Agents for the investors who reaped $44.5 million in taxpayer dollars from the failed plan to save the Great Northern Paper mill in East Millinocket and other ventures aggressively lobbied state lawmakers in 2011 to approve the controversial tax credit program that set up the investors’ windfall.

And the moneymen rewarded the lawmakers who were key to ushering the tax credit program into law.

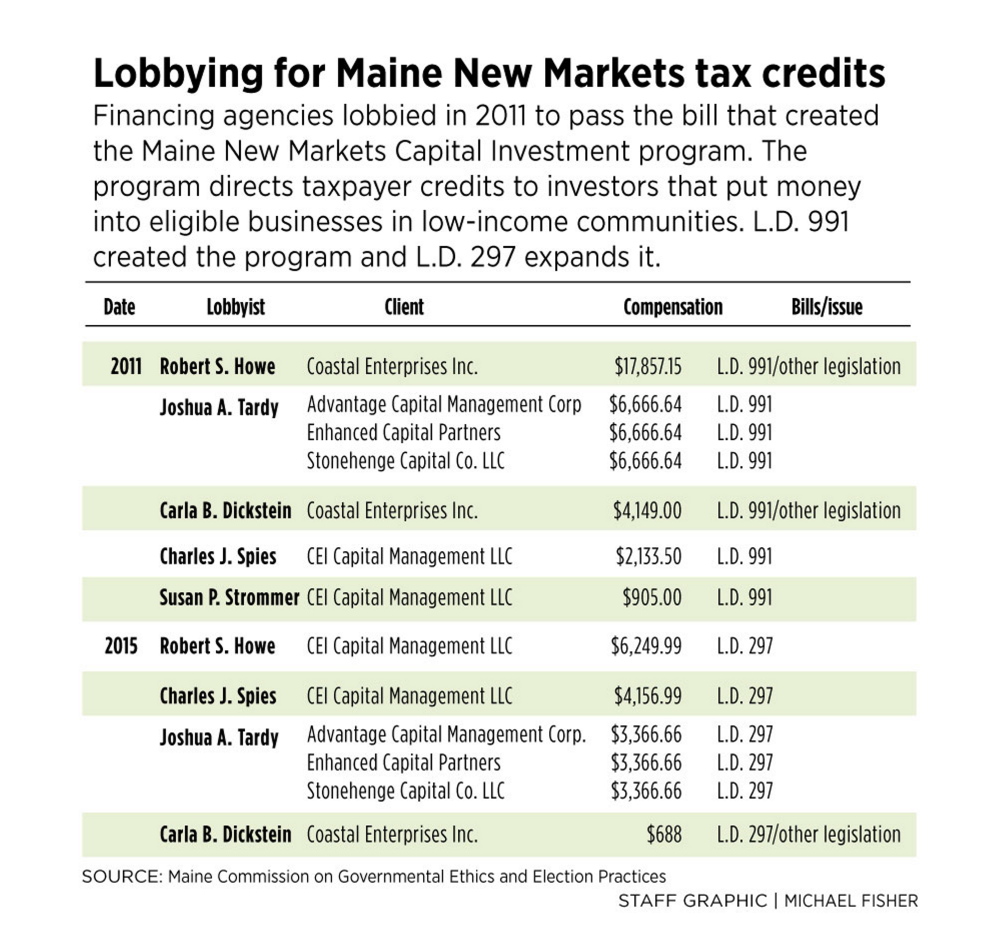

Advantage Capital Partners, Stonehenge Capital and Enhanced Capital, all based in Louisiana, spent a combined $20,000 lobbying lawmakers and Gov. Paul LePage to approve the Maine version of the federal tax credit program initiative in 2011, according to data from the Maine Commission on Governmental Ethics and Election Practices. That’s in addition to the more than $22,000 spent by Coastal Enterprises Inc., a Wiscasset-based nonprofit economic development agency, on the same initiative and other legislation.

In addition, Advantage, Stonehenge and Cate Street Capital, the New Hampshire private equity firm that owned the mill, have combined to make nearly $16,000 in campaign donations to the lawmakers who supported the tax credit law.

By Maine standards, those are relatively large lobbying and campaign contribution numbers.

The $20,000 spent on lobbying is similar to what the firms spent in other states during their attempts to persuade lawmakers to adopt their version of the tax credit program. However, the Maine spending is on the lower end of the spectrum for Advantage, Stonehenge and Enhanced.

IN MAINE, FEW DETAILS ABOUT LOBBYING

The lobbying spending in Maine also lacks detail.

For example, in Arkansas, Advantage Capital alone spent over $12,000 lobbying members of the Legislature between 2012 and 2014, including meals and events at Cajun’s Wharf Restaurant in Little Rock for members of the House and Senate Revenue and Taxation committees. The partners also paid for a $3,690 trip to California’s wine country for House Speaker Jeremy Gillam.

In Maine, however, the financiers’ methods of persuasion are a mystery, because the reports don’t include details on how the money was spent.

The financing firms’ advocacy originally focused on L.D. 991, the bill that created the Maine version of the federal tax credit program. The proposal received broad support during the 2011 public hearing, including a rare letter of endorsement from former Republican U.S. Sen. Olympia Snowe, the mentor of the bill’s lead sponsor, Senate President Kevin Raye.

Although that bill was never enacted, its language was eventually folded into the biennial budget. Such a move required approval from legislative leaders, who negotiate the final details of a budget with the executive branch. It was unanimously approved by the Legislature’s budget-writing committee, according to legislative records.

In 2011, Raye, former House Speaker Robert Nutting, a Republican from Oakland, and Rep. Emily Cain, the Democratic House leader from Orono, played key roles negotiating the budget. They were also sponsors of the original tax credit bill.

Each of them would benefit from making the program law, as they were among the elected officials in Maine who received some of the $16,000 the financiers or their beneficiaries doled out in campaign contributions.

Since 2011, Stonehenge and its principals have donated approximately $9,300 to Maine politicians, much of it to those involved in the passage of the program. Advantage Capital has donated approximately $3,500, which was similarly distributed.

The donations from both companies and their employees include roughly $6,000 to political action committees run either by the sponsors of the original bill or members of legislative leadership. PACs run by legislative leaders are typically used to support the candidacies of other lawmakers, a favor-swapping mechanism considered vital to a leader’s exercise of power and influence.

ACTIVITY AROUND NEW LEGISLATION

Most of the PAC donations to the bill’s co-sponsors were relatively small, $250 or less. The larger donations were saved for Raye and Nutting.

The firms have also supported the subsequent political ambitions of Cain and Raye, both of whom have run for Congress since departing the Legislature. Raye, who ran for the U.S. House of Representatives in 2012 and later lost in the Republican primary in 2014, has received $1,250 in direct donations from Stonehenge and Advantage or its principals. Cain, who lost her bid to replace U.S. Rep. Mike Michaud in the 2nd District last year, received over $2,500 – the most of any Maine candidate’s campaign – from Stonehenge’s Thomas Adamek and Ben Dupuy, both of whom testified in favor of the 2011 bill.

In August 2011, both Cain and Raye were recognized by the National Coalition for Capital, a group in which Stonehenge, Enhanced and Advantage are active members, for their advocacy to get the Maine New Markets tax credit program launched.

Stonehenge has also been active since 2011. Last year it donated $1,000 each to PACs for House and Senate Democrats, led by current House Speaker Mark Eves and Senate Minority Leader Justin Alfond, respectively.

Eves’ support, as well as that of the Democratic caucus, will likely be needed to ensure passage of L.D. 297, a bill that would double the cap on the New Markets program from $250 million to $500 million.

The bill has received the unanimous endorsement of the labor committee, with floor votes pending in the House and Senate. Advantage Capital Partners, Stonehenge Capital and Enhanced Capital have combined to spend more than $10,000 lobbying for the bill. In addition, CEI Capital Management, a Maine-based financing firm that deals in these tax credits, has spent approximately $10,000 lobbying, according to state data.

Stonehenge also donated $1,000 to Michaud, the Democrat who fell short in a bid to unseat LePage last year.

Independent gubernatorial candidate Eliot Cutler was arguably the first public figure to sound the alarm about the financing scheme that involved Cate Street Capital, the company at the center of the failed New Markets deal to save Great Northern Paper.

Last year Cutler called the deal “a massive scandal” and accused LePage of “willful ignorance” for personally supporting the tax credit agreement.

In 2011 LePage lauded Cate Street’s takeover of the two Millinocket-area mills as a “great day for Maine” and he and his administration have been advocates of the tax credit deal. When Cutler criticized him during the campaign for missing the red flags, LePage responded during a debate in October that he’d do it all over again.

In 2013, LePage personally testified before the Finance Authority of Maine in support of another Cate Street deal that pledged $25 million business expansion bond – including state and federal tax credits – for the construction of a torrefied wood pellet facility in Millinocket. The FAME staff was wary of the deal, citing “creditworthiness” and questioning Cate Street’s ability to repay the loan.

“According to the Governor, investment capital goes where it is welcomed and stays where it is appreciated,” said LePage in a September 2013 meeting. “There is no better way to show your appreciation than by becoming their partner.”

Cate Street donated $3,000 to the governor’s re-election committee between 2012 and 2013.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.