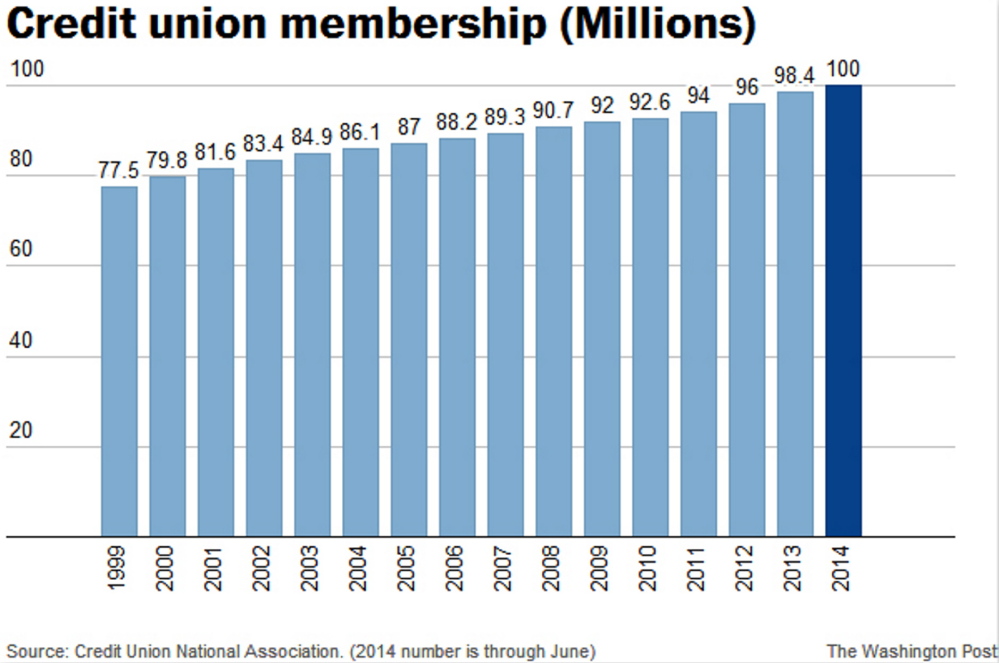

WASHINGTON — Credit unions reached a new milestone in June when membership topped 100 million, the Credit Union National Association announced Tuesday.

The smaller, and often more personal, banking institutions, drew national attention in 2011 following “Bank Transfer Day,” when a Facebook campaign started by consumers called on people to ditch their banks because some had proposed adding fees for debit card use. Credit unions reported a surge in customers seeking perks such as lower fees and better rates on loans and savings accounts. (Many banks later canceled the proposed fees.)

But the growth has kept on, with membership increasing by roughly 2 percent each year.

Bill Hampel, chief executive of the Credit Union National Association, says two main things are driving the new membership: broader eligibility requirements and greater awareness. For instance, many credit unions have made it easier for more people to join over the past several decades by expanding eligibility based on where customers live, instead of restricting membership to a particular employer.

“In the old days, people would have thought ‘those credit unions sound like a good deal, but I don’t think I can get into one,’ ” Hampel says.

So now that roughly a third of Americans are using a credit union, should you be one of them? Here’s a rundown of things to consider.

Free checking

Roughly 80 percent of credit unions offer free checking accounts, compared with less than 50 percent of banks, according to Moebs Services, an economic research firm. Credit unions also charge smaller fees that are generally 5 to 20 percent lower than those charged by most banks, says Mike Moebs, economist and chief executive of Moebs Services. But credit unions are less likely to give customers a break on those fees, he says, waiving less than 10 percent of fees compared to banks, which waive about 26 percent of checking fees for customers.

Overdraft fees

Overspending may sting less at a credit union than it does at a big bank: The median overdraft fee was $28 as of January, compared with $30 for banks, according to Moebs Services. But overdraft fees are among those that credit unions are less likely to waive. Credit unions also increased the fees last year at a time when banks are making it harder for customers to get hit by overdraft fees. (Hampel says credit unions were under pressure to increase fees to make up for income lost because of low interest rates.)

ATM fees

Many credit union customers are able to avoid ATM fees because credit unions – despite having fewer locations – typically give customers access to broader networks of ATMs by sharing branches and other resources. The largest such network of cash machines, dubbed the CO-OP network, offers about 30,000 ATMs across the country, Hampel says.

Saving rates

Because credit unions have fewer expenses than most big banks – they don’t have to pay dividends to shareholders and they’re exempt from federal taxes – they can often afford to reward and attract members with high rates on saving accounts, Hampel says. The low rate environment has made it so that those rates aren’t as attractive as they used to be, but they are still typically more generous than what is offered by banks. For instance, as of mid-July, credit unions offered an average yield of 0.47 percent on one year certificates of deposit, compared to an average 0.10 percent for one-year CDs offered by banks, according to Bankrate.com.

Loans

Credit unions can often offer lower interest rates on loans, but not all loans. Members looking for auto financing and most other types of loans may be able to find better rates, but when it comes to mortgage loans, for instance, their rates are similar to the rates offered by banks, Hampel says. Indeed, the average rate charged by credit unions on a 30-year fixed mortgage in mid-July was 4.26 percent, pretty close to the average 4.31 percent charged by banks, according to Bankrate.com. On home equity lines of credit, however, the credit unions charged an average 4.01 percent, compared to 5.73 percent by banks.

Mobile banking

Some of the largest credit unions offer mobile banking apps that let customers deposit checks remotely using their phones, but for the most part, credit unions typically are behind banks when it comes to such mobile banking tools, Moebs says. Some credit unions don’t let customers deposit checks or cash through ATMs, requiring them to come into the branch for that business. Still, credit unions are catching up, Moebs says.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.