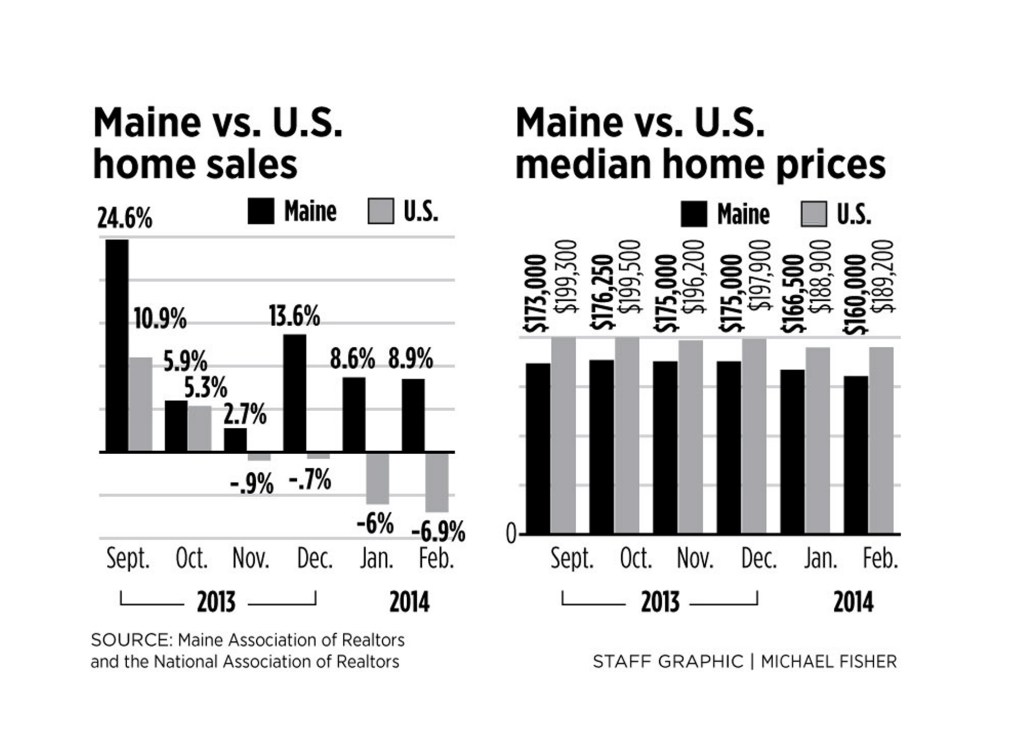

Maine home buyers were undaunted by the snowy conditions in February and pushed home sales up 8.9 percent over the same period last year, bucking a drop in sales nationally.

In Maine, 646 single-family homes changed hands in February, compared with 593 homes in February 2013, according to a report issued Thursday by Maine Listings, a subsidiary of the Maine Association of Realtors.

The statewide median sale price rose to $160,000, an increase of 5.61 percent over February 2013. The median sale price indicates that half of the homes were sold for a higher price and half sold for less.

“The trend reports show that buyers and sellers did not shy away from the snow last month,” said Angelia Levesque, president of the Maine Association of Realtors and a Realtor with Better Homes and Gardens Real Estate/The Masiello Group in Bangor.

Michael Sosnowksi, owner of Maine Home Connection in Portland, said February’s numbers demonstrate an improvement in buyer confidence.

“There’s still a belief that interest rates are good,” Sosnowski said. “There’s still a belief that the economy, while it may not be great, will not crater.”

While the state’s housing market overall has seen an increase in activity, southern Maine has been the primary driver of increased sales, he said.

During the three-month period that ended Feb. 28, sales in Cumberland County rose almost 24 percent, while York County sales increased 8 percent from the same period a year earlier. Sales declined in Franklin, Knox, Penobscot and Waldo counties for the period, according to Maine Listings.

“Buyers understand that the economy is strengthening, and interest rates, which have dipped recently, will start to climb again. That motivates activity,” said Bart Stevens of Century 21 Nason Realty in Winslow. “There are aggressive buyers in winter months who think they can get a good deal, and there’s a lot of sellers who have pent-up desire to move. It’s neither a buyer’s market or a seller’s market – it’s a very balanced market at the moment.”

He cautioned that the strong year-over-year sales growth in February was partly because of a 5 percent sales decline in February 2013.

“The bar was set a little bit low to begin with,” Stevens said. He expects the market to pick up further in April, May and June – traditionally Maine’s strongest months for real estate transactions.

First-time home buyers continue to drive the market in Maine, Stevens said.

February marked the fourth straight month in which Maine showed gains in sales volume, compared with a decline nationally. Maine has been performing better than the nation because of its less volatile conditions during the housing boom-and-bust, as well as the subsequent market recovery, real estate experts said.

“Maine rode the housing wave but didn’t ride it as high, and as a result, the fall wasn’t quite as big for us,” Stevens said. “Our recovery has had less ground to reclaim.”

Nationally, single-family home sales dipped 6.9 percent compared with February 2013. The National Association of Realtors reported a 9 percent increase in the national median sales price of $189,200. Regional sales in the Northeast declined 12.7 percent, though sale prices rose 1.5 percent to a regional median price of $237,800.

“We had ongoing unusual weather disruptions across much of the country last month, with the continuing frictions of constrained inventory, restrictive mortgage lending standards and housing affordability less favorable than a year ago,” said Lawrence Yun, chief economist with the National Association of Realtors. “Some transactions are simply being delayed, so there should be some improvement in the months ahead. With an expected pickup in job creation, home sales should trend up modestly over the course of the year.”

According to mortgage loan-guarantee corporation Freddie Mac, the national average rate for a 30-year, fixed-rate mortgage declined to 4.3 percent in February from 4.43 percent in January. Still, the rate remained well above the 3.5 percent rate in February 2013.

Interest rates began to rise in late May on speculation that the Federal Reserve would slow its bond purchase program. The Fed said Wednesday that it would cut its monthly purchases of U.S. Treasuries and mortgage-backed securities to $55 billion, from $65 billion. Federal Reserve Chair Janet Yellen also raised the possibility of an earlier-than-expected increase in interest rates.

Jessica Hall may be contacted at 791-6316 or at:

jhall@pressherald.com

Twitter: @JessicaHallPPH

Send questions/comments to the editors.

Comments are no longer available on this story