One simple sentence in Maine’s minimum wage statute has inspired three different legal interpretations about Portland’s minimum wage ordinance and how city councilors can amend the ordinance to comply with state law.

“An employer may consider tips as part of the wages of a service employee, but such a tip credit may not exceed 50 percent of the minimum hourly wage established in this section,” the sentence in the statute says.

Depending upon whom you ask, that means the minimum hourly base wage that tipped workers in Portland should receive under the new ordinance is $6.35, $5.05 or $3.75. The lack of consensus increases the likelihood that the city could be vulnerable to lawsuits filed by workers, employers or both after the ordinance takes effect Jan. 1.

The Portland City Council voted 6-3 Monday night to raise the minimum wage in Portland to $10.10 an hour on Jan. 1, increase it to $10.68 a year later, and tie future minimum wages to inflation. The ordinance also says that workers who receive tips are subject to state and federal labor laws, the more stringent of which is a Maine law allowing employers to pay tipped workers up to 50 percent less than the state’s $7.50 minimum wage through what is known as the tip credit. Employers are only required to pay tipped workers $7.50 minus the $3.75 tip credit, which equals $3.75.

The idea is that since the employee is earning tips, the employer shouldn’t have to pay the full minimum wage. If an employee does not earn enough in tips during a work week to meet or exceed the minimum wage, the employer must make up the difference.

Portland elected officials said this week that they believed the ordinance approved Monday would not change the amount that tipped workers receive from their employers. However, several municipal and business officials have clarified this week that the ordinance leaves the tip credit at $3.75, and thus will require businesses with tipped workers to start paying them $6.35 an hour as of Jan. 1. (The city’s new minimum wage of $10.10 minus the $3.75 tip credit.)

As a result of the misunderstanding, Portland officials plan to reconsider the ordinance at their next meeting July 20.

State officials have said in legislative hearings that deviating from the Maine statute regarding tipped workers would violate the law.

So what does the law actually require? No one seems to agree.

THE $3.75 QUESTION

Officials with the state Department of Labor have argued before the Legislature that any local change to the minimum wage cannot establish a tip credit larger than $3.75.

Their reasoning has been that “50 percent of the minimum hourly wage established in this section,” as stated in the statute, equals $3.75, because the state’s minimum wage is $7.50. The words “in this section” refer to the state statute and not any actual or anticipated municipal ordinance, they have said.

If the Labor Department’s interpretation held up in court, Portland would have no choice but to force businesses to pay their tipped workers at least the city’s minimum wage minus $3.75. When the minimum wage becomes $10.10 an hour on Jan. 1, that would make the base pay for tipped employees $6.35.

Under the state’s argument, if the city failed to impose a $6.35 base wage, it could be successfully sued by workers.

Chris O’Neil, a lobbyist for the Portland Regional Chamber of Commerce, said he recalls the Labor Department making that argument.

“The statute says that the tip credit applies to the minimum wage defined in this section,” O’Neil, who owns O’Neil Policy Consulting Inc. in Portland, said in an email. “Those two words ‘this section’ apply. Not ‘in some city ordinance.’ ”

Labor Department spokeswoman Julie Rabinowitz agreed that the department has used that argument in the past, but said it is now taking a wait-and-see approach.

“The … official position is that we are going to refrain from interpreting speculative proposals on how the city could change the ordinance,” Rabinowitz said Wednesday via email. “We are going to continue to research this issue.”

THE GOLDEN RATIO

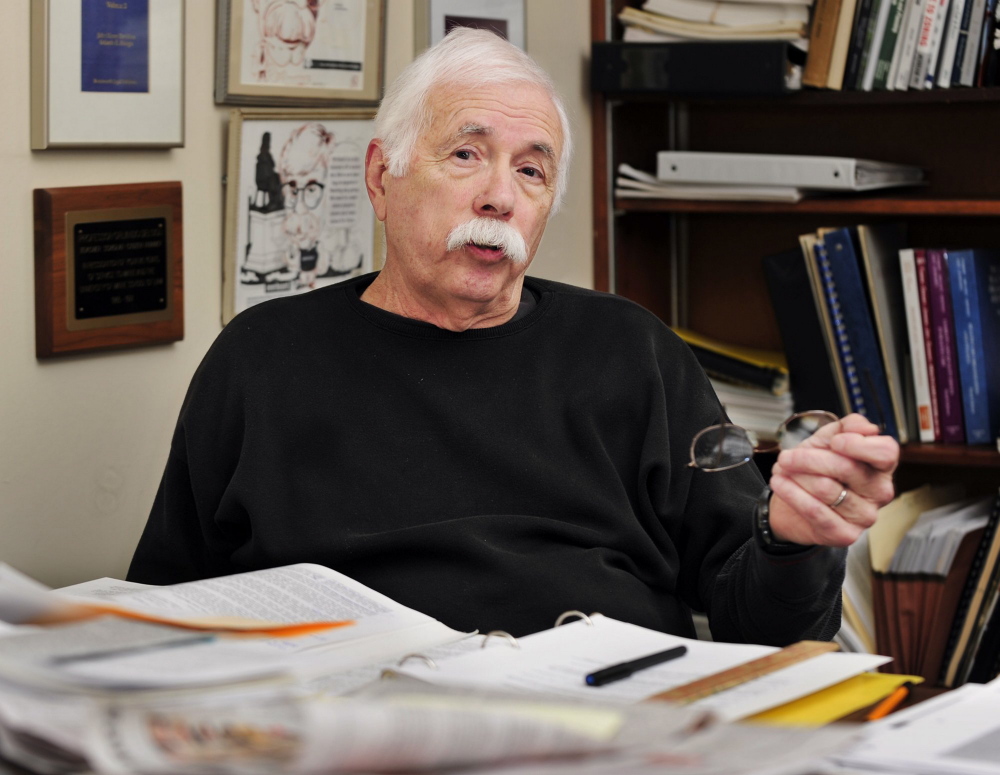

Those harping on the state’s $3.75 tip credit requirement have it all wrong, said Orlando Delogu, professor of law emeritus at the University of Maine School of Law and a founding member of the Maine Civil Liberties Union.

Sure, the statute references 50 percent of the current minimum wage of $7.50 an hour “in this section,” but it also references previous minimum wages of $7.25, $7, $6.75 and $6.50. The existing language was written in 2007, when the minimum wage was being increased incrementally each year.

Each time the state minimum wage increased from October 2006 through October 2009, the tip credit remained at 50 percent, Delogu said, starting from $3.25 up to the current $3.75.

It’s not the amount of the tip credit that is significant, he said. It’s that the authors of the statute clearly believed a 50-50 ratio should be maintained between what the employer pays and what is covered by tips.

“The only thing that’s consistent in the statute is the 50 percent rule,” Delogu said. “You’d have to be the village idiot not to understand that.”

The only way the City Council could maintain the intent of the state law would be to set the city’s tip credit at half the minimum wage, which would be $5.05 if the minimum wage were $10.10, he said.

Delogu said he has been advising city officials about the importance of the 50 percent rule for weeks. He sent an email to them in mid-June saying that holding the employer share of Portland’s higher minimum wage at $3.75 an hour would violate the law, and that increasing it to $5.05 would not.

It is what the legislators who wrote the law wanted, he said.

“They thought it was fair,” Delogu said. “I think it’s fair. I think it avoids litigation.”

WHAT WOULD JUDGES DO?

Those legal interpretations of Maine’s tip credit statute ignore the way courts actually deal with cases in which a plaintiff claims to have been underpaid, said Andy Schmidt, a labor attorney and founder of Andrew Schmidt Law PLLC in Portland.

In cases involving a tipped worker, judges look at two things, he said: whether the worker earned an average hourly wage that met or exceeded minimum wage over the course of a work week, and whether the employer paid that worker a base wage that was not less than the $3.75 an hour required by state law.

When Portland raises its minimum wage to $10.10, the courts will require employers to pay that amount, either through base wages or tips, Schmidt said. However, the city could leave the base wage for tipped workers at $3.75 because it would still be high enough to satisfy state law.

In other words, it’s the base wage that matters to a judge, and not the tip credit, he said.

“They have to get at least $3.75 in cash, and that’s the only constraint,” Schmidt said. “I don’t understand how you could violate state statute as long as you pay the state minimum wage.”

That is generally how it works at the federal level, said Dan Cronin, the U.S. Department of Labor’s Wage and Hour Division’s district director for northern New England.

When federal regulators investigate a tipped worker’s claim that he or she was underpaid, they want to know whether the worker earned at least the federal minimum wage of $7.25 an hour and the federal sub-minimum cash wage of $2.13. The federal maximum tip credit of $5.12 is incidental, Cronin said – it just happens to be the difference between $7.25 and $2.13.

“If the cash wage was more than $2.13 and the total wage was more than $7.25, they are in compliance,” he said.

Cronin noted that just because the federal government does things a certain way, that does not mean states must do the same.

Because Portland is the first city in Maine to raise its minimum wage, there is no clear answer to what Portland officials must do regarding tipped workers, said Portland labor attorney Eric Uhl.

“There is no precedent that I’m aware of,” said Uhl, a shareholder at Littler Mendelson P.C. “It’s really, unfortunately, an open question.”

Uhl said it is a reasonable legal argument to say that if Portland has the authority to raise the city minimum wage, then it also can increase the city’s tip credit. But there are legal nuances involved that would require research beyond the statute itself, such as interpreting language about the power of municipalities in the Maine Constitution, Uhl said.

“Unfortunately it’s just not clear by the statute,” he said.

CORRECTION: This story was updated at 12:07 p.m. on Friday, July 10, to clarify that a warning about state law regarding tipped worker was made indirectly through legislative testimony.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.