While supporters and opponents of the Keystone XL pipeline have been busy debating the controversial proposal, the oil that it’s intended to move has found another carrier – one that didn’t require the president’s stamp of approval or several years and billions of dollars to construct.

Keystone’s friends and foes alike may have underestimated the North American rail system’s ability to handle the thick, gritty oil from western Canada known as tar sands. And while rail was originally a stopgap solution to the lack of a pipeline, oil producers have discovered its advantages.

Now, transportation and energy experts on both sides of the border believe that Canadian crude shipments by rail will continue to increase, whether the pipeline is ultimately approved and built or not.

Concerns about the safety of rail shipments after a series of recent derailments won’t slow the growth, they say.

Nor will the recent State Department report that concluded construction of the $5.4 billion pipeline would not have a major impact on climate change.

The chief objection to tar sands crude is its environmental impact. Extraction of tar sands emits three times more planet-warming carbon dioxide than conventional crude oil, environmentalists say, and destroys forests and pollutes waterways.

Keystone XL would move mostly tar sands oil, and opponents and their allies in Congress have mobilized against it.

‘NIMBLE’ RAILROADS

But the State Department said that whether or not Keystone XL is built, the development of oil resources in western Canada would continue and the product would find ways to get to market, including by rail.

Even the pipeline companies are investing in new rail facilities, in the tar sands region of Alberta and Saskatchewan, as well as the Bakken shale region in North Dakota and Montana.

Julie Carey, a Washington-based energy economist with Navigant Economics, a consulting firm, said railroads have become “tremendously nimble competitors.”

“They changed the competitive landscape forever,” she said.

Rail was long thought to be a more expensive way to ship crude oil than by pipeline, anywhere from $2 to $20 more per barrel.

But Carey and others say such estimates fail to account for rail’s advantages, and when those are factored in, the price difference becomes negligible.

Rail allows for faster delivery and reaches more destinations.

Moving the thicker tar sands oil in a pipeline requires it to be diluted – taking away nearly a third of the pipeline’s capacity.

Shipping the crude in a rail car also requires less diluent to thin out the viscous substance, or none, if the car has heated coils.

Plus, pipelines can only move a product one way, but trains go in both directions; they can back-haul the diluent, which has to be extracted once the oil reaches its destination.

“People have always said railways are more expensive,” said Malcolm Cairns, a transportation consultant in Brighton, Ontario, and a former director of business research at Canadian Pacific Railway. “The gap is not that big.”

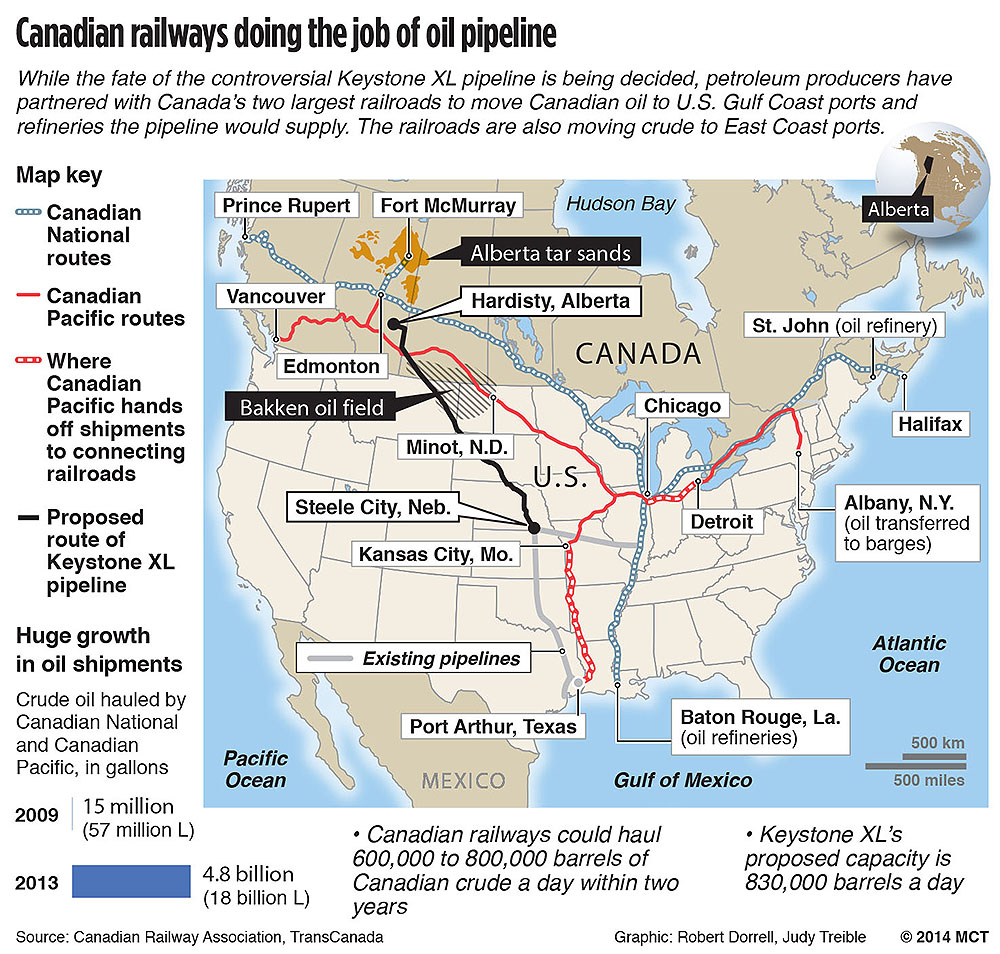

In a research paper last year, Cairns said that Canada’s two largest railroads, Canadian Pacific and Canadian National Railway, could move a combined 600,000 to 800,000 barrels of Canadian crude a day within two years.

That approaches Keystone XL’s proposed capacity of 830,000 barrels a day.

Both railroads reach the Gulf Coast, where 45 percent of U.S. refinery capacity is located, either directly or via connecting rail lines.

They also can haul the oil to East Coast refineries and barge terminals, and they are doing that now.

Keystone XL couldn’t serve those markets, Carey points out.

“Rail has tremendous advantages that pipelines don’t have,” she said. “I think this has caught the pipelines off guard.”

PIPELINE CONSIDERED SAFER

However, the growth of western Canadian oil production is projected to outstrip rail capacity by a long shot, according to Cairns.

The tar sands region in Alberta and Saskatchewan could produce an additional 3 million barrels a day by 2035.

Cairns predicts that rail will provide a “niche service” once more pipelines are built.

And if the U.S. doesn’t build them, Canada will.

“Rail’s just nicely stepped into the breach,” he said.

Shawn Howard, a spokesman for TransCanada, which would build Keystone XL if President Obama approves it, said that the company sees a place for rail but that refiners and customers have indicated the pipeline is their preferred option.

“There are many rail projects that have been announced as pipeline infrastructure has been delayed,” he said. “But none of that changes the fact that it is safer to move products like oil by pipeline.”

Several fiery derailments since last summer revealed that state and local officials and Washington regulators may not have prepared for massive amounts of crude oil moving in trains.

U.S. railroads moved 400,000 rail carloads of oil last year, according to industry estimates, up from fewer than 10,000 five years earlier.

The bulk of those shipments involved Bakken crude oil, which regulators have concluded is more flammable than conventional kinds.

The thicker tar sands crude, in contrast, is difficult to ignite.

NEW TERMINALS CONSTRUCTED

Meanwhile, pipeline companies are ramping up their investment in rail loading facilities on both sides of the border. They’re also involved in constructing new unloading terminals on the East and West coasts to serve refineries in those regions.

Rail companies are aggressively marketing their ability to transport crude oil, even as uncertainty lingers over new safety requirements.

Federal regulators have announced several initial steps to improve the safety of crude oil transportation and are writing new standards for tank car construction.

Carey said that railroads have defied skeptics and are in it for the long haul.

“I believe they will continue to be the solution even if the pipeline catches up,” she said.

Send questions/comments to the editors.

Comments are no longer available on this story