fed governor and vice chairman of Macroeconomic Advisers. “And the Democrats don’t talk much about it, so they’re not a counterweight. They are not going to mix it up on this one and not going to give political support to Bernanke. It’s not what they want their political energies going to.”

Even as Bernanke faces criticism from Republicans for low interest-rate policies aimed at boosting the economy, he has become more vocal in making his views on other policy tools available to Congress and the Obama administration.

In Thursday’s speech, he again issued a warning that if the government withdraws stimulus too quickly, it could undermine the recovery. “There is ample room for debate about the appropriate size and role for the government in the longer term,” Bernanke said in an address at the Economic Club of Minnesota, but “a substantial fiscal consolidation in the shorter term could add to the headwinds facing economic growth and hiring.”

Similarly, in a closely watched speech in Jackson Hole, Wyo., two weeks ago, Bernanke chided Congress for engaging in dangerous brinksmanship over raising the federal debt limit, which the Fed chief said was likely a negative for the economy.

The Fed has always occupied a unique place in Washington: It is designed to be insulated from political pressure, yet it is ultimately a creation of the political system, and its decisions have great consequence. Congress may not be able to order the Fed to raise or lower interest rates, but it can pass laws to limit or change the Fed’s powers. A president can’t fire a Fed chief but can appoint members of the central bank’s board of governors with a different philosophy.

That said, being able to make sound economic decisions even while facing political pressure comes with the job of Fed chief.

“The chairman is a very balanced and deliberate person,” said Randall Kroszner, an economist at the University of Chicago Booth School of Business who was a Fed governor. “The Fed chairman is always under political pressure. It’s important that he or she focus on the economic issues and what he or she thinks is the most appropriate policy to pursue.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.