The recent openings of three hotels in downtown Portland is expected to trigger intense competition as rival properties try to keep rooms occupied in what is already a volatile market.

Since December, 550 hotel rooms have been added to the Portland market. Another 110 rooms are expected to become available in early 2015, when the renovation of the former Portland Press Herald building into a boutique hotel is completed.

Competition for guests to fill those rooms could lead to price slashing and other promotions, say industry observers.

The additional rooms reflect the hotel boom that’s occurring in comparable New England cities – especially Burlington, Vermont, and Portsmouth, New Hampshire – buoyed by rising revenues in the lodging industry.

“A lot of this (building) has to do with the performance of the market,” said Matthew Arrants, the Falmouth-based executive vice president of the Pinnacle Advisory Group, a hospitality consulting firm. “The market is performing very well. There was no trouble absorbing the supply of new rooms offered by the Hampton Inn and the Residence Inn on the (Portland) peninsula,” which opened within the past two years.

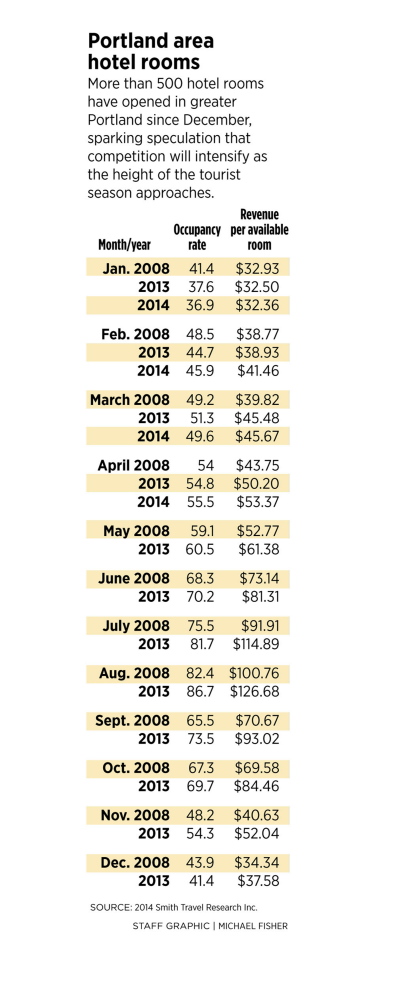

Five years ago, total revenue for hotels in the Greater Portland market was $153.8 million. At the end of 2013, total revenue stood at $190 million. They’re on a pace to exceed $200 million in 2014, according to data compiled by Smith Travel Research Inc.

But competition for bookings is expected to intensify as the tourist season builds through this summer and business travelers become aware of the additional offerings.

The newcomers are the Westin Portland Harborview (289 rooms), the Courtyard Portland Downtown/Waterfront (131 rooms) and Hyatt Place Portland-Old Port (130 rooms). Westin completed its renovation of the former Eastland Park Hotel and reopened it in December. The other two properties opened in late May.

“I’m sure the existing hotels are watching the openings very closely,” said Arrants, who gave a forecast on the state of the hospitality industry at the annual Maine Real Estate and Development Association meeting in January. “They’re going to wait to see how it looks once all the competitors open. If it looks like a train wreck, they’ll take action.

“I’m sure they’re closely watching their advance bookings this year versus last year and waiting to see if any price adjustments are necessary,” Arrants said.

DEMAND VS. SUPPLY VS. PRICE

The Greater Portland market had nearly 7,600 hotel rooms as of April, compared with 6,885 rooms in April 2008, according to Smith Travel Research.

The new rooms could help meet demand for accommodations in August, the height of Portland’s tourism season, when occupancy rates exceed 85 percent, according to Smith Travel Research. But many of those rooms could be empty in January, when occupancy rates hover around 38 percent.

Room rates in Portland have been creeping higher since 2008, when the average daily rate was $99.42. Last year, the average daily rate was $114.13, according to Smith Travel Research.

“The pricing now is not yet related to increasing supply,” said Arrants. “You’ll see that happen later, when more properties come on line.”

“Nobody has taken that tack yet for big promotional pricing,” said Greg Dugal, executive director of the Maine Innkeepers Association. “It may be too early to see how supply-and-demand balances out.”

Jim Brady, the developer of the Press Hotel, in the former Press Herald building on Congress Street, is investing $10 million in his belief that there’s an unmet demand for hotel rooms downtown.

“Rates have been particularly strong in Portland,” he said. “There’s pent-up demand for new rooms. The new supply will help ease some of that pent-up demand.”

BOOST FOR CITY AS DESTINATION

Hoteliers have responded to increasing demand for rooms elsewhere in New England, Arrants said.

In Burlington, a historic armory is being transformed into a Hilton Garden Inn in a $20 million project. In Portsmouth, a new Hampton Inn & Suites is in the pipeline, a waterfront Residence Inn opened last year and a new boutique hotel, the Hotel Portsmouth, opened recently.

Some hotel operators said they think the new properties in Portland, and recent renovations of properties such as the Hilton Garden Inn-Downtown Waterfront, will make Portland more of a tourist destination with broader options for service and price.

Sean Riley, president and CEO of Maine Course Hospitality, which is managing the new Portland Courtyard Downtown/Waterfront hotel, said, “We want people to come to Portland. If they stay with us – great. But we want Portland to succeed and we all will do better. Portland will be a more vibrant and much bigger destination.

“There was a great amount of demand for Portland and supply was tight,” Riley said. “We’re probably peaking out a bit, but the supply that’s there now will be filled.”

Competition will prompt rivals to maintain their properties more carefully and improve service, hotel operators said.

“New competition comes in and everyone steps up their game,” Riley said. “A clean room and a smile doesn’t do it anymore. Service will separate us and differentiate the properties.”

In his address to Maine real estate and development professionals in January, Arrants said that hotels will likely start to drop rates for corporate and group travelers in the fall, after the peak of the tourist season, to capture more market share.

Hotels without ideal locations and strong brand identity are likely to lose occupancy, even if their rates are lower, because of the appeal of newer facilities.

MUCH IMPACT IN SOUTH PORTLAND?

Hospitality investors and analysts have mixed opinions on whether the hotel development in downtown Portland will drain demand from the South Portland market, where rates are generally $50 less per room.

Brady, the developer of the Press Hotel, said he believes the demand will be met by the extra rooms downtown, and hotels farther away will suffer. Others think travelers will migrate back into the city from the suburbs.

“There were people who were priced out of the peninsula who went to the mall area. There could be efforts made to lure those travelers back now with more supply and better pricing,” Arrants said.

Others see the South Portland market as unaffected by the downtown development because the city and the suburbs cater to different travelers.

“South Portland is a distinct market,” said Riley. “The business market likes the (Maine Mall) area, to be near companies like WEX, Unum and Anthem. The downtown market tends to be a younger crowd interested in the culture of being near restaurants and shops and galleries.”

The real test for the Portland area will be filling rooms in the off-season. But even cheaper rates in the winter can’t create demand that’s not there.

“The supply isn’t going to create any new demand,” Arrants said.

Jessica Hall can be contacted at 791-6316 or at:

jhall@pressherald.com

@JessicaHallPPH

Send questions/comments to the editors.

Comments are no longer available on this story