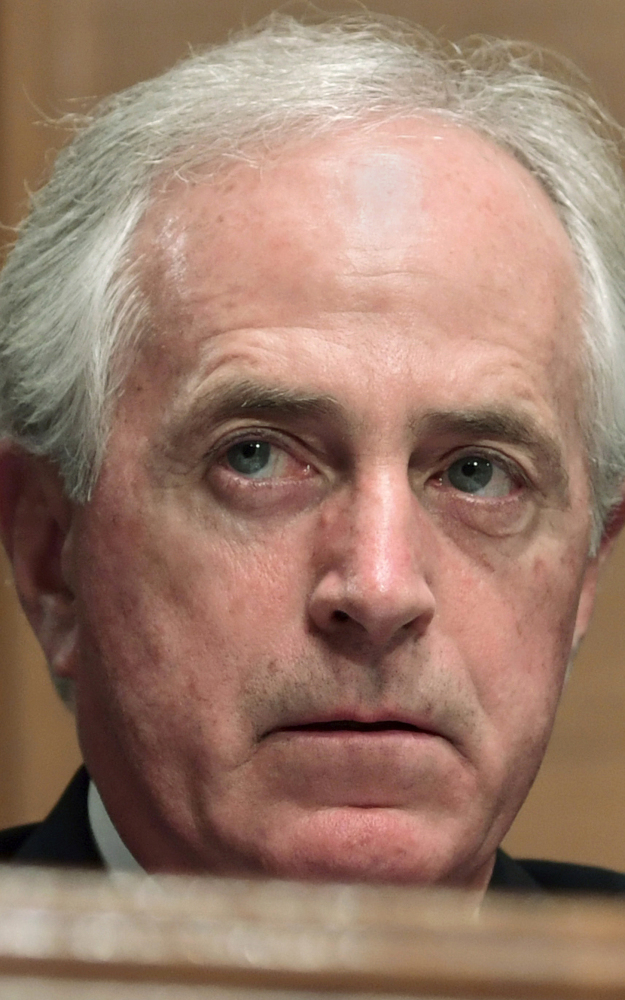

WASHINGTON —Republicans rallied to Sen. Bob Corker’s defense Monday, rejecting a report that the Tennessee lawmaker stealthily tucked a provision into the massive tax package to benefit himself financially and then reversed course to back the bill.

Democrats were unrelenting as they howled about the “Corker kickback” and argued the tax benefit for real estate developers boosts the wealthy – President Trump, his son-in-law, Jared Kushner, and Corker among them – at the expense of average Americans.

In a letter on Monday, the Republican chairman of the Senate Finance Committee said that he – not Corker – was the author of the provision and that it was hardly a brand-new creation dropped into the final version of the bill.

Sen. Orrin Hatch, R-Utah, outlined the legislative path for the provision, starting with its unveiling Nov. 2 by his House counterpart, Ways and Means Chairman Kevin Brady, R-Texas.

Calling himself “disgusted,” Hatch said it was “categorically false” that the provision was “airdropped” into the bill and Corker was responsible.

“It takes a great deal of imagination – and likely no small amount of partisanship – to argue that a provision that has been public for over a month,” debated on the House floor and included in a House-passed bill “is somehow a covert and last-minute addition to the conference report,” Hatch said.

Corker said in a statement late Sunday that “he is not a member of the tax-writing committee and had no involvement in crafting the legislation.” Corker said he requested no specific tax provisions throughout the monthslong debate and had no knowledge of the real estate provision in question. He pressed Hatch for details on the process, prompting the chairman’s letter hours later.

A story in the International Business Times, an online publication, said Corker “suddenly switched his vote to yes” after Republican leaders added the provision, which could boost Corker’s real estate income. The story was co-written by David Sirota, a former Democratic political strategist who has worked for former Montana Gov. Brian Schweitzer, a Democrat, and Sen. Bernie Sanders, I-Vt.

House and Senate negotiators finalized the tax bill last week and included a version of the provision to benefit the real estate industry.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.