WASHINGTON – Top House Republicans rebelled Sunday against a bipartisan, Senate-approved bill extending payroll tax cuts and jobless benefits for two months, reigniting a politically fueled holiday-season clash that had seemed all but doused.

The House GOP defiance cast uncertainty over how quickly Congress would forestall a tax increase otherwise heading straight at 160 million workers beginning New Year’s Day.

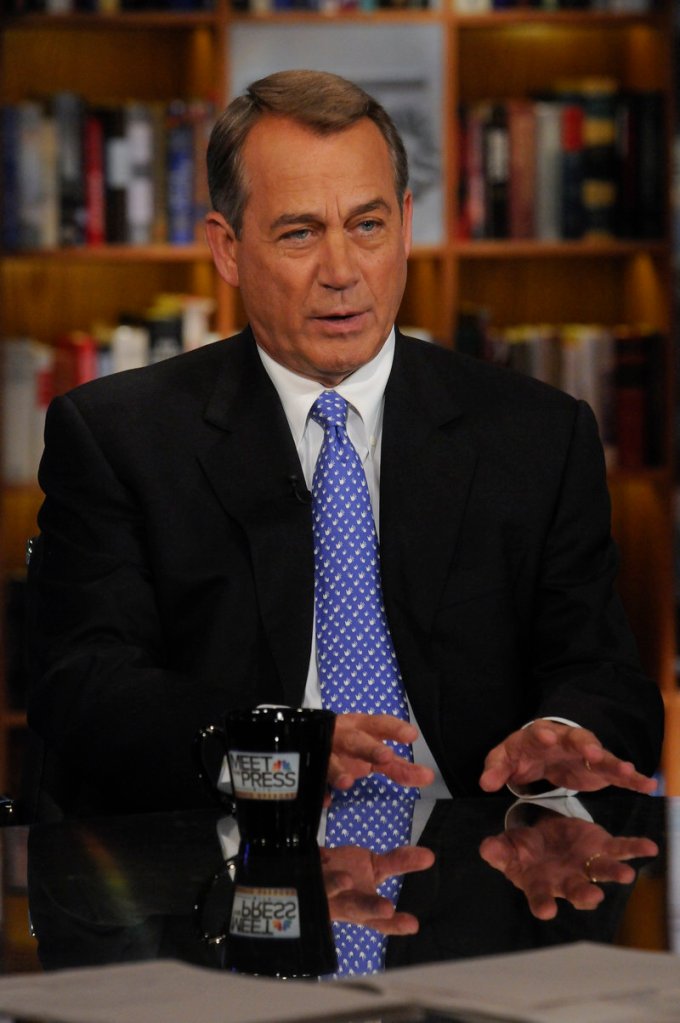

House Speaker John Boehner, R-Ohio, said it could be finished within two weeks, which suggested that lawmakers might have to spend much of their usual holiday break battling each other in the Capitol.

A day after rank-and-file House GOP lawmakers used a conference call to spew venom against the Senate-passed bill, Boehner said he opposed the legislation and wanted congressional bargainers to craft a new, yearlong version.

“The president said we shouldn’t be going anywhere without getting our work done,” Boehner said on NBC’s “Meet the Press,” referring to President Obama’s promise to postpone his Christmastime trip to Hawaii if the legislation was not finished. “Let’s get our work done, let’s do this for a year.”

A spokeswoman for House Majority Leader Eric Cantor, R-Va., said the House would vote today to either request formal bargaining with the Senate or to make the legislation “responsible and in line with the needs of hard-working taxpayers and middle-class families.”

Cantor spokeswoman Laena Fallon did not specify what those changes might be, beyond a longer-lasting bill. Boehner, though, expressed support for “reasonable reductions in spending” in a House-approved payroll tax bill and for provisions that blocked some Obama administration anti-pollution rules.

Democrats leaped at what they saw as a chance to champion lower- and middle-income Americans by accusing Republicans of threatening a wide tax increase unless their demands are met.

If Congress doesn’t act, workers would see their take-home pay cut by 2 percentage points beginning Jan. 1, when this year’s 4.2 percent payroll tax reverts to its normal 6.2 percent.

“They should pass the two-month extension now to avoid a devastating tax hike from hitting the middle class in just 13 days,” said Dan Pfeiffer, the White House communications director. “It’s time House Republicans stop playing politics and get the job done for the American people.

Adam Jentleson, spokesman for Senate Majority Leader Harry Reid, said the Nevada Democrat would be “happy to continue negotiating a yearlong extension as soon as the House passes the Senate’s short-term, bipartisan compromise to make sure middle-class families will not be hit by a thousand-dollar tax hike on Jan. 1.”

Keeping this year’s 2 percentage point payroll tax cut in effect through 2012 would produce $1,000 in savings for a family earning $50,000 a year. The two-month version would be worth about $170 for the same household.

On Saturday, the Senate voted 89-10 for its legislation, which was negotiated by Senate GOP and Democratic leaders and backed by solid majorities of senators from both parties.

It would provide a two-month extension of the payroll tax cuts and jobless benefits, and would prevent 27 percent cuts to doctors’ Medicare reimbursements during that period, reductions that could convince physicians to stop treating elderly patients covered by the program.

That measure was praised by Obama, and even Senate Minority Leader Mitch McConnell, R-Ky., expressed optimism that the measure would become law. Initial bills produced by both sides lasted for a year, but negotiators working on the final product could not agree to savings to finance such a measure, likely to cost roughly $200 billion.

The Senate bill included language cherished by Republicans giving Obama 60 days to approve an oil pipeline stretching from western Canada’s tar sands to Texas refineries, unless he declared the project hurt the national interest.

Though GOP leaders support extending the payroll tax and jobless benefits, some House Republicans question doing that, arguing it won’t produce jobs and could weaken Social Security. The payroll tax, subtracted from paychecks, is used to finance Social Security.

The Senate adjourned Saturday and is not scheduled to conduct legislative work until late January.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.