AUGUSTA — By three votes, the Maine House gave preliminary approval Thursday to a bill that would cut the state income tax in half over time.

Republicans said the bill would stimulate the job market and send tax money back to Mainers. Democrats said it would create a permanent fiscal crisis for the state.

The measure, L.D. 849, passed 74-71. It faces additional votes in the House and Senate, and will likely be referred to the Legislature’s Appropriations Committee for further consideration.

The bill, sponsored by Sen. Jonathan Courtney, R-Springvale, would lower Maine’s top income tax rate to 4 percent over time by using surplus state funds.

The rate – which is 8.5 percent now and will drop to 7.95 percent in January under legislation passed last year – would be lowered only if there was surplus money. Once the rate went down, it would not go back up.

The bill would add an income tax relief account to the state’s Rainy Day Fund. Twenty percent of any surplus money would be put into the account.

Over the last 30 years, the state has had surplus funds every year except two, Courtney said. While it may take several years to cut the income tax rate in half, he said, the proposal is a responsible way to pay for tax relief.

“It sends a message that the Maine Legislature is committed to reducing the income tax to 4 percent,” he said.

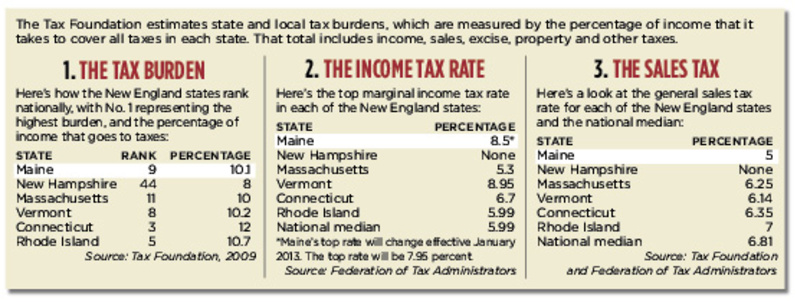

Maine’s top income tax rate is the second-highest in New England, behind only Vermont’s 8.95 percent, according to the Federation of Tax Administrators. Neighboring New Hampshire has no income or sales taxes.

Nationally, the median income tax is 5.99 percent.

Within the last decade, Maine was first in the nation in tax burden – a calculation of the percentage of income it takes to pay all taxes. The most recent ranking, for 2009, dropped Maine to ninth, according to the nonpartisan Tax Foundation in Washington, D.C.

For years, Maine lawmakers have struggled with various proposals for tax relief, sometimes focusing on property taxes or combinations that would reconfigure the sales and income taxes.

In 2009, the Legislature, with a Democratic majority, passed a tax reform package that would have lowered the top income tax rate from 8.5 percent to 6.5 percent for Mainers who earn less than $250,000 and 6.85 percent for those who earn more than $250,000; extended the 5 percent sales tax to more than 100 new services; increased the meals-and-lodging tax from 7 to 8.5 percent; and increased the tax on rental cars from 10 to 12.5 percent.

Republicans gathered enough signatures force a repeal referendum, and the bill was repealed by voters in June 2010.

Courtney’s bill has initial approval from the House and Senate. Even with further votes of approval, it would have to be reviewed by the Appropriations Committee because it would cost the state money. The Legislature’s nonpartisan budget office says there could be “significantly reduced revenues” in future years if the tax rate is lowered.

That cost has concerned Gov. Paul LePage, who has said he supports lowering the income tax to 4 percent or even eliminating it. He said earlier this year that he doesn’t think the state can afford to go to a 4 percent rate immediately, although Courtney said he believes the governor is supportive of his bill.

LePage’s spokeswoman, Adrienne Bennett, did not return a call late Thursday seeking comment from the governor on the bill.

Rep. Gary Knight, R-Livermore Falls, House chairman of the Taxation Committee, said a lower income tax would help attract new business to Maine and encourage retirees to stay in the state.

“When we have a tax rate bordering 8 percent, it’s too high,” he said.

Rep. Wayne Parry, R-Arundel, said the taxpayers deserve to get some of their money back when the state has a surplus.

“We’re taking 20 percent of extra money,” Parry said. “One side of the aisle wants to give a little bit back, while the other side of the aisle wants to spend every penny.”

Parry said the top tax rate applies to annual income of less than $20,000, so not only the rich would benefit from a reduced top rate.

“I think the people of Maine may be a little bit upset we’re only giving them 20 percent of their money,” he said.

Democrats fought hard against the bill, saying that while it would lower taxes when there’s extra money, the lower rate would stay even when there are no funds to pay for it.

“The whole point of this bill is to trigger future budget crises,” said Rep. Bob Duchesne, D-Hudson.

Rep. Seth Berry, D-Bowdoinham, compared the plan to buying a car with enough money for the first payment but no income to afford future payments.

“The payment made toward reduction in income taxes is only in the first year,” he said. “All future years are left unfunded.”

Duchesne said a change made in the Senate in recent days, to lower from 40 percent to 20 percent the amount of surplus money that would go into the income tax relief account, doesn’t make enough difference to win his support.

“Now we’re just haggling,” he said. “I say we hold out until they throw in a toaster oven.”

State House Writer Susan Cover can be contacted at 620-7015 or at:

scover@mainetoday.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.