AUGUSTA – Maine lawmakers approved a new two-year, $6.7 billion budget early Wednesday that would provide $135.4 million in tax cuts by 2017 as part of a compromise hatched in secret by top legislative leaders and kept under tight wraps until just before the voting began.

The Democrat-controlled House voted 105-42 to approve the deal endorsed by the Legislature’s budget committee June 6, as well as a separate amendment that incorporated the agreement drafted by leaders after weeks of closed-door negotiations.

The Republican-controlled Senate voted 31-4 to ratify the deal, but stripped out a provision that would determine whether some asylum seekers can receive General Assistance aid. The decision prompted many members of the Portland delegation to vote against the budget.

The budget now goes to Gov. Paul LePage, who indicated again Tuesday that he will veto it. His threatened veto – and his hints that he will take the full 10 days allowed to issue it – puts additional pressure on legislative leaders to retain Wednesday’s two-thirds majorities in both chambers, which would override the veto and avoid a government shutdown July 1.

“There was a lot of give, there was a lot of take. There are benefits to both sides in this,” said Rep. Jeff McCabe, D-Skowhegan, the House majority leader. “A true compromise is an example that divided government can work.”

Sen. Roger Katz, an Augusta Republican who serves on the budget-writing committee, said that “trying to find the right balance has been elusive,” and that some political setbacks along the way we’re “completely unnecessary.”

“Although the soup took way too long to cook, we are getting it right,” Katz said before the Senate voted to send its version of the budget bill back to the House. The sole dissenting vote came from Sen. Anne Haskell, a Portland Democrat who objected to Senate decisions that will likely lead to a loss of welfare benefits for asylum-seeking immigrants.

Sen. James Hamper, R-Oxford, co-chairman of the budget committee, said, “We put together the best budget we possibly could.”

The budget includes an array of changes to taxes, welfare and nursing home funding that would affect all Mainers. Leaders delivered details of the plan to rank-and-file lawmakers during closed-door caucus meetings Monday night and Tuesday morning. They had announced the framework of a deal late Monday evening, but refused to disclose any specifics until votes were scheduled in the House of Representatives.

Some of the details were contained in a budget deal ratified June 6 by a majority of the Legislature’s Appropriation and Financial Affairs Committee. But the most contentious items have been negotiated since then by leadership.

The budget plan includes an income tax cut paid for with changes to the sales tax and meals and lodging taxes. The current sales tax is 5.5 percent but is set to decrease to 5 percent by July 1. The budget deal retains the current rate to help fund the income tax cut, which would be phased in over the next two fiscal years.

Meals and lodging taxes also would increase. The current meals tax is 8 percent and is scheduled to fall to 7 percent on July 1. The budget deal would maintain the current rate of 8 percent for both meals and lodging taxes until Dec. 31, then increase the lodging tax to 9 percent on Jan. 1, in an attempt to capture more revenues from tourists.

The deal does not include a major broadening of the sales tax to now-exempt goods and services, as originally proposed by LePage. However, it does eliminate an exemption from the service provider tax for cable and satellite television and radio services. The service provider tax also would increase from 5 percent to 6 percent beginning Jan. 1.

The agreement also expands the definition of “prepared foods” in order to capture more groceries currently exempt from the sales tax. For instance, peanut butter would be taxed under the new definition while bread and jelly would remain tax-exempt “grocery staples.”

INCOME TAX CHANGES

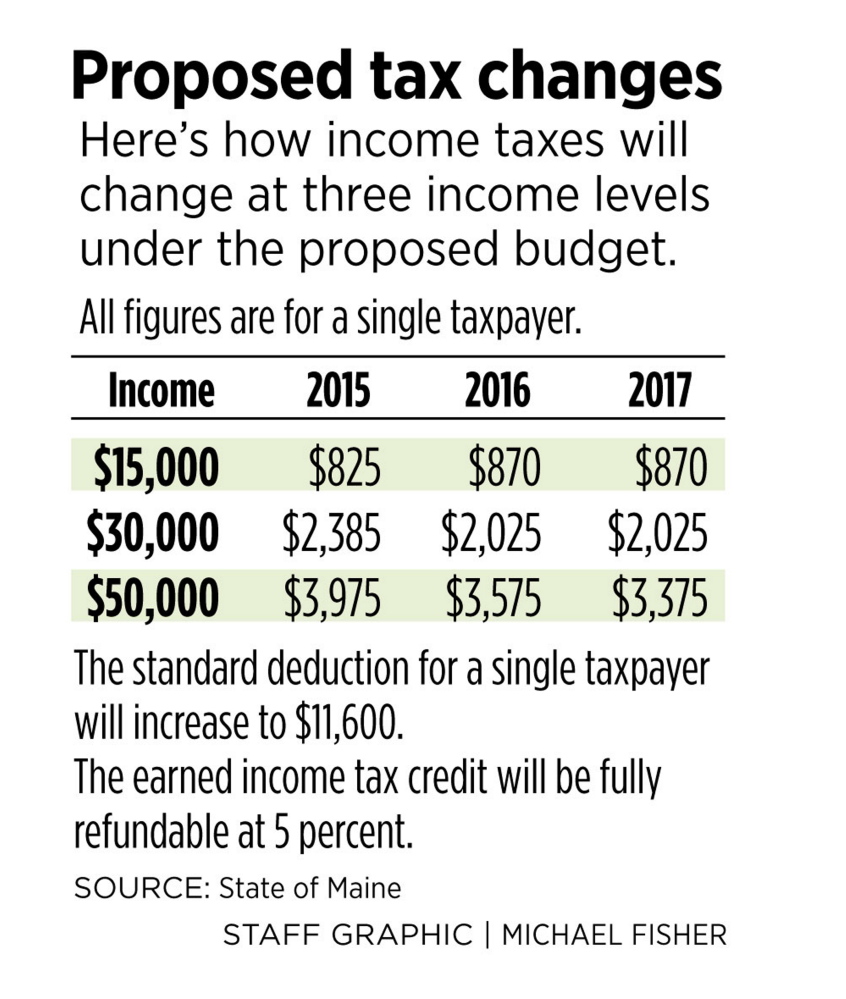

Maine income tax brackets would also change under the compromise.

Under current law, the top marginal rate is 7.95 percent for people earning $20,900 or more per year, 6.5 percent for people earning from $5,200 to $20,899 and 0 percent for people earning up to $5,199.

The budget agreement would lower the top rate to 7.15 percent for a single filer in 2016 and raise the income threshold where that rate kicks in to $37,501 and higher. Those earning from $21,051 to $37,500 would pay 6.75 percent and those earning $0 to $21,050 would pay 5.8 percent.

Democrats said that under the revised tax structure, many Mainers earning up to $5,200 would have to start filing income tax forms in order to receive the full tax cuts. That is because the standard deduction is increasing to $11,600, and low-income Mainers will qualify for a fully refundable Earned Income Tax Credit.

The tax brackets would change in 2017, but the rates would remain the same. The top rate would kick in for those earning $50,001 or more, while the middle rate would cover those earning from $21,400 to $50,000. The income threshold for the bottom rate would remain the same.

The budget plan also would eliminate the income tax on military pensions, and it would increase the current homestead property tax exemption from $10,000 to $15,000 in 2016.

The secrecy of the agreement underscores its fragility. The budget has come under intense media and interest group scrutiny both because of the deal’s impacts and because failure to reach an agreement by July 1 would result in the shutdown of state government. Many of the changes released Tuesday had been rumored at the State House for weeks, drawing opposition from organized groups who have pressured lawmakers to reject them.

The tenuousness of the agreement was illustrated when the Senate altered the deal to change a provision that affects emergency benefits for legal non-citizens. The original deal installed a 240-day cap on certain benefits, a compromise designed to curtail LePage’s plan to eliminate them altogether. But the change was met with suspicion by the House Democratic caucus prior to the enactment vote, prompting leadership to determine whether it still had the two-thirds support it would eventually need enact the budget as an emergency measure.

Overall, 579,567 families would see a tax cut under the plan, while over 117,509 would see an increase, according to an analysis released with the budget agreement. Those figures take into account a number of tax changes, including the income tax, sales tax, property tax and earned income tax credit.

WELFARE, GENERAL ASSISTANCE CHANGES

The proposal also includes a provision to address the so-called welfare cliff for Temporary Assistance For Needy Families. Details of that change were not immediately available Tuesday, but the initiative is designed to eliminate policies that discourage people from taking a job, or a higher-paying job, because they’d earn too much money to continue getting benefits.

The agreement also sets the state General Assistance reimbursement rate for all cities and towns at 70 percent. Most communities are now reimbursed for up to 50 percent of General Assistance payouts. But several larger cities – most notably Portland, Bangor and Lewiston – receive a 90 percent reimbursement rate because they act as service centers for more low-income households.

LePage’s proposed budget would have flipped the reimbursement formula, paying 90 percent of communities’ costs initially but then dropping to a 10 percent reimbursement rate after communities hit a new threshold.

The bipartisan compromise is effectively silent on one of the most partisan issues in the budget negotiations: whether asylum-seeking immigrants should qualify for General Assistance.

The budget preserves food stamps, Temporary Assistance for Needy Families and Supplemental Security Income benefits for legal non-citizens who are waiting for work authorization from the federal government or who are elderly, disabled or victims of domestic violence. But there is no language on General Assistance for asylum seekers.

The budget agreement also sets state revenue sharing with municipalities at a rate of 2 percent, which translates into $62 million for each year of the two-year budget. That’s roughly equal to what cities and towns are getting now.

The two-year budget has become the singular focus of a legislative session in which neither the Republican-controlled Senate nor the Democrat-controlled House has been able to claim many policy victories. The same is true of LePage, who won re-election in November but has seen the majority of his conservative policy initiatives fall into the chasm of divided government.

The budget stands as the one piece of legislation in which all sides have the chance to claim something of a victory from a legislative session marked by partisan votes, gubernatorial vetoes and abandoned efforts to reach a compromise.

Compromise on the budget, however, wasn’t an option. It’s necessary to keep the state running. The Maine Constitution requires the state to have a balanced budget.

This story was corrected at 4:32 p.m. on Thursday, June 18 to correct the results of the Senate’s roll call vote.

Send questions/comments to the editors.

Comments are no longer available on this story